Eco World Development Group Bhd (Oct 27, RM1.35)

Maintain buy with a target price of RM1.80: A relatively new property developer with only three years of history, Eco World Development Group Bhd (EcoWorld) has been able to sell properties at an unprecedented pace, reflecting property buyers’ confidence in the group’s strong brand name.

We believe EcoWorld deserves to trade at a lower discount relative to its peers given its prominence as the bellwether of the local property sector with ongoing “outperformance” in a weak market. We continue to like EcoWorld for the proven and impeccable track record of its key senior executives, who have helped the developer establish strong brand recognition among property buyers.

After booking RM3.2 billion and RM3.016 billion sales in financial year 2014 (FY14) and FY15 respectively, EcoWorld is targeting RM4 billion sales in FY16, despite the relatively weak property market in which most of its peers are having slower sales performance.

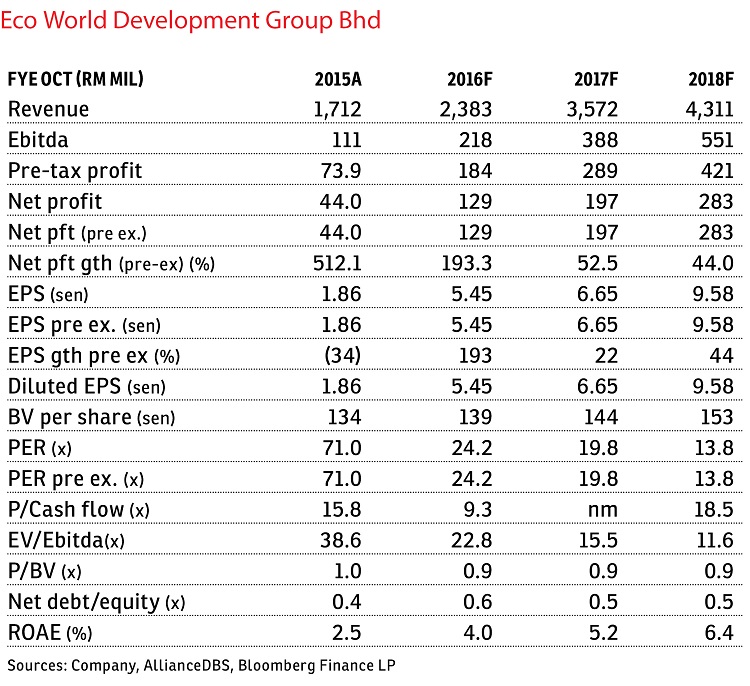

EcoWorld has clearly been gaining more market share at the expense of its competitors. We are projecting an explosive three-year earnings compound annual growth rate of 86% over FY15 to FY18 on its relatively smaller profit base at this juncture.

This is supported by its all-time high unbilled sales of RM4.72 billion as at end-August 2016 which will underpin earnings up to FY19.

In anticipation of better cash flow with the handover of completed units, as well as the completion of a proposed private placement by end-2016, EcoWorld’s balance sheet is expected to remain healthy and accommodative for its aggressive expansion plans.

It is looking to venture overseas via a proposed subscription of up to a 30% stake in Eco World International which has significant exposure to London, the UK, and Sydney, Australia. This will further cement its earnings growth from FY18 upon completion of projects.

EcoWorld is targeting RM4 billion sales in FY16, which will be anchored by 15 ongoing projects and its proportionate share of sales from its proposed 30% stake in Eco World International.

Key risks to our view include the surge in property prices over the last few years, coupled with recent tightening measures, which could weaken property sales as buyers turn more cautious.— AllianceDBS Research, Oct 27

This article first appeared in The Edge Financial Daily, on Oct 28, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

METROCITY SQUARE SOHO APARTMENT

Sarawak, Sarawak

Muara Tabuan Light Industrial Park

Kuching, Sarawak