UEM Sunrise Bhd (Oct 19, RM1.19)

Maintain outperform with target price (TP) of RM1.85: We met up with UEM Sunrise Bhd’s (UEMS) management recently for updates on its ongoing projects, planned launches, especially in 2017, and progress on land deals. We understand that most of the planned launches are on track to be unveiled by end-2016 with the exception of St Kilda, Melbourne which has been postponed to 2017, as guided earlier in the second quarter of financial year 2016 (2QFY16) conference call.

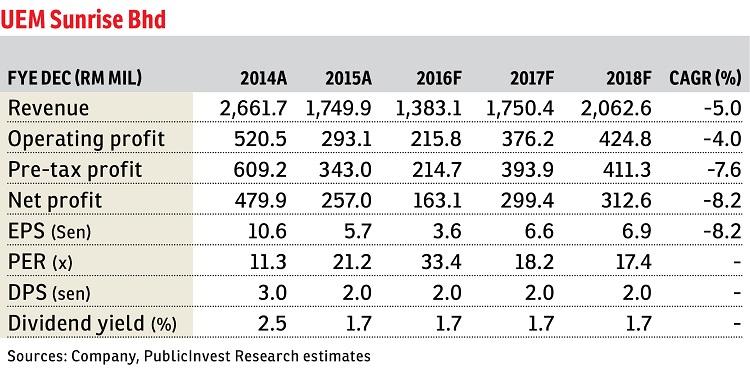

Also, the expected land sale for Puteri Harbour (estimated land value circa RM300 million) is now likely to be sealed next year, from the end-2016 period expected earlier. As for launches in FY17, UEMS plans to launch more projects, which include Solaris 3, Artisan Hills, St Kilda and Alderbridge in Vancouver. All told, FY16, FY17 and FY18 earnings are adjusted downwards by 46%, 17% and 15% respectively after we remove the land gain sale, adjust our billing assumptions and impute higher marketing expenses. Maintain “outperform” and RM1.85 TP however, pegged at circa 40% of our revalued net asset valuation (RNAV).

UEMS’ revised sales target of RM1 billion should be achievable with the impending launch of projects such as Southern Industrial Logistics Clusters Phase 3 (RM500 million gross development value [GDV]), and a landed project in Bukit Indah, Iskandar Malaysia (GDV of RM114 million). Admittedly, sales are still weak with the group chalking only circa RM427 million in the first half from total projects worth RM553 million in GDV launched.

Similar to other developers, UEMS has stepped up its marketing campaigns but local sales remain stubbornly weak due to the current tough operating environment. As for overseas projects, St Kilda is now slated to be launched in 2017, with the GDV expected to be improved to circa RM1 billion from RM750 million earlier, with a new plan to tear down the existing building instead of just refurbishment. Unrecognised revenue as at 2QFY16 stood at RM4.3 billion.

While still early, we understand that UEMS has plans to unveil more projects in 2017 with potentially higher sales targets such as Gerbang Nusajaya worth circa RM485 million in GDV, Solaris 3 (RM1.3 billion GDV) and Artisan Hills (RM1.6 billion GDV).

We understand that management is now also exploring other deals to monetise its vast land bank, especially in Iskandar Malaysia. Remaining land bank is circa 13,000 acres (5,261ha) with an estimated GDV in excess of RM100 bilion.

— PublicInvest Research, Oct 19

This article first appeared in The Edge Financial Daily, on Oct 20, 2016. Subscribe to The Edge Financial Daily here.