- DBKL should treat its underlying problems with financial accountability rather than increase rates that will cause inflation and make the rakyat suffer the domino effect down the supply chain.

Recent news have reported that Kuala Lumpur City Hall (DBKL) is considering an increase in assessment tax rates, following the Selangor state government’s 25% hike from January next year.

Minister in the Prime Minister’s Department (Federal Territories) Dr Zaliha Mustafa said “DBKL had been running a deficit in recent years, necessitating efforts to increase revenue”, reported The Star on Dec 13.

Before that, DBKL must be selective and make a distinction between residential properties and industrial properties. Perhaps that should be done first before it imposes new rates on new residential, commercial, industrial and mixed development projects. After all, pricing is reflective of current valuations and there are so many new developments: stratified and landed, high-end residential condo, commercial retail blocks, office blocks, shopping complexes, SoFo (small-office flexible-office), SoHo (small-office home-office), condotel, hotels, serviced apartments, boutique buildings and industrial developments.

Not enough money?

Firstly, the issue of not having enough funds should not even arise. This is because plot ratios and density have been increased drastically for developers in KL, so more revenue in terms of development charges levied and assessment revenue would be collected. DBKL has also been collecting Infrastructure Service Fund (ISF) in the millions from developers for the development of infrastructure in KL and millions in lieu of the non-availability of car park bays.

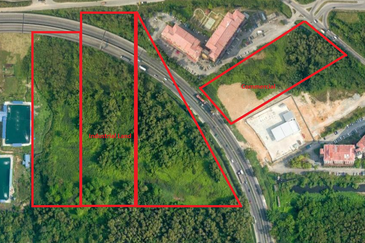

The host of projects driven by the Economic Transformation Programme, namely, Tun Razak Exchange, Merdeka 118, KL Metropolis, KL Eco City, Bukit Bintang City Centre (BBCC) and multi-block multi-storey Razak City (RC) Residences, M-Vertica KL City, the mass rapid transit (MRT) and many more is also a boon to DBKL’s resources.

Secondly, the last tax increase was implemented in 2013, whereupon assessment taxes were periodically revised and imposed on all rate payers.

On top of that, some “newly” completed properties delivered four to five years ago suffered the fate of a revision with an increase of 100–200%, as though the properties had doubled in value within that short span of time. Some owners in Cheras have even received notices of revision that translate into a 200% hike in rates, without considering that the leasehold land upon which the property is erected will expire in 60 years, thus diminishing the property resale value.

Maintenance borne by owners, not DBKL

In fact, a rebate should be offered to those living in stratified properties like flats, apartments and condominiums, as they are already paying maintenance fees to their joint management bodies (JMBs) and management corporations (MCs) for the upkeep of their infrastructure and playgrounds, trees and landscape, internal roads and drains, rubbish disposal, parking lots and other facilities within their perimeters. Only the drains and roads outside the perimeters are under DBKL’s maintenance.

Moreover, DBKL’s duty no longer covers sewerage services, whereby taxpayers today have to make separate payments to Indah Water Konsortium. Shouldn’t this warrant a reduction?

Long list of non-rate revenue sources

DBKL does not depend on assessment collection alone for revenue. There are other major sources of revenue, termed as non-rate revenue, which are, inter-alia:

1. Licensing and permits from:

Engineering Department

Department of Buildings

Licensing Department

Department of Health

Department of Environment

Department of Enforcement

2. Sale proceeds from DBKL properties

3. Interest on fixed deposits

4. Rent proceeds from council homes

5. Dividends from investments

6. Returns on investments

7. Compound and fine collections

8. Infrastructure contributions

9. Remittance from federal agencies

10. Privatisation of buildings

11. Parking collections

12. Sale of plans

13. Billboard erection fees and rent proceeds

14. Joint-venture housing projects

15. (And many more)

Proper audit?

One of the significant income streams is the sale of DBKL-owned properties and joint venture housing projects or land sales. This forms a major portion of DBKL’s income; but is there a proper audit in place for the money received? Has DBKL implemented value-for-money practices in these ventures and are all projects and procurements done through genuine open tenders?

Besides that, it seems there are hundreds of million ringgit that DBKL has not collected from defaulting taxpayers as well as defaulters of rent from PPR (People’s Housing Project) homes. This raises the question: Why not?

In addition, development expenditure is largely funded by the federal government. We wonder how many hundreds of million ringgit DBKL have received from federal government funding, allocation under the 12th Malaysia Plan and grants. Anyway, these figures can be obtained from Parliament, if our local members of parliament are interested to unearth.

Where is the service?

The proposed hike has understandably irked the city’s dwellers, triggering a long list of complaints against the standard of service by DBKL. Among the grievances are roads riddled with potholes, untrimmed trees, unkempt and unsightly public parks, undergrowth on road reserves, inconsistent rubbish collection, broken drains, poor upkeep of public playgrounds, flooding, parking woes, uneven roads, a spike in dengue fever, illegal dump sites, rat infestations, illegal immigrants and beggars, illegal buntings and billboards, lack of enforcement on regulations, failure to collect rent from council home defaulters, faulty public lightings ... and the list goes on and on.

Notably, has the KL Draft Local Structure Plan 2040 that has been flooded with voluminous objections from land proprietors, occupiers and stakeholders been finalised and gazetted?

How taxes can be saved with financial accountability

1 Transparency in budgeting and spending:

- Public access to financial information: Governments can improve transparency by providing easy access to budgets, financial statements and spending reports. This allows taxpayers to see exactly where their money is going, helping to build trust.

- Clear allocation of funds: Clear communication on how the increased tax revenue will be spent—whether for infrastructure, public services or debt reduction—can ensure taxpayers see value in the hike and are more willing to support it.

2 Efficient use of funds:

- Cost-cutting: Governments should look for areas where spending can be reduced without affecting services, e.g. cutting wasteful practices, renegotiating contracts or streamlining operations.

- Performance audits: Regular audits and reviews of how public funds are spent can identify inefficiencies or misuse of funds. Implementing these audits ensures that taxpayer money is spent effectively.

3 Public engagement and feedback:

- Governments can hold open forums or consultations to involve taxpayers in budget decisions. When citizens feel they have a say in how taxes are spent, they are more likely to accept necessary tax increases.

- Taxpayer incentives: Offering credits, rebates or deductions for responsible property ownership or energy efficiency improvements can help offset the impact of higher taxes for some taxpayers.

4 Technology and data transparency:

- Open data platforms: Local governments can utilise technology to make financial data more accessible and understandable to the public. Platforms that track tax revenue, spending and the progress of projects funded by taxes can reassure taxpayers that their money is being used prudently.

- Tax incentives for transparency: Governments can implement systems where taxpayers or businesses that maintain transparent financial practices—such as clear reporting of income and deductions—can benefit from lower rates or deductions.

5 Governance measures:

- Accountability: Establishing systems where local officials are held accountable for tax increases—by showing positive results or improvement in services—encourages responsible decision-making. Elected officials should provide regular updates to the public on how the additional funds are being used and whether they are delivering the promised outcomes.

- Independent oversight: An independent body or watchdog can be tasked with overseeing the use of tax funds. This ensures that funds are not misappropriated and that tax hikes are justified by improvements in public services or infrastructure.

DBKL must be committed to transparency and responsibilities. By fostering transparency, ensuring financial accountability, and engaging with the public, governments can justify necessary tax hikes and help citizens understand the benefits of those increases. This, in turn, can promote trust in the system and potentially reduce resistance to tax hikes. It is the ratepayers’ right to live in a safe and well-maintained environment with a good sense of accountability by the governing authority.

Establish Ombudsman

Accusations of inflated pricing of asset and services procured is not something uncommon and these issues are on every rate payer’s lips.

To prevent false accusation, corruption and poor fiscal management, DBKL’s expenditure must be made public and easily accessible and ratepayers should have the ability to oversee spending and influence decisions including scrutiny of annual budgets. We propose that an Ombudsman be established to monitor funds spent and to minimise “self-inflicted” wastages.

Selangor’s tax hike may be subject to legal challenge

The same rationale applies to the Selangor state government’s residential property rate increase.

Do note, though, it may be unlawful as the property valuation increase may not be consistent across the state of Selangor as it varies from cities to municipalities. Thus, this artificial method of fixing a 25% increase across the board may be subject to legal challenge.

The councils should carry out a comprehensive evaluation of their respective entity’s’ financial and operational performance to see where they can reduce excesses and wastage and optimise costs before taking the easy route of increasing property assessment rates.

Moreover, can DBKL and the Selangor state government give a guarantee that the quality of services will greatly improve if taxes are increased?

Taxpayers’ right to know how public money is used

Councils spend public money. The money comes from national and local taxes as well as charges to users of services. Councils have a special responsibility to tell local residents and taxpayers how they spend our money by publishing yearly accounts and details of their spending.

Council accounts are the financial statements that most organisations have to produce at the end of the year—a balance sheet and summary of income and expenditure. But the term also covers all related documents used to make up the council’s accounts and any report by the external auditor about how the council organises itself to conduct its business.

As a local resident or interested party, we have legal rights which let us inspect, query and object to our council’s accounts and related documents.

Datuk Chang Kim Loong is the Hon Secretary-general of the National House Buyers Association (HBA).

HBA can be contacted at:

Email: [email protected]

Website: www.hba.org.my

Tel: +6012 334 5676

The views expressed are the writer’s and do not necessarily reflect EdgeProp’s.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Pangsapuri Seri Dahlia, Desa Alam

Shah Alam, Selangor

Residensi PR1MA Bandar Bukit Mahkota

Kajang, Selangor

Conezión @ IOI Resort City

Putrajaya, Putrajaya

Pusat Bandar Putra Permai

Seri Kembangan, Selangor