WHEN Ta Ann Holdings Bhd announced its proposed acquisition of Agrogreen Ventures Sdn Bhd for RM211.14 million on Oct 24, what immediately caught the market’s attention was that there is an existing claim in court over a significant portion of the latter’s land.

Agrogreen owns 5,279.8ha of brownfield plantation land in Stungkor, Sarawak. Over 96% is planted with palm trees aged five years and below. Buying the company would add 12% to Ta Ann’s planted area and boost its overall land bank by 8%.

But with an ongoing court case hanging over the land at the heart of the transaction, some quarters are of the view that Ta Ann has rushed into the deal, which analysts also consider expensive. However, the group feels that, on balance, the risk is minimal compared with the opportunity cost going forward.

“Land disputes in Sarawak can take a long time to wind their way through the courts,” says Ta Ann in an email response to The Edge. “There are pending cases in the courts of Sarawak involving native land claims which stretch back over a decade.”

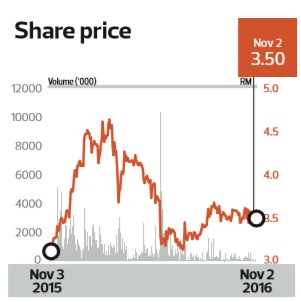

However, the market has not reacted much to the announcement. The counter closed at RM3.58 per share on Oct 24 and daily closing prices have since ranged from RM3.50 to RM3.52 per share up to last Wednesday. Year to date, the share price has fallen over 16%, although its one-year return remains 13%, based on Bloomberg data.

The court action was filed in May this year in the Kuching High Court by 13 plaintiffs representing 11 villages in Singai, in Bau, Sarawak, according to a copy of the statement of claim obtained by The Edge.

The lawsuit was filed against nine defendants including the Sarawak government, the Federal Land Development Authority and four plantation companies — Agrogreen, First Binary Plantation Sdn Bhd, Pro Jaya Plantation Sdn Bhd and Golden Practice Sdn Bhd. The other defendants are Yayasan Sarawak, the Superintendent of Lands & Survey Kuching Division and security company Kawalan Keselamatan Sanubari Sdn Bhd.

Among others, the plaintiffs allege that they have native customary rights (NCR) to wide areas of land owned by the plantation companies. The statement of claim further alleges trespass and harassment of the villagers by the companies involved. The plaintiffs are seeking vacant possession of the land in question. They are also seeking an injunction against the companies from further trespass as well as various damages.

In a filing with Bursa Malaysia last Monday, Ta Ann clarified that even if the plaintiffs win their case, it had been advised that at most, they would only be entitled to damages against the Sarawak government, based on judicial precedents.

Given the uncertainty over when the legal case would be resolved, considering the number of parties involved, Ta Ann said it would be impractical to wait. While admitting that having litigation risk attached to a deal would generally draw a very negative reaction from the market, it argued that the merits of the particular case should also be considered.

It is worth noting that another listed player has already walked away from essentially the same deal. In March, BLD Plantations Bhd proposed to wholly acquire Pekan Semangat Sdn Bhd (a 70% shareholder of Agrogreen) for RM155.22 million. Following due diligence, however, BLD Plantations and the vendors of Pekan Semangat agreed to call off the transaction on Oct 5 for undisclosed reasons.

Litigation risk aside, some analysts deem the proposed transaction expensive. In separate reports, Maybank Research estimated the enterprise value (EV) of Agrogreen’s estates to be as high as RM56,020 per hectare while CIMB Research’s estimate is lower at RM41,473 per hectare.

Both figures are higher than the RM34,000 per hectare at most Sarawak Oil Palms Bhd (SOP) will pay for a recent acquisition, according to separate estimates by Maybank and CIMB. The Agrogreen acquisition is therefore “expensive for largely immature estates in Sarawak”, says Maybank.

In July, SOP announced that it is buying Shin Yang Holdings’ wholly-owned unit Shin Yang Oil Palms (Sarawak) Sdn Bhd for RM873 million. It is a related-party transaction as Shin Yang Holdings is a substantial shareholder in SOP with a 28.6% direct shareholding.

However, Ta Ann is of the view that the RM211.14 million price tag for Agrogreen is fair. It said good, sizeable plantation areas in Sarawak are becoming scarce as the state government has imposed a moratorium on new plantation land with all new developments to be carried out via joint ventures with NCR landowners.

It also points to a transaction of raw land close to Agrogreen’s land that exceeded RM60,000 per hectare. Similarly, Ta Ann’s acquisition price comes up to RM39,990 per hectare, based on back-of-the-envelope calculations done by The Edge.

“Furthermore, Agrogreen’s brownfield plantation is strategically located (unlike other plantations which are in the interior of Sarawak) about 30km, or less than an hour’s drive (75km by road), to Kuching city and the palm oil refinery,” said Ta Ann, adding that an added bonus of this location is the potential for development a couple of decades down the road.

This article first appeared in The Edge Malaysia on Nov 7, 2016. Subscribe here for your personal copy.

TOP PICKS BY EDGEPROP

ARA SENDAYAN @ BANDAR SRI SENDAYAN

Seremban, Negeri Sembilan

ARA SENDAYAN @ BANDAR SRI SENDAYAN

Seremban, Negeri Sembilan

Charms of Nusantara, Setia Eco Glades

Cyberjaya, Selangor

Liu Li Garden, Setia Eco Glades

Cyberjaya, Selangor

Isle of Botanica, Setia Eco Glades

Cyberjaya, Selangor

Monet Springtime @ Sunsuria City

Dengkil, Selangor

New Launch Semi-D @ Kota Kemuning

Kota Kemuning, Selangor