Property sector

Maintain neutral: Recently, cooling measures have been announced in several states in Australia to curb speculation by foreign property buyers. New South Wales (capital city: Sydney) will be proposing a stamp duty surcharge of 4% and a 0.75% land tax in its today’s Budget following the move by Victorian and Queensland.

The Victorian government (capital city: Melbourne) announced in its 2016 to 2017 Budget that additional stamp duty for foreign buyers (3% to 7%) will be imposed from July 1 and its land tax surcharge will be tripled for absentee landholders from 0.5% to 1.5% from 2017.

In addition, tightening measures have also been introduced to the banking system. The press has reported that Westpac, one of the big four banks in Australia, has stopped lending money to foreign property investors and tightened the rules for Australian citizens whose main source of income derives from overseas, after similar move announced by Commonwealth Bank.

The cooling measures mentioned above should lead to moderation in demand for investment property with a consolidation of prices in Melbourne and Sydney. We expect buyers’ sentiment to be dampened in the short term.

Under our universal of stock coverage, a few listed developers have exposure to the Australian market. S P Setia Bhd, UEM Sunrise Bhd and Matrix Concepts Holdings Bhd have presence with majority projects concentrated in Melbourne, which is subject to 7% stamp duty and 1.5% of land tax surcharge. In terms of percentage of remaining total gross development value (GDV), their exposure in Australia is relative small, with S P Setia at 2.9%, Matrix (1.4%) and UEM Sunrise (1%).

For new projects in the pipeline, UEM Sunrise is targeting to launch St Kilda by the end of the year with a GDV of RM750 million (about 38% of FY16’s total GDV launches). As such, any slowdown in Australia’s property market is expected to impact UEM Sunrise on its new sales.

In terms of geographical profile of buyers, foreign buyers (non-Australians) account for a large percentage (ranging from 54% to 86%). The Chinese and Malaysians are the majority of foreign buyers. We understand that majority of Malaysian buyers secure financing from local banks. That said, we would expect tightening of lending rules on foreigners to dampen sales growth.

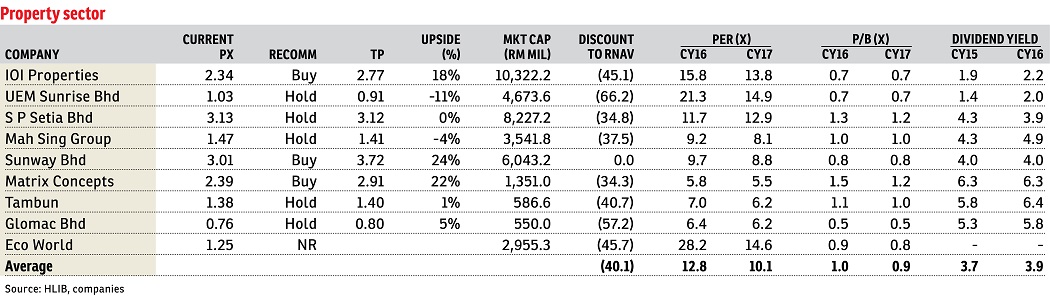

There is a negative bias given prolonged weakening of domestic consumer sentiment. Recent external policy headwinds represent further dampener on the sector. We maintain neutral on the sector and our top pick is IOI Properties Group Bhd with a “buy” call and a target price (TP) of RM2.77. We also have a “buy” call on Sunway Bhd with a TP of RM3.72. — HLIB Research, June 17

This article first appeared in The Edge Financial Daily, on June 21, 2016. Subscribe to The Edge Financial Daily here.

TOP PICKS BY EDGEPROP

Dua Sentral Residential Tower

Brickfields, Kuala Lumpur

Kaleidoscope Residence

Wangsa Maju, Kuala Lumpur

Kemensah Villa Condominium

Taman Melawati, Kuala Lumpur

Bayu Angkasa Apartments @ Nusa Bayu

Gelang Patah, Johor