- The company said it will focus on the timely completion of its on-going development projects, monetisation of its inventories and prudent financial management to navigate the evolving market environment.

KUALA LUMPUR (Nov 12): GuocoLand (M) Bhd's (KL:GUOCO) net profit more than halved to RM2.32 million in the first quarter ended Sept 30, 2024 (1QFY2025), from RM4.79 million a year earlier, as revenue fell on reduced contribution from the property development division.

Earnings per share of the Hong Leong Group's property arm fell to 0.35 sen from 0.72 sen in 1QFY2024.

Revenue for the three months declined nearly 50% year-on-year to RM60.34 million from RM119.15 million, according to the company's bourse filing.

The company did not declare any dividends in the quarter.

On prospects, GuocoLand said challenges in the domestic property sector stemming from elevated interest rates and rising construction costs had led to depressed profit margins.

Property sales remain challenging due to an oversupply of properties in different markets and segments, it noted.

The company said it will focus on the timely completion of its on-going development projects, monetisation of its inventories and prudent financial management to navigate the evolving market environment.

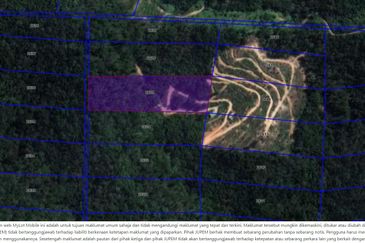

“New product launches will be phased in line with the prevailing local market conditions," it said. “Furthermore, the group remains vigorous in reviewing the development plans of its existing landbank to ensure their marketability and relevance as well as seeking acquisitions for expansion.”

GuocoLand's share price closed down half a sen or 0.71% at 69.5 sen, valuing the company at RM487 million.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Tenderfields @ Eco Majestic

Semenyih, Selangor

Central Residence, Sungai Besi

Salak Selatan, Kuala Lumpur

Kuala Terengganu Golf Resort

Kuala Terengganu, Terengganu