- The selling price of RM160 million of the hotel represents a discount of 5.88% from the market value, which stood at RM170 million as appraised by valuer Nawawi Tie Leung Property Consultants Sdn Bhd. Nonetheless, Yong Tai anticipated a gain of RM45.86 million from the proposed disposal.

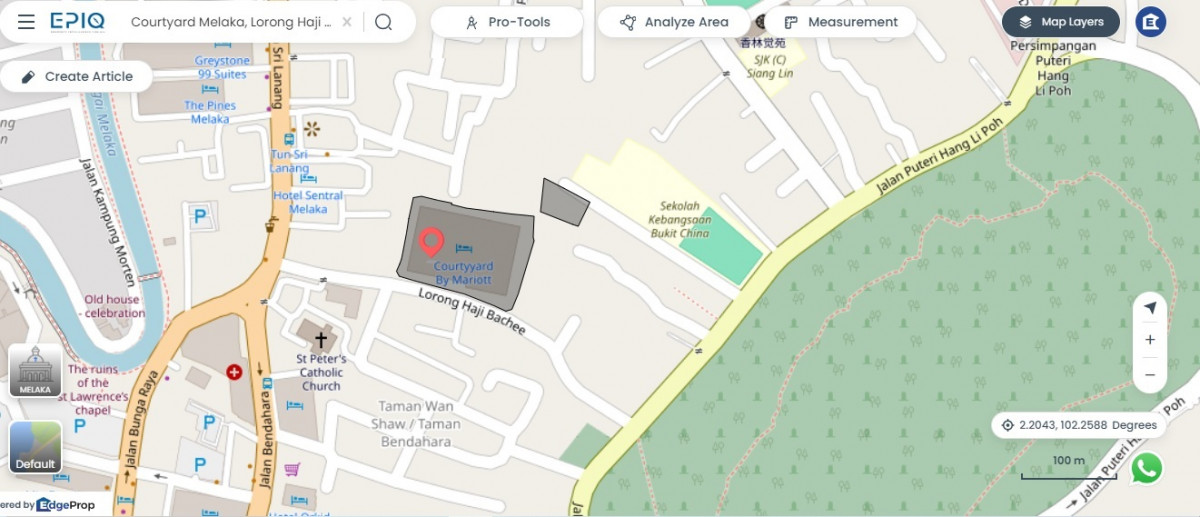

KUALA LUMPUR (July 31): Tourism-related property developer Yong Tai Bhd (KL:YONGTAI) said on Wednesday that it is selling its five-star hotel Courtyard by Marriott Melaka for RM160 million.

This confirms The Edge Malaysia weekly’s report on July 22 to 28 that the company is selling the 248-room hotel, which started operating in April last year and had a net book value of RM113.84 million based on the company's 2023 annual report.

In filing with Bursa Malaysia, Yong Tai said its wholly owned subsidiary Apple 99 Development Sdn Bhd had entered into a conditional sale and purchase agreement with Southern Envoy Sdn Bhd (SESB) for the proposed asset disposal.

According to Yong Tai, SESB is principally involved in trading of computer hardware, peripherals, software and provision of related information technology services. The company is in the midst of diversifying its business to include carrying on the business of a hotelier, resort and providing hotel management services as well as business of shopping centres.

The directors of SESB are Ong Yoong Nyock, Ong Wei Kuan and Datuk Seri Lee Ee Hoe.

The selling price of RM160 million of the hotel represents a discount of 5.88% from the market value, which stood at RM170 million as appraised by valuer Nawawi Tie Leung Property Consultants Sdn Bhd. Nonetheless, Yong Tai anticipated a gain of RM45.86 million from the proposed disposal.

In the first six months of 2024, the hotel recorded an occupancy rate of 68.2%, with a net operating profit of RM6.24 million.

Special issue to raise RM57 million

In addition, Yong Tai also proposed to undertake a special issue of up 190.05 million new shares, or up to 30% of the company’s issued shares, to third-party investors to be determined later, in a bid to raise RM57.02 million.

Based on an illustrative issue price of 30 sen, Yong Tai said proceeds from the proposed special issue, totalling RM15 million, will be allocated to repay its term loans and bank overdraft.

Meanwhile, RM20 million would be set aside to partly finance three existing projects with a total gross development value of RM1.4 billion and total gross development cost of RM1.23 billion.

Yong Tai will also allocate RM15 million from the proceeds for future acquisition of land bank and/or property development projects, followed by the remaining RM7.02 million for working capital and estimated expenses for the proposed special issue.

As at end-March, the company's total borrowings stood at RM169.65 million, with cash and bank balances of RM7.5 million.

The company has been suffering annual losses since the financial year ended June 30, 2019 (FY2019). FY2022 was the worst year, with a net loss of RM346.63 million, but this narrowed to RM21.67 million in FY2023.

For the first nine months ended March 31, 2024 (9MFY2024), net loss narrowed further to RM6.09 million. The company attributed the loss to interest on its term loans, and the fact that Encore Melaka had yet to resume its daily shows during the period.

Yong Tai’s share price has gained almost 13.56% year-to-date, and closed two sen or 6.35% higher at 33.5 sen on Wednesday, giving the company a market capitalisation of RM142.3 million.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!