- While HBA supports the tax relief for first home buyers, HBA feels that such an incentive should also be given to all existing homeowners with outstanding housing loans as this will benefit more rakyat which have been burdened for the past years.

The National House Buyers Association (HBA) views the incentives announced in Budget 2025 on affordable housing and homeownership with high optimism and anticipation.

The proposals, under the leadership of Prime Minister and Finance Minister, Datuk Seri Anwar Ibrahim, are well thought out, and if implemented right, can go far towards increasing the supply of affordable housing and reducing the threat of a Homeless Generation.

Read also:

Budget 2025: Biggest ever allocation to reinvigorate economy

Consultants see tax relief for housing loans supporting first-time buyers amid limited property measures in Budget 2025

KPKT’s Budget 2025: 14 of its financial initiatives have been approved

However, HBA is of the opinion that there is a need to define what “Affordable Housing” is to ensure that this term is not abused by housing developers who deem prices of RM500,000 are “affordable”.

The government has to ensure Affordable Housing meets these three criteria:

1. Price

Affordable Housing are properties priced between RM150,000 and RM300,000 and must also be differentiated from “Social Housing Units” such as Low-Cost Housing or Medium-Cost Housing priced below RM100,000 such as PPR (People’s Housing Programme) units.

2. Built-up

Affordable Housing must be conducive for “Family Living” and must have a minimum built-up of 800 sq ft (excluding balcony) and have at least two bedrooms.

3. Location

Affordable Housing must be located in areas that are accessible and served by good public transportation links such as buses and rail links (LRT, MRT, KTM, etc) and located in areas with good public amenities such as government schools, public hospitals, hypermarkets, etc.

A home is not just a physical asset but also a form of financial security in our golden years. It is the aspiration of every citizen to have a roof over their head and HBA hopes that the Housing Minister will always put the interest of the rakyat and country first before the interest of housing developers.

Our comments and response to Budget 2025 on matters relating to the property sector are as follows:

1: Housing Credit Guarantee Schemes (SJKP: Skim Jaminan Kredit Perumahan) has approved RM12.8 billion in government guarantees for over 57,000 first-time homebuyers, with ongoing guarantees of RM10 billion for 20,000 first time buyers.

The above new guarantee scheme is more meaningful as it equals the average price of RM224,000 per unit which falls within the Affordable Housing price category.

However, the existing guaranteed ones of RM10 billion for 20,000 house buyers (Budget 2024) equates to about RM500,000 per unit, which is above the level of Affordable Housing price.

HBA welcomes the announcement that the government will allocate up to RM12.8 billion for the SJKP to guarantee housing loans to help those without stable incomes such as those in the gig economy to buy properties.

HBA hopes that this SJKP will only be extended to first-time house buyers and only for affordable properties priced M300,000 and below, and also available for purchasing secondary properties, i.e. existing completed properties, and not just properties directly from property developers.

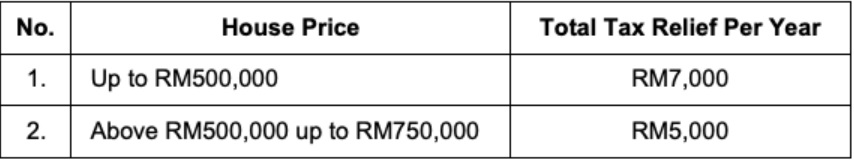

2. First homebuyers will enjoy individual income tax reliefs on the interest payments for home loans with sale and purchase agreements (SPA) executed between Jan 1, 2025 and Dec 31, 2027, applicable for three consecutive years of assessment, commencing from the first year the housing loan interest is paid.

While HBA supports the tax relief, HBA feels that such a relief should also be given to all existing homeowners with outstanding housing loans as this will benefit more rakyat which have been burdened for the past years. As such, the three-year tax relief should start from the date of handover instead of the date of SPA.

Similarly, the tax relief on interests should be applied strictly for first-time buyers irrespective of purchasers from housing developers or from the secondary market i.e. sub-sale.

More importantly, the government should come up with a policy to exempt all buyers of abandoned projects from paying interests until the handover of their completed units.

3. People’s Residence Programme (PRR): Almost RM900 million will be allocated to implement 48 PRR and 14 Rumah Mesra Rakyat (RMR) or People-Friendly Housing projects, including two new PRR projects in Port Dickson, Negeri Sembilan and Seberang Perai Tengah, Penang. 30 PRR projects are expected to be completed by the end of 2025, benefiting nearly 17,500 new residents.

HBA welcomes the grant announcement to build Rumah Mesra units. Rumah Mesra are forms of social housing for the B40 and hardcore poor segment of the rakyat. HBA has always stressed that the Government, not private developers, should provide any form of social housing.

However, HBA urges the Government to ensure that these Rumah Mesra units reach the intended target segments for self-occupation, and are not abused by unscrupulous people who rent out the units to be used as foreign workers dormitories.

(Read also: Preventive enforcement and proactive scheme needed to help rakyat own homes)

4. PPR or PRR?

We have this current form of social housing termed as People’s Housing Programme or referred to as Program Perumahan Rakyat (PPR). Units built are only temporary living quarters for those looking, in future, to buy their own houses. They should only be rented out by the relevant agencies. The objective and aspiration of the government is for these transit homes to provide temporary living places for those who want to save enough money before embarking on buying their own homes. Those renting the PPR flats should regard them as merely temporary abodes to shelter their families and have roofs over their heads whilst striving to look for permanent homes.

Now, it seems we have a new terminology in Program Residensi Rakyat (PRR) or People’s Residence Programme and a huge sum has been allocated for this new programme. We don’t have details of this PRR scheme but we have voiced our utmost concern of the idea of PRR when it was announced earlier this year. Our concerns, as delineated in an earlier article: PRR — Is giving away taxpayers’ money sustainable? have yet to be addressed.

This article is written by National House Buyers Association (HBA) honorary secretary general Datuk Chang Kim Loong.

HBA can be contacted at:

Email: [email protected]

Website: www.hba.org.my

Tel: +6012 334 5676

The views expressed are the writer’s and do not necessarily reflect EdgeProp’s.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!