THE early 1990s are known as Malaysia’s golden years. This is when the economy expanded at a rapid pace, driven by a thriving manufacturing sector that served as a pillar of growth and the huge rural-urban migration that fuelled the need for housing in the cities.

As a result, property prices increased the most during the early part of the 1990s. According to the Valuation and Property Services Department, house prices rose 25.5% and 12.2% in 1991 and 1992 respectively.

In 1995, house prices increased 18.4% and in 1996, they were up 12.9%. And then, the Asian financial crisis struck, crippling the property market. House prices went up by a subdued 1.9% in 1997 before crashing by 9.5% in 1998.

The property market did not recover in 1999 as house prices declined by another 2.4%. It only recovered in 2000, when house prices rose 6%. Over the first half of the Noughties, prices increased at a low single-digit rate.

The property market crash in 1998 caused many projects to be abandoned as developers could not service their debts as interest rates soared. At the same time, house buyers were having a hard time as they still had to service their mortgages although their properties were abandoned.

The property market crash in 1998 caused many projects to be abandoned as developers could not service their debts as interest rates soared. At the same time, house buyers were having a hard time as they still had to service their mortgages although their properties were abandoned.

One major example of the effect of the Asian financial crisis on property projects was the Plaza Rakyat development.

The project was only revived recently after Kuala Lumpur City Hall took legal possession of the site from the original developer in 2013 and awarded it to another developer two years later — almost 20 years after work stopped at the site.

Now, many fear the same situation could happen again.

The years after the 2008/09 global financial crisis saw the rise of a new breed of investors in Malaysia. These so-called “property flippers” fuelled the rapid rise in property prices between 2011 and 2013, to the extent that Bank Negara Malaysia had to intervene.

The Malaysian House Price Index rose 9.9%, 11.8% and 11.6% in 2011, 2012 and 2013 respectively, almost as rapidly as in the 1990s, before Bank Negara’s ban on the developer’s interest bearing scheme (DIBS) and other tightening measures put the brakes on the soaring property prices.

The rapid increase in property prices was worrying as it was not supported by a fast growing economy. Malaysia’s economy has grown at an average of only 4.75% since the new millennium, a far cry from the heady 8% to 9% in the early 1990s.

While the Malaysian economy is not in a full-blown crisis, the slowdown is definitely giving many developers a headache. Developers have taken a step back to reassess their position — to continue with the planned launches or hold them for another year or two?

While the Malaysian economy is not in a full-blown crisis, the slowdown is definitely giving many developers a headache. Developers have taken a step back to reassess their position — to continue with the planned launches or hold them for another year or two?

But will the property market rebound in another year or two? Have both the economy and property market hit the bottom? Or is the current slowdown only a precursor to something more devastating?

‘Healthy price correction likely in secondary market’

“Owing to the current weak economy, poor property market sentiment and tightening guidelines for banks, residential property prices in the secondary market have dropped by 5%. This year, residential property prices in the Klang Valley could see a single-digit drop. We also expect office prices to decline,” says James Wong, managing director of real estate consultancy VPC Alliance (M) Sdn Bhd.

Malaysia’s economy grew 4.2% year on year in the first quarter of this year, the slowest since the global financial crisis. While crude oil prices have risen to about US$50 per barrel, this is still far from the US$100 per barrel seen in 2013.

At the same time, household debt continues to inch up. In its Financial Stability and Payment Systems Report 2015, Bank Negara states that the household debt-to-gross domestic product ratio in 2015 was 89.1%, compared with 76.1% in 2011.

According to Christopher Boyd, executive chairman of real estate services provider Savills (M) Sdn Bhd, the market will improve by the end of the year or early next year as there is still a lot of pent-up demand across the board.

“There is a slowdown in the property market, but some launches have been very successful. The launch of Nordica Residences @ Gravit8 by Mitraland — serviced residences priced between RM400,000 and RM500,000 in Klang South — received great sales response,” he says.

However, he notes that the sales of properties in the RM1 million to RM1.5 million price range have been very slow. Nevertheless, the housing market generally has reached its bottom as developers responded quickly when it started to slow down.

According to the National Property Information Centre (Napic), the volume of property transactions (residential and non-residential) declined 5.7% last year while total value dropped 8% y-o-y to RM149.9 billion.

This is still a manageable decline, unlike the plunge in 1998. In that year, the volume of property transactions fell 32.3% from 1997 while total value plunged 47.6% y-o-y to RM27.9 billion.

On average, property prices are still rising as the Malaysian House Price Index was up 7.8% last year, albeit slower than 2014’s 9.4%.

But with the global economy deteriorating, exacerbated by uncertainties caused by the UK’s vote to exit the European Union, the question remains as to whether the Malaysian property market has reached its bottom or if this is just the start of a long slide.

During the Asian financial crisis, both the volume and value of property transactions experienced sharp declines of 32.27% and 47.55% respectively, according to Napic data.

In 1Q2016, the volume of transactions in the commercial and industrial segments declined 42.17% and 41.17% y-o-y respectively, likely due to the implementation of the Goods and Services Tax and an oversupply situation.

“Although demand for residential units remained weak in 1Q2016, it is still considered stable as the value of residential property transactions was RM16.25 billion, compared with

RM17.95 billion [in 1Q2015],” says VPC Alliance’s Wong.

He adds that during the Asian financial crisis, the worst affected property type was the high-end condominium subsector. Prices of high-end condos fell by as much as 40% to 50% in some locations but today, there is only a 5% to 10% decline, “which in our opinion is still considered healthy”.

“Landed residential properties in prime locations also experienced a sizeable price drop in 1998. Double-storey terraced houses in Bukit Bandaraya, which were selling for RM700,000 in 1996/97, were sold for RM550,000 in mid-1998, a decline of 21.42%,” says Wong.

What if the property market crashes?

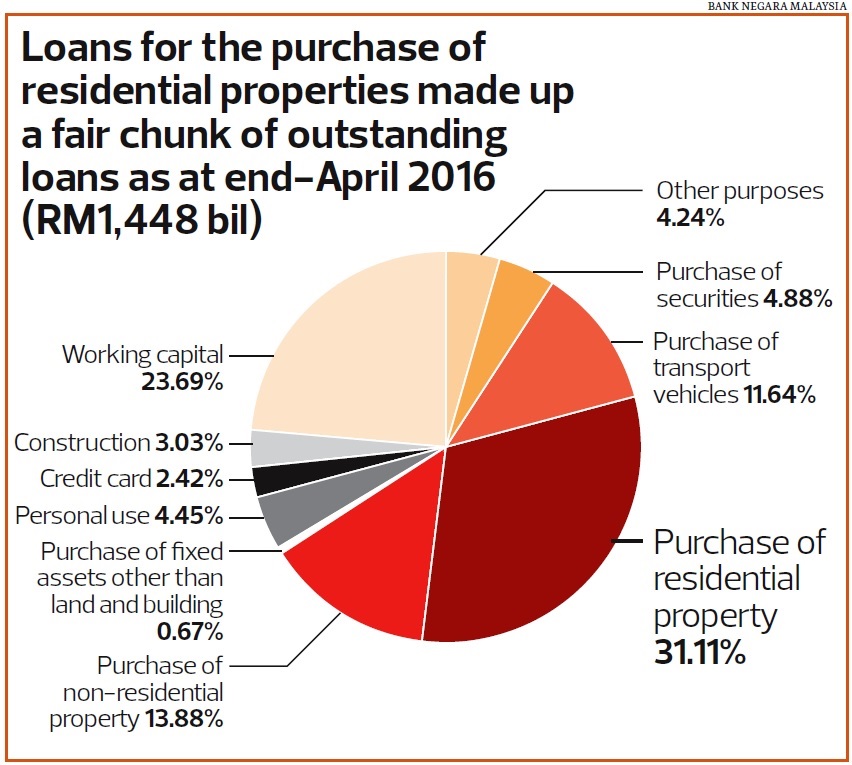

Over the years, the property sector has grown in importance to the Malaysian economy. As at December 2007, outstanding loans for the purchase of properties constituted 35.6% of total loans in the banking system.

As at April 2016, this percentage rose to 45%. In contrast, the percentage of outstanding loans for the purchase of transport vehicles dropped to 11.64% as at April 2016, from 16.6% in December 2007.

From these numbers, it is clear that if the property market crashes, the entire banking system will be severely affected. Back in 1998, some banks had to be bailed out by the government due to the financial crisis, which led to massive lay-offs and a rise in unemployment.

However, unlike in 1997/98, prices of terraced houses in prime locations in 1Q2016 are stable compared with 2015, says Wong. For example, a 1-storey terraced house in Bangsar Park was transacted at RM1.13 million in August 2015 and RM1.25 million in March 2016.

“Based on the current property market trend, we don’t expect to see a huge drop in prices in the secondary market like in 1997/98 but rather a healthy price correction, which will lead to a stable market,” says Wong.

He concludes that the property market crash seen during the Asian financial crisis is not expected to happened again in the current market situation.

The unemployment rate is still low, albeit ticking up. As at April 2016, the rate was 3.49%, compared with 2.97% a year ago.

While the labour market is still quite steady, there is a fear that property investors who bought multiple properties three years ago on DIBS, may have to start servicing their loans as soon as they take delivery of their units.

It is this group that is the most fragile now as they may not be able to “flip” their properties and walk away. They may also find it difficult to rent them out. These owner-investors will be hard-pressed to service their mortgages.

However, Savills’ Boyd thinks that this issue will not be a factor that will bring down the property market and eventually the economy as a whole. He says if these owner-investors defaulted, at most, the small office/home office sector will be shaken.

“The delinquency rate for home loans in Malaysia is traditionally very low — about 1% to 2%. Even during a crisis, it will just grow a little bit. People have always managed to scrape through,” he adds.

While the numbers seem to suggest that the property sector is still holding up despite the worsening macroeconomic situation and outlook, the fact that developers are offering various financing schemes and rebates shows that the sector is indeed going through a tough time.

The question is whether the worst is over and demand for properties will recover soon. Or could this be just the beginning of an even greater contraction in sales volume and value, just like what happened in 1998?

Start your search for a condominium of your choice HERE.

This article first appeared in The Edge Malaysia on July 4, 2016. Subscribe here for your personal copy.