- Its property segment also recorded a higher operating profit of RM132 million, from RM124.7 million in the same period a year earlier.

KUALA LUMPUR (Sept 24): Scientex Bhd (KL:SCIENTX) said on Tuesday that its net profit rose more than 18% year-on-year (y-o-y) in the fourth quarter, thanks to higher contributions from its packaging and property segments.

Net profit for the three months ended July 31, 2024 (4QFY2024) was RM135.86 million compared to RM114.89 million over the same period last year, the plastic packaging manufacturer and property developer said in an exchange filing.

Earnings per share were up to 8.76 sen against 7.41 sen a year earlier. Revenue for the quarter increased 9.04% to RM1.17 billion compared to RM1.07 billion in 4QFY2023.

For the quarter under review, the group’s packaging revenue was RM651.3 million compared to RM619.7 million in the same quarter last year, mainly driven by its industrial packaging products. This segment also recorded a higher operating profit of RM45.2 million from RM24.3 million last year due to the product mix.

Its property segment recorded an increase of 14.4% in revenue to RM517.0 million from RM451.8 million a year earlier, mainly due to the construction progress for its ongoing projects in Bandar Jasin, Rawang, Sungai Petani, Kundang, Tasek Gelugor and Pulai. This segment also recorded a higher operating profit of RM132 million, from RM124.7 million in the same period a year earlier.

Scientex has declared a final dividend of six sen per share for 4QFY2024, to be paid on Jan 17, 2025. This brings the total dividend paid for FY2024 to 12 sen per share, up from 10 sen in FY2023.

For the full year of FY2024, Scientex’s net profit was up 24.44% to RM545.21 million from RM438.14 million in FY2023, as revenue grew 9.78% to RM4.48 billion as compared to RM4.08 billion a year ago.

Moving forward, Scientex expects that the packaging business will continue to face a challenging outlook due to ongoing supply chain disruptions, inflationary pressure, fluctuation in foreign currency exchange rates, geopolitical tensions and subdued market sentiment.

However, the group said it remains committed to driving sustainable performance for the packaging division in the upcoming financial year while managing its operational costs and improving its operational efficiency to maintain its competitiveness in the market.

On the property division, the group said it remains optimistic that the demand for affordable homes will remain resilient for the coming financial year following the positive take-up rate from its new property launches.

"The new launches of its project in Jenjarom (Selangor), Sungai Dua (Penang), Sungai Petani (Kedah), Ipoh (Perak), Jasin (Melaka) and Pulai (Johor) have achieved encouraging take-up rates, signalling the continued strong demand for our affordable homes. We expect this positive momentum to continue with our future launches," it said.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

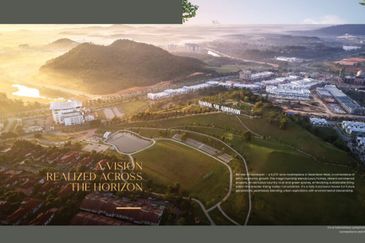

Mah Sing Integrated Industrial Park

Subang Bestari, Selangor

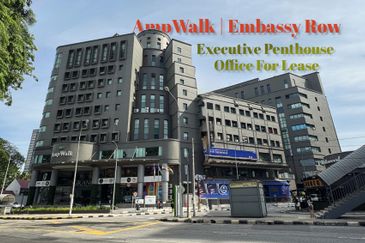

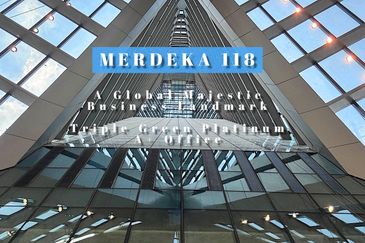

Merdeka 118 @ Warisan Merdeka 118

KLCC, Kuala Lumpur

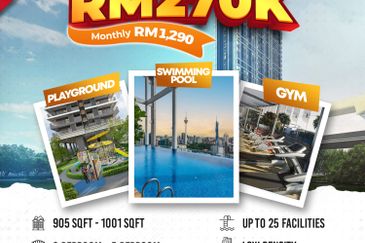

Horizon Residence (Dwi Mutiara)

Bukit Indah, Johor