Malaysian Resources Corp Bhd (July 4, RM1.08)

Maintain market perform with a target price (TP) of RM1.20: Malaysian Resources Corp Bhd (MRCB) announced a letter of award to carry out the Pahang river estuary conservation (Phase 3) project, package 2 for a contract sum of RM188.7 million.

The main component of the project is to extend an additional 345m in length to the breakwater constructed earlier and river protection works under the Pahang river estuary conservation (Phase 3) project.

The construction period will take up to 24 months and be completed by July 2018.

We are neutral on this news as the project value of RM188.7 million is within our construction order book replenishment assumption of RM1 billion.

That being said, we are mildly positive on this particular project, compared to other construction awards, as pre-tax margins are higher for environmental projects at about 15%, compared to other construction projects of about 7%.

As such, this contract is expected to contribute about RM14 million to MRCB’s bottom line per annum.

Year to date, MRCB has bagged RM893.5 million worth of construction works, representing 89.3% of our financial year ending Dec 31, 2016 estimated (FY16E) construction order book replenishment assumption, with a remaining RM106.5 million balance to be filled.

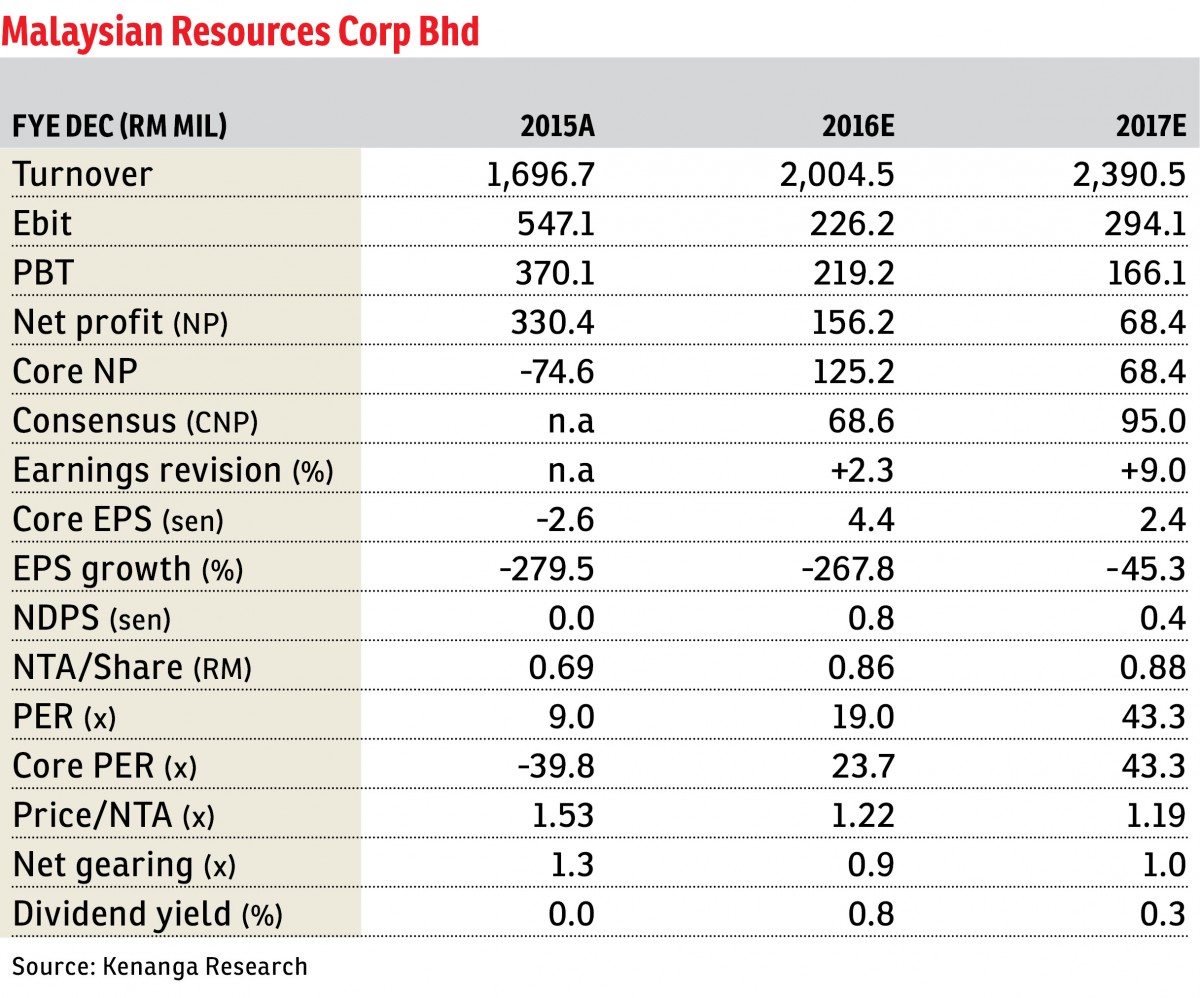

We are increasing our earnings estimates marginally by 2.3% to 9% for FY16E to FY17E, to RM125.2 million to RM68.4 million, to account for better margins recognised for this project of about 15%, compared with our 7% pre-tax margin assumption for other construction projects.

While this contract is within expectations, we note that MRCB has already bagged 89.3% of our construction replenishment assumption within six months of FY16, and we may look to upgrade our construction order book assumptions if it continues securing jobs at this pace.

MRCB’s remaining external construction order book is at about RM6.4 billion, coupled with about RM1.5 billion unbilled property sales, providing the group with at least four years of earnings visibility.

We reiterate “market perform”, but lower our TP to RM1.20 on a fully diluted FY16E net tangible assets (NTA) per share of 86 sen as we apply forward P/NTA of 1.4 times, which is a decrease of 1.5 standard deviation to the average six-year historical mean.

We apply a below-average discount as sentiment continues to weaken, while we expect the sector to de-rate further in the absence of near-term earnings-accretive catalysts.

Downside risks to our call include: weaker-than-expected property sales, lower-than-expected sales and administrative cost, negative real estate policies and a tighter lending environment. — Kenanga Research, July 4

Do not ask your BFF about the value of your home. Go to The Edge Reference Price to find out.

This article first appeared in The Edge Financial Daily, on July 5, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

The Hipster @ Taman Desa

Taman Desa, Kuala Lumpur

Subang Jaya City Centre (SJCC) : Teja

Subang Jaya, Selangor

Arte Solaris @ Mont Kiara

Mont Kiara, Kuala Lumpur

Arte Solaris @ Mont Kiara

Mont Kiara, Kuala Lumpur

Arte Solaris @ Mont Kiara

Mont Kiara, Kuala Lumpur

Arte Solaris @ Mont Kiara

Mont Kiara, Kuala Lumpur

Arte Solaris @ Mont Kiara

Mont Kiara, Kuala Lumpur