WCT Holdings Bhd (Nov 2, RM1.83)

Maintain neutral with an unchanged target price (TP) of RM1.70: WCT Holdings Bhd, in a surprise move, announced that two existing co-founders and major controlling shareholders — Taing Kim Hwa, who is also the managing director of WCT, and Wong Sewe Wing — had disposed of their 19.7% stake or 245.7 million shares held via WCT Capital Sdn Bhd for an undisclosed amount to Tan Sri Desmond Lim, best known as the chairman of Pavilion Real Estate Investment Trust (REIT) and Malton. The stake disposal or cashing out by the controlling shareholders could possibly see changes in key management and business direction, in our view.

With the stake below the 33% threshold, no general offer will be triggered. Its share price was undisturbed before the announcement, at RM1.75, an almost-one-year high. While not disclosed, filings indicated that the blocks of shares were crossed at RM2.50 each, a premium of 75 sen or 42.8% to the last closing price or total sale proceeds of RM614.3 million. The premium, we believe, is justifiable for the controlling stake and synergy that Lim can offer, especially for existing and new malls in the pipeline. The existing malls are Aeon Bukit Tinggi Shopping Centre, Paradigm Mall (Petaling Jaya) and gateway@klia2. Meanwhile, Paradigm Mall in Johor Bahru is slated to be opened in the third quarter of financial year 2017, and another new mall, Paradigm Garden City, is still in the planning stage.

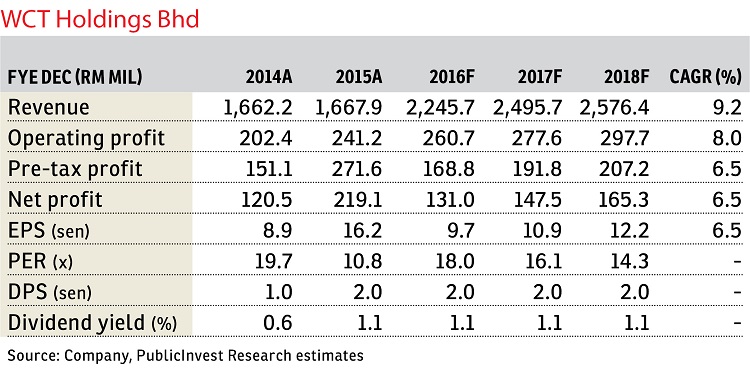

News of the stake disposal came in as a surprise. Lim already has a retail REIT in Pavilion REIT and property development business in Malton. Earlier plans for WCT to list its investment assets and construction business could also change now. All told, details are still sketchy at this juncture, but we expect more clarity in the coming days. Pending more clarifications from management, we maintain “neutral” with an unchanged sum-of-parts-derived TP of RM1.70. — PublicInvest Research, Nov 2

TOP PICKS BY EDGEPROP

Subang Hi-tech Industrial Park

Subang Jaya, Selangor

Taman Teknologi Tinggi Subang

Shah Alam, Selangor

The Park Sky Residence

Bukit Jalil, Kuala Lumpur

De Tropicana Condominium

Kuchai Lama, Kuala Lumpur

Taman Perindustrian Putra Puchong

Puchong, Selangor

The Sky Residence @ Shamelin

Cheras, Kuala Lumpur