- LBS Bina said the proposed disposal would result in a pro-forma disposal gain of about RM80 million, improve its net asset by about 10%, and reduce its gearing from 0.42 times to 0.38 times.

KUALA LUMPUR (June 18): LBS Bina Group Bhd has exited its investment in Chinese motor circuit company Zhuhai International Circuit Ltd (ZICL) after more than a decade, as it sold its stake in Lamdeal Investments Ltd (LIL), which owns a 60% stake in ZICL, for 192.18 million yuan (RM124.74 million) cash.

ZICL was formed in 1992 to jointly develop and operate China’s first professional racing track on land measuring some 246.53 acres in Zhuhai City, which is located in the southern part of Guangdong, bordering Macau. For the development, ZICL was granted the right to use the land till 2043.

LBS Bina acquired LIL in 2002 as part of a restructuring of Instangreen Corp Sdn Bhd (formerly Instangreen Corp Bhd) approved under the Pengurusan Danaharta Nasional Bhd Act 1998. ZICL was at the time poorly managed and loss-making, so LBS Bina devised a safety plan to sell LIL to a third party with an option to repurchase it back at US$1.

LBS Bina exercised this option in 2013, saying it foresaw huge potential in the circuit land as it provided an opportunity for the group to venture into property development.

In a bourse filing on Wednesday, LBS Bina said its unit Dragon Hill Corp Ltd had inked an equity transfer and debt repayment agreement with Huafa Urban Operation (HK) Ltd for the proposed disposal. Huafa Urban Operation is principally involved in investment holding, asset management, and business management consulting.

Besides the cash payment, Huafa will also pay off debts totalling 227.82 million yuan (RM147.88 million) owed by LIL and its subsidiaries to LBS Bina and its subsidiaries.

LBS Bina said the proposed disposal would result in a pro-forma disposal gain of about RM80 million, improve its net asset by about 10%, and reduce its gearing from 0.42 times to 0.38 times.

As at March 31, 2024, LBS Bina had total borrowings of RM909.51 million, of which RM482.99 million are short term borrowings.

LBS Bina said the proposed disposal provides an opportunity to monetise the investment, as ZICL's right to use the Zhuhai City land will expire in 19 years.

The disposal is also because LIL has constantly incurred losses over the years due to land amortisation and the increasing challenges the racing circuit faces in meeting stringent sustainability requirements, it added.

The disposal is slated to be completed by end-October 2024.

LBS Bina shares were suspended on Wednesday to make way for the announcement. The stock will resume trading on Thursday.

LBS Bina made a net profit of RM30.53 million for the first quarter ended March 31, 2024 (1QFY2024), little changed from the RM30.5 million it made in 1QFY2023, even as revenue dipped 11.11% to RM342.1 million from RM384.86 million, thanks to cost management and optimisation.

LBS Bina’s largest shareholder is executive chairman Tan Sri Lim Hock San, who holds 39.25% in the company, of which 36.66% is held indirectly.

The stock's last closing price on Tuesday was 89 sen, giving the group a market capitalisation of RM1.4 billion. Year-to-date, the stock has risen 55%.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Taman Sri Putra, Sungai Buloh

Sungai Buloh, Selangor

Taman Sri Putra, Sungai Buloh

Sungai Buloh, Selangor

Taman Bukit Rahman Putra

Sungai Buloh, Selangor

Taman Impian Indah, Sungai Buloh

Sungai Buloh, Selangor

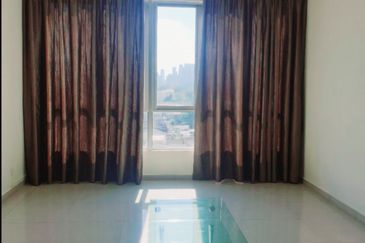

Menara Sri Damansara

Bandar Sri Damansara, Selangor

Afiniti Residences @ Medini Iskandar

Iskandar Puteri, Johor

HighPark Suites @ Kelana Jaya

Petaling Jaya, Selangor