- "The expansion initiatives come at an opportune time, as the construction industry stands to benefit from government-led initiatives and spending, particularly in infrastructure development.”

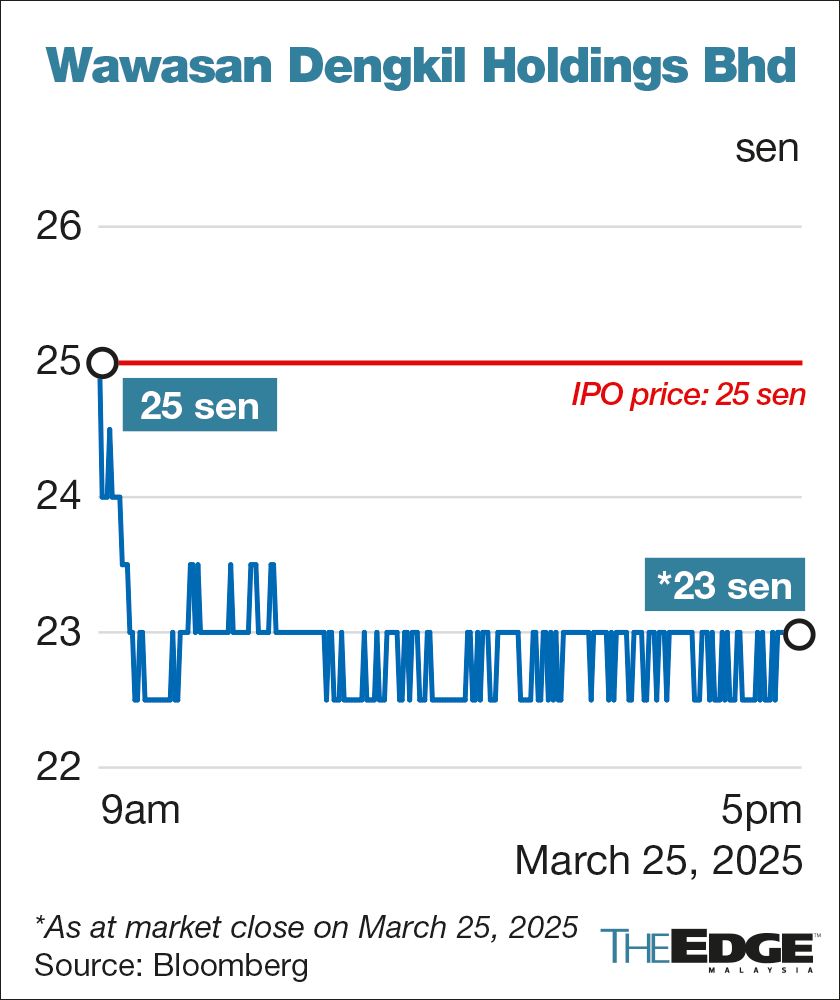

KUALA LUMPUR (March 25): Construction services firm Wawasan Dengkil Holdings Bhd (KL:DENGKIL) became the fourth company this month to make a disappointing debut on Bursa Malaysia, closing below its initial offering price (IPO) on its first trading day on the ACE Market.

Opening at 25 sen, the same as its IPO reference price, Wawasan Dengkil fell nearly immediately below that on its Tuesday trading debut to 2.35 sen at 9.10am. It then slipped to as low as 22.5 sen, before closing at 23 sen — down 2 sen or 8% from its IPO price, after the company's listing raised RM40.51 million, including RM13.5 million from an offer for sale of existing shares that will accrue entirely to its selling shareholders.

The three other IPOs which dropped on their maiden trading day this month were Pantech Global Bhd (KL:PGLOBAL), Saliran Group Bhd (KL:SALIRAN) and Lim Seong Hai Capital Bhd (KL:LSH).

“With fresh capital from our IPO, we are ready to accelerate our growth and seize new opportunities,” Wawasan Dengkil's executive director Lim Soon Yik said at the company's listing ceremony on Tuesday.

Applications for its shares came in 17 times above the total set aside for public retail investors during the initial share sale. Shares allocated for eligible persons were fully subscribed, while private placement for select investors were all taken up.

The company raised RM27.01 million from the IPO, of which more than one-third of the proceeds have been earmarked for project working capital. The company is also setting aside 28% for the purchase of excavators, a mobile crane, and dump trucks.

"The expansion initiatives come at an opportune time, as the construction industry stands to benefit from government-led initiatives and spending, particularly in infrastructure development,” said Lim.

The company has 14 ongoing projects with unbilled orders worth RM378.14 million, and is bidding for projects worth RM1.3 billion. It is involved in major projects, including the third phase of the Light Rail Transit.

“As earthworks are typically needed in the initial phase of building and infrastructure construction, we are well positioned to capitalise on these growth prospects,” Lim added.

Wawasan Dengkil will use 5% of the money raised for general working capital, repayment of bank borrowings, office renovation, and to defray listing expenses.

Meanwhile, the RM13.5 million raised from the offer for sale of existing shares will accrue entirely to selling shareholders Lim and his family.

M&A Securities is the adviser, sponsor, underwriter and placement agent for the IPO, while Eco Asia Capital Advisory is the financial adviser.

Want to have a more personalised and easier house hunting experience? Get the EdgeProp Malaysia App now.

TOP PICKS BY EDGEPROP

Jalan Tuanku Abdul Rahman

KL City, Kuala Lumpur

Bandar Damai Perdana, Kuala Lumpur, Kuala Lumpur

Cheras, Kuala Lumpur

Damansara Heights (Bukit Damansara)

Damansara Heights, Kuala Lumpur

Apartment Tanjung Puteri Resort

Pasir Gudang, Johor