S P Setia Bhd (June 12, RM3.33)

Maintain hold with unchanged target price of RM3.62: The company recorded RM1.6 million in sales for five months of financial year 2015 (5MFY15), representing only 34% of both ours and the company’s full-year sales forecast. Compared to sales for the first quarter of FY15 (1QFY15), which were largely derived from the Battersea project, domestic sales picked up in February and March 2015. In Malaysia, the central region remained as S P Setia’s stronghold, registering RM615 million in sales (or 40% of 5-month sales).

Landed properties in Setia Alam (gross development value [GDV]: RM240 million), and Setia Ecohill (GDV: RM250 million), which were priced below the RM1 million per unit mark, continued to drive company sales. Within the Setia Alam township, the company also launched 539 units of medium-cost apartments with selling prices starting from RM250,000 per unit. We understand that these medium-cost apartments have been 80% sold to date.

The sales performance of Battersea has been affected by the six-month general election campaign for the United Kingdom parliamentary election, which was held on May 7. The take-up rate for Phase 3A, which features 539 designer homes (effective GDV: RM2.1 billion, launched in November 2014), was little changed at 50% since 1QFY15. Management indicates that marketing and promotional activities have intensified post-election. Recently, the design of a six-acre (2.43ha) public park @ Battersea was unveiled to further strengthen the company’s market position in London. With this, management expects Battersea sales to improve in the second half of FY15 (2HFY15).

The jittery macro outlook has made the company to remain cautious about future launches. For 2HFY15, the company will continue to focus on landed properties, targeting medium-to-high income earners and more phases are expected to be rolled out from existing townships such as Setia Alam and Setia EcoHill. Meanwhile, the maiden launch at Setia Eco Templer in Rawang, Selangor (Link villas and Rumah Selangorku [state government housing projects] GDV: RM278 million) is expected by 4QFY15.

Elsewhere, we expect S P Setia to put in greater efforts to convert bookings into actual sales by providing the necessary assistance to buyers in loan applications.

S P Setia will release its 2QFY15 results tomorrow. We estimate the three-month net profit to be in the range of RM170 million to RM200 million. This will account for 44% to 49% of our full-year projections and 46% to 51% of consensus’ forecasts. On a year-on-year basis, we expect 1HFY15 net profit to leap by 59% to 76% driven by a lumpy revenue recognition of Fulton Lane @ Melbourne (unbilled sales: RM1.4 billion), which was fully completed in May this year. All in, the company is expecting bumper earnings for FY15 and FY16, driven by the lumpy revenue recognition of its Australia and London projects.

In view of slower-than-expected sales from Battersea Phase 3A, we cut our FY15 sales assumption by 13% to RM4 billion. However, our FY15 to FY17 earnings are largely unchanged as the revenue contribution from Battersea Phase 3A will only come in 2020.

Rerating catalysts include a potential consolidation of Permodalan Nasional Bhd’s property entities such as Sime Darby Property Bhd, I&P Group Sdn Bhd and S P Setia to create a mega property group to facilitate future landbanking and overseas expansion opportunities. — TA Securities

This article first appeared in The Edge Property pullout, on June 15, 2015.

TOP PICKS BY EDGEPROP

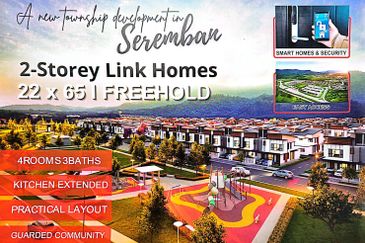

VISION HOMES @SEREMBAN 2

Seremban, Negeri Sembilan

Taman Senawang Perdana

Seremban, Negeri Sembilan

Taman Senawang Perdana

Seremban, Negeri Sembilan