IJM Corp Bhd (Nov 25, RM3.35)

Maintain buy call with a lower target price (TP) of RM3.83: We continue to favour the group for its well-diversified business model, especially its strong growth in infrastructure division coupled with encouraging performance posted by industry division as benefiting from the domestic construction activity.

Meanwhile, we believe the construction division’s performance is expected to be underpinned by an all-time high order book of RM7 billion while its property division is supported by its unbilled sales of about RM1.7 billion, and its focus on launching more affordable housing products.

IJM reported net profit of RM174.8 million for its second quarter FY16. The quarterly earnings tumbled 52.8% quarter-on-quarter (q-o-q), but jumped 13.1% year-on-year (y-o-y) as there was an one-off gain derived from the disposal of 74% equity interest in Jaipur Mahua Tollway Pvt Ltd totalling RM168.7 million.

Meanwhile, top-line increased 12.4% q-o-q and 2.8% y-o-y respectively.

After stripping out foreign exchange losses of RM7.2 million and derivatives contract losses of RM6.2 million coupled with other one-off adjustment, we derived the core net profit of RM192 million (increased 12.1% q-o-q and 13.1% y-o-y).

The advance in core net profit was mainly attributed to the stellar performance in port and Malaysia’s tollway operations.

The cumulative six-month period (1HFY16) core net profit stood at RM363.1 million, and within our and consensus expectations.

This article first appeared in The Edge Financial Daily, on Nov 26, 2015. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

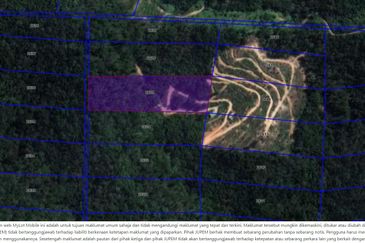

Tenderfields @ Eco Majestic

Semenyih, Selangor

Central Residence, Sungai Besi

Salak Selatan, Kuala Lumpur

Kuala Terengganu Golf Resort

Kuala Terengganu, Terengganu

Taman Sutera Lama

Port Dickson, Negeri Sembilan