- In the property sector, Gamuda achieved its RM5 billion sales target for FY2024, and is setting its sights on RM6 billion in FY2025. The property division contributed RM410.8 million in net profit, a 30.5% increase from a year ago.

KUALA LUMPUR (Sept 27): Gamuda Bhd (KL:GAMUDA) is targeting a RM35 billion order book by the end of 2024, on the back of both international and domestic projects, positioning it for strong growth in the financial year ending July 31, 2025 (FY2025), analysts said.

MIDF Research noted that the management is confident that its order book will grow between RM30 billion and RM35 billion by the end of 2024, fuelled by upcoming projects like the Ulu Padas hydro project, hyperscale data centres, and the Pan Borneo Highway.

“There is high certainty of securing an additional RM10 billion to RM15 billion in projects over the next two quarters,” said MIDF in a note on Friday.

Furthermore, Gamuda’s order book stood at RM24.8 billion as of July, with overseas projects, especially in Australia, comprising a large chunk.

Although FY2024 earnings fell slightly short of expectations due to the impact of foreign exchange (forex) and delayed local infrastructure projects, Public Investment Bank echoed similar sentiments about the property developer’s outlook for FY2025.

Citing potential new wins in both the local and international markets, Public Investment Bank remained optimistic about Gamuda’s near-term prospects.

“The group expects new project wins to come from domestic and data centre projects, with better margins to drive its engineering and construction earnings,” said the house.

Gamuda reported a 5.4% year-on-year growth in core net profit, reaching RM907.3 million.

Besides, the group’s revenue surged 62.1% to RM13.35 billion, largely supported by its overseas operations, which accounted for 84.5% of construction revenue of RM10.6 billion.

However, forex impact, particularly from the Vietnamese dong and Australian dollar, shaved about RM35 million off profits.

“One of the reasons for the weaker-than-expected earnings was the forex impact, due to strengthening of the ringgit against the Vietnamese dong and the Australian dollar, resulting in a negative impact of about RM35 million,” MIDF added.

While the group’s earnings came in below MIDF’s expectations at 90% of its full-year estimate, it remained within the consensus at 96.3%.

In the property sector, Gamuda achieved its RM5 billion sales target for FY2024, and is setting its sights on RM6 billion in FY2025. The property division contributed RM410.8 million in net profit, a 30.5% increase from a year ago.

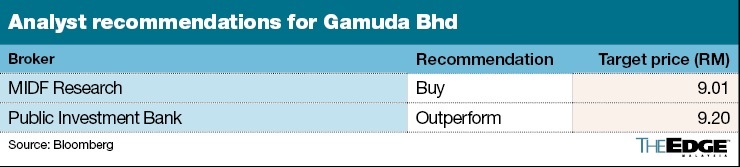

MIDF revised up its target price (TP) for Gamuda to RM9.01 (from RM8.26), and maintained its ‘buy’ call on the stock, while Public Investment Bank maintained its TP of RM9.20, with an ‘outperform’ call.

The group has also announced plans for a one-for-one bonus issue, which is expected to enhance liquidity and attract a broader base of investors.

Gamuda’s unbilled property sales, currently standing at RM7.7 billion, are said to provide strong visibility for future earnings.

Public Investment Bank added that Gamuda’s property division will focus on two quick turnaround projects in Vietnam in FY2025, aiming to bolster sales and improve margins.

At the time of writing on Friday, Gamuda’s share price had risen 23 sen or 2.87% to RM8.24, valuing the group at RM23.23 billion.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

senaiairportcity-overallview.jpg?wyCmw4_M_WK1b.OkWEhqLZeyUgCmSweP)