- Paragon Globe expects a net pro forma gain of RM68.47 million from the proposed disposal, which is expected to increase its net assets per share to 49 sen from 40 sen.

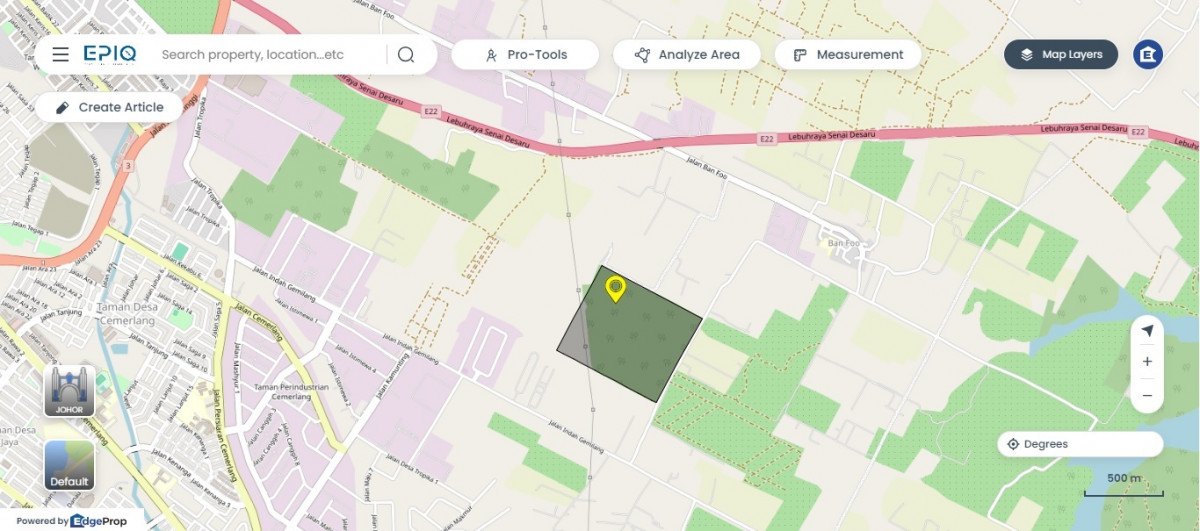

KUALA LUMPUR (May 8): Paragon Globe Bhd (KL:PGLOBE) is selling part of a parcel of freehold land it had just acquired in the district of Plentong, Johor Bahru, for RM238.32 million to improve its liquidity and financial position.

It had just completed the purchase of the land, measuring 104.5 acres (42.29ha), for RM71.5 million in November 2023. It is now selling 47.86 acres of that to Bridge Data Centres Malaysia IV Sdn Bhd, which is primarily involved in the business of leasing premises with computer facilities, and the provision of infrastructure services. The parties signed a conditional sale and purchase agreement for the disposal on Wednesday.

Of the proceeds, Paragon Globe will use RM94.47 million to build roads and infrastructure on the plot, RM57 million to repay bank borrowings, RM26.76 million to fund purchases of other lands, RM38 million to fund ongoing projects and RM21.7 million for working capital.

Paragon Globe expects a net pro forma gain of RM68.47 million from the proposed disposal, which is expected to increase its net assets per share to 49 sen from 40 sen.

“The disposal provides an opportunity for the group to unlock and realise the value of the land in the near term," the group said in a bourse filing, as it indicated the third quarter of 2025 for the expected completion of the disposal.

“As some proceeds are earmarked for the repayment of bank borrowings, the group anticipates potential finance or interest costs savings as well as reduction in gearing level. This in turn will alleviate the risk of indebtedness and repayment obligation, thereby improving the liquidity position of the group moving forward,” said Paragon Globe.

The group's bank borrowings totalled RM148.6 million as at end-2023, while its cash and bank balances stood at RM46.8 million, according to Paragon Globe.

Prior to its acquisition of this freehold land (Land A), Paragon had, in April 2023, completed the acquisition of an adjacent plot measuring about 9.75 acres (3.95ha) (Land B) for RM9.52 million. Paragon Globe had originally wanted to build industrial properties and a hostel on the plots, which carried a total gross development value of RM686.8 million.

But the group had yet to formalise any development plan, and no planning permission had been obtained.

On completion of the disposal, it will hold the remaining net sellable land size of the combined plots — totalling 11.739ha.

"The company will be making revisions to the development project for future development which is expected to yield development profit, and contribute positively to the group. The details have yet to be finalised as any revisions to be made to the development project will be subject to the management’s further feasibility assessments and market study on the prevailing market conditions then,” it added.

Paragon Globe shares closed half a sen or 1.79% lower at 27.5 sen on Wednesday, giving the group a market capitalisation of RM201.52 million. Year to date, the counter has risen over 20%.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!