- TA Securities and Hong Leong Investment Bank (HLIB) said the net gearing of IOI Properties would substantially rise to 0.88x (from 0.73x), assuming the acquisition is financed entirely through debt.

KUALA LUMPUR (June 26): Shares of IOI Properties Group Bhd (KL:IOIPG) extended its decline to their lowest in seven weeks amid concerns of rising debt after the developer announced its chief executive has proposed the joint development of Shenton House in Singapore.

IOI Properties fell nearly 5% or 11 sen to RM2.14, its lowest since May 6, 2024. The stock have been declining for nine out of ten trading sessions since June 12. IOI Properties was trading at RM2.17 at 11.30am, valuing the developer at RM11.95 billion on Bursa Malaysia.

The stock was also more active than usual with more than 13.38 million shares changing hands, double the trading volume’s 200-day moving average.

While investors are wary of the related-party transaction being considered, analysts flag further increase in IOI Properties' already high net gearing level if it accepts a proposal from its group chief executive officer cum major shareholder Lee Yeow Seng to participate in the development of Shenton House, a commercial property located in Singapore.

In separate notes on Wednesday, TA Securities and Hong Leong Investment Bank (HLIB) said the net gearing of IOI Properties would substantially rise to 0.88x (from 0.73x), assuming the acquisition is financed entirely through debt.

TA Securities said despite Shenton House’s promising prospects, it is neutral on the development due to concerns that the acquisition will further elevate IOI Properties’ already high net gearing level.

“Meanwhile, establishing a REIT for further de-gearing may be a lengthy process, involving regulatory approvals, asset valuation and market conditions for the IPO (initial public offering).

“We maintain ‘buy’ on IOIPG, with an unchanged target price (TP) of RM3.00, based on CY2025 P/Bk (price-to-book ratio) multiple of 0.7x,” it said.

HLIB, on the other hand, said while there are persistent concerns among investors on the elevated net gearing level of IOI Properties, the research house reiterated its view that investors should not be overly jittery about this.

“Firstly, IOIPG is expected to recognise substantial revaluation gains upon completion of IOI Central Boulevard, which should lower its net gearing.

“Secondly, the group’s property investment and hotel assets are strong cash flow generators, which should help to service interest and debt repayments.

“Maintain our conviction ‘buy’ recommendation with an unchanged TP of RM3.30, based on a 45% discount to our estimated RNAV (revised net asset value) of RM6.00. IOIPG is now at the cusp of unleashing the value from its jewel assets in Singapore, namely IOI Central Boulevard and Marina View Residences,” it said.

Broadly, analysts are still bullish on IOI Properties with a majority of five 'buy' calls, two 'hold', and one 'sell' recommendation. The consensus 12-month target price is RM2.73, according to Bloomberg.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Suadamai, Bandar Tun Hussein Onn

Cheras, Selangor

Jalan Setiawangsa

Taman Setiawangsa, Kuala Lumpur

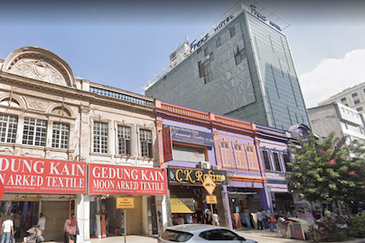

Jalan Tuanku Abdul Rahman

KL City, Kuala Lumpur

Jalan Tuanku Abdul Rahman

KL City, Kuala Lumpur

Damansara Heights (Bukit Damansara)

Damansara Heights, Kuala Lumpur