PROPERTY stocks have gone into a tailspin as the boom years have come to an abrupt halt. Although valuations have eased, developers are still out of favour with investors because of a lack of earnings catalysts for the medium term.

“We generally don’t favour property stocks right now, other than those with significant exposure to affordable and/or mid-range landed developments, such as Matrix Concepts Bhd and MKH Bhd,” says Bernard Ching, head of Malaysia research at AllianceDBS Research.

“While the near-term earnings of most developers will still be healthy, most are riding the progress billings of property sales in the previous years. These unbilled sales will likely dwindle as the rate of replenishment through new sales is slower than the billings. Investors who look beyond the near term will recognise such earnings risks. Thus, while property stock prices have come off, valuations are still unappealing.”

However, many of these companies are sitting on landbank with huge values waiting to be unlocked beyond the current market slowdown.

Given the depressed valuations of the public-listed property companies, they could now become prime targets of mergers and acquisitions (M&A) as well as privatisation. After all, most of the developers are currently valued at steep discounts to their book value.

M&A activity has already begun to pick up with the proposed privatisation of Petaling Tin Bhd and Karambunai Corp Bhd by Tan Sri Chen Lip Keong. The tycoon, who controls 65.07% and 76.15% of the companies respectively, is offering 24 sen per share for Petaling Tin and five sen per share and two sen per warrant for Karambunai.

For the minority shareholders, Chen’s offer is at barely a premium, valuing Petaling Tin and Karambunai at only 0.233 times and 0.34 times net asset value. Not surprisingly, independent advisers have recommended that the minorities reject the deal because it is “not fair”.

Chen, however, cannot be faulted for driving a hard bargain because not only is the outlook for the property market gloomy but both companies are also loss-making and thinly traded. For these reasons, the independent advisers consider the deal “reasonable”.

But how else are the investors supposed to exit?

Housing loan approvals , which are a good gauge for property sales, saw its 14th consecutive contraction in March 2016, down 13.75%y-o-y to RM7.69 billion.

It was still better than February approvals, which crashed to RM5.12 billion — the lowest monthly approvals in over five years.

Against this backdrop, it remains to be seen if Chen will sweeten the deal for the minorities. In the meantime, other investors might be able to put aside their emphasis on earnings growth and look instead at developers that might become M&A targets on account of their landbank.

Developers that are trading at a sharp discount to their net asset value are the obvious candidates. However, investors would still have to be highly selective in identifying such stocks.

“Many of the developers have been aggressively landbanking in the past few years, some of which didn’t come cheap. Developers with weaker balance sheets will be vulnerable to the current downturn and credit tightening,” cautions Ching.

In a nutshell, the quality and location of the landbank as well as gearing will be the key determinants of how attractive a company is as an M&A target. Companies that have net cash positions are especially sought after for privatisation since the offeror can offset the acquisition cost with the company’s cash pile.

However, very few developers are sitting on cash at the moment. Petaling Tin happens to have a marginal net cash position of one sen per share (RM2.3 million) while MK Land Bhd has net cash of RM5.86 million, which is not much.

However, Plenitude Bhd has RM339.34 million in net cash on its books. That works out to almost 60% of its share price. This is before taking into account the RM193.4 million worth of land held for future development.

The bulk of Plenitude’s prime land is situated in Penang — about 91 acres worth RM148.4 million — ranging from Bandar Batu Feringgi to Daerah Timor Laut. Over in the Klang Valley, Plenitude has 105 acres in Dengkil, Selangor, worth RM33.8 million. On top of this, the group has almost RM500 million worth of investment properties on its books, including hotels and residences.

While this makes Plenitude an attractive M&A target, its large size and ownership might make things a little more difficult. The company’s market capitalisation stood at RM640.98 million as at June 2.

“I believe an owner buyout is more likely as owners with deep pockets will have the confidence and patience to ride out the current rough patch. The prevailing low valuations of property stocks present an opportunity for them to buy assets they are familiar with at well below market prices. However, funding is the key. Currently, getting funding is very tough, given the more stringent credit underwriting policies of domestic banks,” Ching explains.

Interestingly, Plenitude’s management and directors have virtually no interest in the company. Instead, its largest shareholder is Ikatanbina Sdn Bhd with a 32.19% stake. Ikatanbina is held 60:40 by Khadijah Abdul Khalid and Siti Kulthum Abdul Khalid.

Their only representative on management is Elsie Chua, who is the executive chairman of Plenitude and a director of Ikatanbina.

Assuming Ikatanbina makes an offer of RM1.91, which is at a 10% premium to the three-month volume weighted average price, it would cost about RM584.06 million. But taking into account the net cash, the actual cash cost is only RM244.72 million. If borrowed, this would increase Plenitude’s net gearing to only 0.16 times.

It is worth noting that the offerors do not have to take the entire company private. The major shareholder may also take advantage of the low valuations to raise his shareholding to gain control of the company at a cheap price.

Take BCB Bhd, which saw an offer from its founder and group managing director Datuk Tan Seng Leong in May last year. He intended to maintain BCB’s listing status and raised his stake from 32.8% to 57.874%.

The company has since undertaken a two-for-one share split. Thus, at last Thursday’s close of 44 sen, the stock was trading at below Tan’s offer price made a year ago.

While the bulk of BCB’s landbank is located in Johor, either in Kluang or Batu Pahat, the company’s prime landbank is in the Klang Valley. It has 5.03 acres of freehold land in Kuala Lumpur, which it had acquired in 2010 for RM172.96 million and another 151.27 acres of leasehold land in Klang that was acquired for RM148.38 million in 2011.

Another interesting pair of property companies are Asian Pac Holdings Bhd and South Malaysia Industries Bhd (SMI), which have a common shareholder — Mah Sau Cheong. It is worth noting that Asian Pac also has an 11.56% stake in SMI. Mah owns 18.34% of Asian Pac and 7.65% of SMI.

SMI is interesting because it has a relatively senior board. Its youngest executive director is 64 years old while the oldest is its 80-year-old chairman. The company’s prime asset is a 30-year-old office building that is worth RM30 million. SMI’s market capitalisation was RM35 million as at June 2.

Asian Pac, which as at June 2 had a market capitalisation of RM178.7 million, owns Kota Kinabalu Times Square Mall, which is worth almost RM1 billion on its books. Furthermore, Asian Pac is one of the few companies on the list that are making a profit and is valued at only 0.23 times its net asset value.

The downside is that Mah’s stake in both companies is a little small.

Country Heights Holdings Bhd is an example of a company that is managed by the controlling shareholder, which also has a big stake in the company. Tan Sri Lee Kim Yew owns 63.38% of the company, which is run by his daughter, Lee Cheng Wen.

While the company does not have any large piece of land left with a high book value, it has numerous small plots around the Klang Valley. Its jewel in the crown is the Palace of Golden Horses, which is valued at RM366.9 million.

Interestingly, Lee has advanced RM37.7 million in loans to the company, which is struggling with high debts. If he were to convert the debt to equity at the company’s current share price of around RM1, this would increase his stake in the company to roughly 67.8%. However, taking the entire company private would require another RM100 million at least.

This article first appeared in The Edge Malaysia on June 6, 2016. Subscribe here for your personal copy.

TOP PICKS BY EDGEPROP

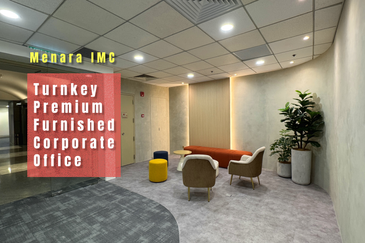

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

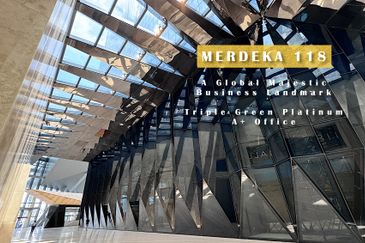

Merdeka 118 @ Warisan Merdeka 118

KLCC, Kuala Lumpur

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Damansara Heights (Bukit Damansara)

Damansara Heights, Kuala Lumpur

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Jalan Ampang Hilir

Ampang Hilir, Kuala Lumpur

Sri Cempaka Apartment Bandar Puchong Jaya

Puchong, Selangor