- Over the past one year, Ireka has been hit with at least two other lawsuits over defaults in payment.

KUALA LUMPUR (Feb 13): Ireka Corp Bhd said RHB Bank Bhd has filed a lawsuit against the company, claiming RM6.53 million over an alleged default in a revolving credit facility.

In a filing with Bursa Malaysia on Tuesday, Ireka said the bank had granted the revolving credit facility of RM6.5 million in 2015 and 2017 to Ireka's subsidiary Ireka Engineering & Construction Sdn Bhd (IEC), which has been under liquidation since March 2023.

In June 2023, Ireka entered into a settlement agreement with RHB Bank to pay off all monies owed by IEC under the banking facility.

"As it was alleged that the company had defaulted in its obligations to make such payments to the bank as required under the settlement arrangement, the bank had terminated the same on Dec 8, 2023," Ireka said.

Following the termination of the settlement agreement, Ireka said it had further proposed a revised scheduled payment to the bank on Dec 22, 2023.

"However, our proposed terms of repayment were not agreeable by the bank on Jan 10, 2024. It is still our intention to continue our efforts to discuss a repayment term which is acceptable by the bank and the company," Ireka said, adding that it is in the midst of appointing a solicitor to defend itself in the case.

Over the past one year, Ireka has been hit with at least two other lawsuits over defaults in payment.

Last month, AmBank (M) Bhd filed a petition to wind up Ireka after the company defaulted in debt payment of RM4.34 million on Dec 12, 2023. This is following a judgment obtained by the petitioner at the High Court. The petition is fixed for hearing on April 17.

In March 2023, AmBank sued Ireka and IEC, claiming RM4.24 million, comprising a claim on overdraft facilities amounting to RM3.1 million and a claim on revolving credit amounting to RM1.14 million.

At the time, Ireka said negotiation was still ongoing with the bank to restructure and reschedule the claimed amount over a period of nine quarters.

Ireka has been loss-making for three consecutive quarters since the third quarter ended March 31, 2023 (3QFY2023).

The company reported a net loss of RM4.07 million for 1QFY2024, against net profit of RM172.99 million a year earlier. Quarterly revenue rose to RM69.43 million from RM11.86 million.

As of Sept 30, Ireka had a cash balance of RM3.76 million with a short term borrowing of RM10.06 million and long term borrowings of RM71.99 million.

In October 2023, Ireka said its external auditor had flagged the company's ability to operate as a going concern as it could not provide a basis for an audit opinion on Ireka's audited financial statements for FY2023 as it was unable to obtain sufficient appropriate audit evidence.

Baker Tilly Monteiro Heng PLT noted that as at June 30, Ireka’s current liabilities exceeded its current assets by RM48.72 million and the company recorded a capital deficiency of RM44.91 million.

Ireka said it expects to address all issues related to the disclaimer of opinion by FY2024.

Shares of Ireka rose 0.5 sen, or 1.15%, to close at 44 sen, giving the company a market capitalisation of RM99.09 million.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

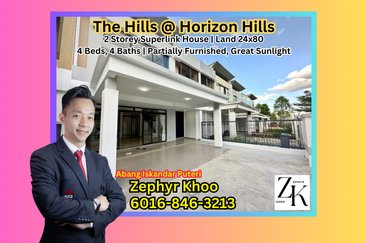

The Hills @ Horizon Hills 2 Storey Superlink House

Horizon Hills, Johor

Seksyen 6, Kota Damansara

Kota Damansara, Selangor

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur