- Barring any unforeseen circumstances, the proposed private placement is expected to be completed by 1Q2025.

KUALA LUMPUR (Aug 9): Loss-making property developer and builder Jiankun International Bhd (KL:JIANKUN) is seeking to raise up to RM3.86 million via a private placement of shares at an issue price to be determined later.

The proceeds will be used for working capital, mainly to pay staff salaries and the balance for operating and administrative expenses such as utilities, rental costs, transportation costs and upkeep of office.

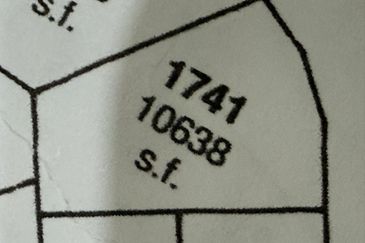

The group raised RM19 million in March this year, which has been fully utilised towards partial settlement of the acquisition of a piece of land in Klebang, Melaka, which has been earmarked for commercial development comprising, among others, retail, serviced apartments and/or office units.

"The proposed development is expected to commence by the first quarter of 2025 (1Q2025), subject to approval from the relevant authorities," Jiankun said in a filing with Bursa Malaysia on Friday.

It added that the group's cash and bank balances amounted to RM270,000 as of Thursday. For the 15-month period ended March 31, 2024, the group incurred administrative expenses of RM10.52 million for its business operations, which translated into an approximate overhead requirement of RM700,000 per month or RM8.42 million per year.

"The proposed private placement will enable the group to raise funds without incurring additional interest expenses, thereby minimising cash flow commitment and preserving the group’s cash flow."

Under the exercise, up to 55.2 million new shares will be issued. "This is after considering that it is unlikely for all the outstanding Warrants B as at Aug 8 to be exercised into new shares prior to completion of the proposed private placement, in view that Warrants B are currently out-of-the-money, based on the five-day volume-weighted average price (VWAP) of the shares up to Aug 8 of 7.48 sen, vis-à-vis the exercise price of Warrants B of 12 sen."

As at Thursday, the group's issued share capital stood at RM104.64 million, comprising 496.81 million shares.

Based on an illustrative issue price of seven sen per placement share, which is a 6.42% discount to the five-day VWAP of Jiankun shares of 7.48 sen, the proposed private placement will raise between RM3.48 million and RM3.86 million.

Barring any unforeseen circumstances, the proposed private placement is expected to be completed by 1Q2025. TA Securities Holdings Bhd is the principal adviser and placement agent for the exercise.

Jiankun shares closed unchanged at 6.5 sen on Friday, giving the group a market capitalisation of RM32.29 million. Its share price has fallen 45.83% so far this year.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Taman Taming Indah 2

Bandar Sungai Long, Selangor

COLLEGE HEIGHTS GARDEN RESORT (PAJAM)

Seremban, Negeri Sembilan

COLLEGE HEIGHTS GARDEN RESORT (PAJAM)

Seremban, Negeri Sembilan

[CHEAPEST RENOVATED_PARTLY FURNISHED] 2Storey Terrace House in Taman Setiawangsa, KL near AEON AU2, Giant Setiawangsa, ST Rosyam Mart For SALE DIJUAL

Taman Setiawangsa, Kuala Lumpur