PETALING JAYA (March 23): Kuala Lumpur’s central business district (CBD) office market – which includes the Kuala Lumpur City Centre (KLCC), the Golden Triangle and the city centre’s older commercial area – is expected to see higher absorption rates from 2016 to 2018, with demand expected to overtake new office supply of about 1.5 million sq ft, said JLL country head of Malaysia YY Lau.

“The market has stabilised for now [in terms of rental] where there is more supply than demand for office space. We don’t expect any increase in terms of rental this year but once the oversupply of spaces has been absorbed, we will see rents increasing marginally sometime in 2017 and 2018,” she said at the Property Market Outlook 2016 media briefing organised by JLL.

“Subsequently, there will be more office supply coming in 2019,” she added.

According to Lau, KL City can expect a total of 4.8 million sq ft of incoming supply in 2019 from five developments – the OSK office building, Aurora Tower, Hotel Equatorial Redevelopment, the OLC integrated development and the Tun Razak Exchange Tower (TRX Tower).

Meanwhile, JLL noted that the KL prime fringe area which includes KL Sentral, Mid Valley City, Bangsar/Pantai/Kerinchi and Damansara Heights still retained the highest occupancy rate with a vacancy of 8%.

This compares with KL CBD’s 13.5% and the decentralised area in Selangor – including Petaling Jaya, Mutiara Damansara, Bandar Utama, Kelana Jaya, Subang Jaya, Shah Alam, Klang and Puchong – which has a 10.9% vacancy rate.

Meanwhile, other locations such as Cyberjaya and Putrajaya saw vacancy rates of 25.3%.

“Firms are now considering going out of the CBD area with the upcoming accessibility of transportation such as the MRT line and relatively cheaper rental rates,” said JLL’s associate director of capital markets Nick Charlton who was also at the briefing.

According to JLL, the average rents in KL CBD are going for RM3.60-RM13 psf while the KL prime fringe rents are going for RM4-RM8 psf.

“In this tough economic situation, every cent counts. There are more companies who realise that they can save a lot of money by renting a cheaper place away from the city centre but still complete with amenities. Once people see that it only takes an extra 15-20 minutes’ train ride from their houses to their offices which are not in the city centre, they will definitely prefer to save the money and rent from a cheaper place,” he said.

On whether companies in the CBD will eventually move to KL fringe, Charlton said that the CBD is still a place where companies would want their addresses.

“The CBD will always be a prime area where the address is wanted by big multinational firms such as oil and gas companies and financial institutions. There will always be demand catered to different tenants in the different areas,” he noted.

According to the report, the KL CBD is mainly occupied by financial companies and oil and gas companies taking up a 39% and 32% market share respectively, while KL fringe sees hi-tech firms and business services taking the major market share of 26% and 23% respectively.

TOP PICKS BY EDGEPROP

Bandar Setia Alam

Setia Alam/Alam Nusantara, Selangor

Duduk Huni @ Eco Ardence

Setia Alam/Alam Nusantara, Selangor

Impian 7, Setia Alam

Setia Alam/Alam Nusantara, Selangor

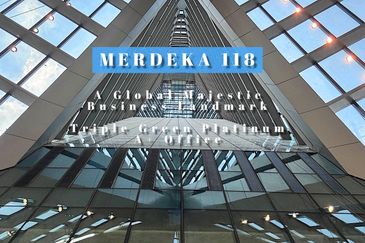

Merdeka 118 @ Warisan Merdeka 118

KLCC, Kuala Lumpur

Merdeka 118 @ Warisan Merdeka 118

KLCC, Kuala Lumpur