- Almost half the respondents reported having unsold completed residential units, citing the top reasons as loan rejection, low demand and bumiputera lots.

KUALA LUMPUR (Sept 12): The Malaysian property market exhibited mixed signals in the first half of 2024 (1H2024). While there was a slight increase in property launches and sales, several challenges persisted, including rising costs, financing issues and economic uncertainty, according to a Real Estate and Housing Developers' Association Malaysia (Rehda) survey.

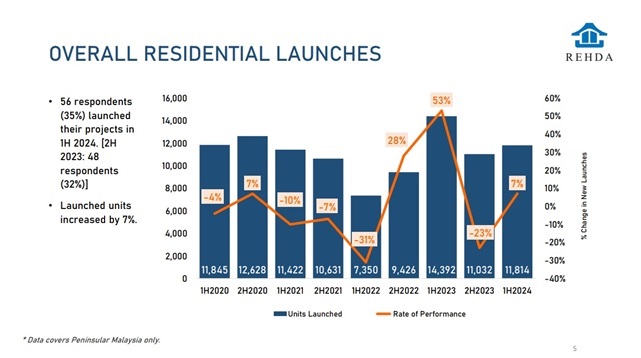

In a media briefing of the property industry survey today, Rehda president Datuk Ir Ho Hon Sang pointed out that launched units increased by 7% to 11,184 units in 1H2024 compared to 11,032 units in 2H2023.

Sales also rose marginally by 12% from 12,017 units in 2H2023 to 13,445 units in 1H2024, with 65% of these coming from unsold units from the previous year, while the remaining were from new launches in 1H2024.

The survey found that 74% of launches were priced between RM300,001 and RM700,000.

The most sold property types were serviced residences and 2- to 3-storey terrace houses.

Issue of unsold bumiputera units needs to be addressed

Meanwhile, 49% of respondents reported having unsold completed residential units, with 24% of them being serviced residences. The top reasons for this situation, according to respondents, were loan rejection, low demand and bumiputera lots.

“33% of unsold completed bumiputera lots aged more than 36 months, which I believe is an issue that the industry needs to address,” Ho said, adding that the majority of the unsold bumi lot units were priced between RM500,001 and RM700,000.

Rising costs dampen developers' sentiment

The higher price of building materials was cited to have a critical impact on business operations. Respondents reported more than a 10% annual increase in the average price for sand, glass and concrete as of June 30.

Ho highlighted there was a noticeable hesitation sentiment among developers in 1H2024 due to rising costs, including the sales and service tax (SST) and building materials.

“If you look at the [rising cost of] SST and the building materials, then the sentiment will be pessimistic. There is a high possibility of [adopting a] wait-and-see approach over the next six months.

“We hope to hear positive news for the industry in the upcoming Budget 2025 announcement next month. We should be able to enjoy a robust and thriving property industry should the major industry challenges be mitigated,” Ho said.

With affordable housing remaining a key priority for the government, the survey respondents cited the reduction of development charges, lower land conversion premiums and exemption of utility contribution charges as the top three wishes in easing their offerings of affordable housing.

“Making these changes to existing requirements will make free-market housing more affordable for the M40, who are currently paying for the burden of these cross-subsidies,” Ho highlighted.

Positive outlook for 2025 property market

Looking forward, Ho is optimistic that the property market will see a surge in 2025, as developers aim to capitalise on the improving market conditions.

He emphasised the overall economic outlook for Malaysia is positive, with strong GDP (gross domestic product) growth and a stable currency. Recent announcements, such as the commitment of global tech giants like Google and Microsoft to invest in data centres here, further bolster the country's economic prospects.

He concluded that these positive economic indicators, combined with the government's focus on urban regeneration, are expected to create a favourable environment for the property market in the coming year.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

HIJAYU 2 - RESORT HOMES

Seremban, Negeri Sembilan

HIJAYU 2 - RESORT HOMES

Seremban, Negeri Sembilan

HIJAYU 2 - RESORT HOMES

Seremban, Negeri Sembilan

Azalea @Resort Residence 2

Seremban, Negeri Sembilan

ARA SENDAYAN @ BANDAR SRI SENDAYAN

Seremban, Negeri Sembilan

Hijayu 1, Bandar Sri Sendayan

Siliau, Negeri Sembilan

Hijayu 1, Bandar Sri Sendayan

Siliau, Negeri Sembilan

Bandar Springhill

Port Dickson, Negeri Sembilan

Bandar Springhill

Port Dickson, Negeri Sembilan

Bandar Springhill

Port Dickson, Negeri Sembilan

Kawasan Perindustrian Mount Austin

Johor Bahru, Johor