- UOA REIT did not declare any income distribution for the quarter under review, but said its manager intends to distribute at least 95% of the realised income before tax for the first half of FY2024.

KUALA LUMPUR (May 2): UOA REIT, a trust which mainly manages commercial properties, said its net rental income fell 12.7% in its quarter ended March 31, 2024 (1QFY2024) due to lower occupancy rates and higher property operating expenses.

Net rental income fell to RM18.48 million from RM21.17 million a year earlier, as gross rental dropped 8.5% to RM26.22 million from RM28.65 million, its bourse filing showed.

Net profit fell 20.2% to RM11.67 million from RM14.61 million, while earnings per unit dropped to 1.73 sen from 2.16 sen.

UOA REIT did not declare any income distribution for the quarter under review, but said its manager intends to distribute at least 95% of the realised income before tax for the first half of FY2024.

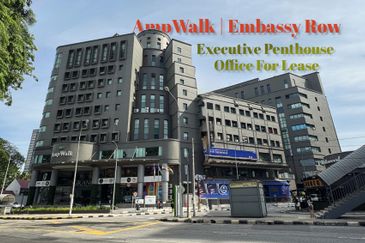

On outlook, the trust said the office rental market remains challenging amid the escalating cost of doing business and the influx of new offices.

“While we endeavour to improve the occupancy rates for buildings with higher vacancy rates, we foresee the improvement in rental rates will remain restrained in the near term,” it said.

At Thursday’s market close, shares of UOA REIT were up by one sen or 0.9% to RM1.12, valuing the group at RM756.7 million.

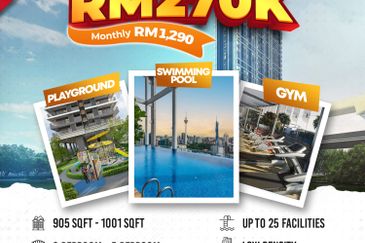

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Mah Sing Integrated Industrial Park

Subang Bestari, Selangor

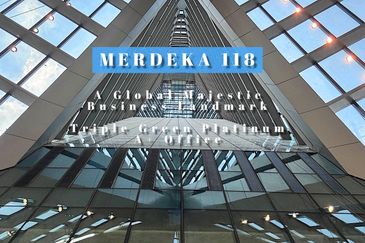

Merdeka 118 @ Warisan Merdeka 118

KLCC, Kuala Lumpur

Horizon Residence (Dwi Mutiara)

Bukit Indah, Johor