- The group is principally engaged in hotels and service apartments, the provision of limousine services and hotel management.

KUALA LUMPUR (July 19): Trading of securities in Grand Central Enterprises Bhd (KL:GCE) will be suspended on Monday (July 22) from 9am to 5pm, pending the release of a material announcement.

The group is principally engaged in hotels and service apartments, the provision of limousine services and hotel management.

It currently owns and manages five hotels under the Hotel Grand Continental brand. It also manages Hotel Grand Crystal, which is owned by an affiliated company, Hotel Grand Central Ltd which is listed on the Stock Exchange of Singapore, its annual report showed.

The group has been loss-making in recent years. It posted an annual net loss of RM6.48 million for the financial year ended Dec 31, 2023 (FY2023), up from RM3.36 million in FY2022. Prior to that, it recorded net losses of RM2.34 million for FY2021, RM9.57 million for FY2020 and RM6.7 million for FY2019.

For the first quarter ended March 31, 2024 (1QFY2024), it booked a net loss of RM3.27 million, widening from RM1.89 million in 1QFY2023, as revenue declined by 14.8% to RM4.77 million from RM5.6 million due to lower room occupancy and average room rates. Increases in upkeep and maintenance works, together with higher utility and staff costs, also caused its net loss to widen.

Higher staff costs, difficulty in retention and recruitment, rising opening costs and intense competition from other countries remain key challenges to the group, it said.

It anticipates the group’s performance for the next quarter to be challenging.

Shares of Grand Central Enterprises closed 2.5 sen or 6.3% lower at 37 sen, bringing the group a market capitalisation of RM73 million. Year to date, the stock has climbed four sen or 12.12%.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

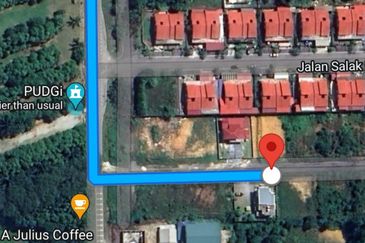

Taman Pandan Perdana

Pandan Perdana, Selangor

Alstonia Residence

Bandar Sungai Long, Selangor

Taman Tun Dr Ismail

Wilayah Persekutuan Kuala Lumpur, Kuala Lumpur

Kawasan Perindustrian Kajang Jaya

Semeyih, Selangor

Taman Tasik Titiwangsa

Titiwangsa, Kuala Lumpur