Eastern & Oriental Bhd (May 27, RM1.57)

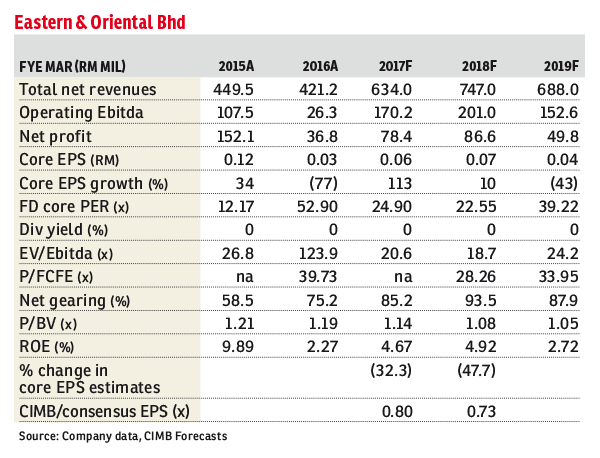

Downgrade to hold with a lower target price (TP) of RM1.51: Excluding the asset disposal gain, financial year ended 2016 (FY16) net profit fell 18% year-on-year (y-o-y) due to higher administration costs, a lower revenue and weaker property margin.

Eastern & Oriental Bhd (E&O) slipped into losses in the fourth quarter of 2016 due mainly to higher admin costs and foreign exchange losses. About RM425 million worth of properties were sold in the quarter, lifting FY16 sales by 12% y-o-y to RM1.1 billion.

In a separate announcement, E&O said that its deputy managing director Eric Chan was resigning, citing expiry of contract and family as the reasons. Chan has been overseeing the company’s operations for more than a decade and we are negatively surprised by his sudden departure.

During the analysts’ briefing, E&O assured investors that there will be a proper leadership transition as Chan’s replacement, Kok Tuck Cheong, the former chief executive officer and marketing director of AmInvestment Bank Bhd, will join the group before Chan officially resigns.

Chan also gave an assurance that E&O will be in good hands as his replacement will be supported by the existing management team. However, his resignation coincided with a delay in stake sale in Seri Tanjung Pinang 2A (STP2A), a land reclamation project in Penang. E&O previously guided that it would secure strategic investors for STP2A by June 2016, but during the analysts’ briefing it was disclosed that the deadline was probably unachievable. Chan’s departure could exacerbate concerns over a further delay in the stake sale.

We still have high hopes that E&O will eventually secure strategic investors for its STP2A project. The strategic investors’ entry price should set the benchmark for the valuation of the bigger STP2B and 2C projects, which currently accounts for 57% of its total realised net asset value, based on our estimate. However, poor earnings, the unexpected leadership transition and a missed deadline for the stake sale, in our view, could reduce the market’s confidence in the stock in the near term.

The only silver lining comes from the high unbilled sales of RM1.2 billion as at end-FY16, which should boost E&O’s earnings in FY17 and FY18. But earnings improvement in FY17 is unlikely to rerate the stock as its FY17 price-earnings ratio (PER) of 25 times is the highest among all the developers we cover.

While we think the stock’s risk reward remains favourable in the long run, management did not commit to a new timeline for the stake sale. The absence of a firm timeline, in our view, is a major hindrance to the stock’s rerating.

We upgraded E&O to “add” from “hold” in February this year as we had anticipated the group to secure strategic investors for STP2A by June 2016. Based on the land price of a comparable transaction, STP2 could potentially be worth RM19.5 billion, or almost 10 times E&O’s market capitalisation.

Although we had also expected unexciting near-term earnings due to weak economic conditions and the sluggish property market, the potential value of STP2 and the committed timeline for the stake sale made the upside of E&O’s share price too big to ignore.

The key downside risk to our “hold” recommendation is weaker-than-expected property sales, while the key upside risk is the sooner-than-expected stake sale. — CIMB Research, May 27

This article first appeared in The Edge Financial Daily, on May 30, 2016. Subscribe to The Edge Financial Daily here.