- Overhang properties is mainly due to unmet housing demand related to varying economic climates, housing preferences, market sentiment, housing affordability, credit accessibility, as well as demographics and lifestyle changes.

Malaysia is facing a unique housing problem. On one hand, the median property prices are too high and are beyond the mass population's affordability. As a result, even middle-income groups, not to mention the lower-income groups, find it almost impossible to buy their first homes.

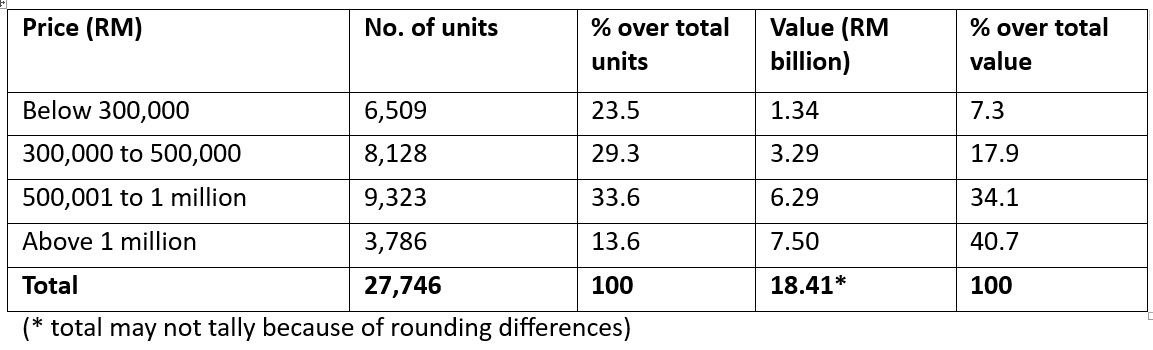

On the other hand, Malaysia also has unsold completed properties or overhang properties totalling 27,746 units valued at RM18.42 billion as at end-2022 – that’s a huge number. (The 2023 figures have not been published by the National Property Information Centre yet). Thankfully, this is actually an improvement compared to end-2021, which recorded total overhang units of 36,863 units valued at RM22.79 billion.

Still, it begs the question – how can the country, where the general population are struggling to buy their first homes, also have a problem of overhang properties totalling RM18 billion? The short answer is – those acquisitive and grasping class of property developers.

A quick breakdown of the overhang properties as at end-2022 are as follows:

Under the Housing and Local Government Ministry guidelines, the criteria for properties which are deemed as affordable to the majority of the rakyat are as follows:

- Priced RM300,000 or below

- Minimum built-up of 900 sq ft (excluding balcony) with 3+1 rooms

- Located in areas with good public transport or connectivity

From the above table, properties that are priced below RM300,000 only make up 23.5% of the overhang property stock and only 7.3% in value. The reason they remain unsold is probably their failure to fulfil the third condition – accessible locations.

However, the balance of 76.5% of units or 92.7% of the value of overhang property is due to developers who continue to build what the majority of the rakyat cannot afford.

Overhang properties is mainly due to unmet housing demand related to varying economic climates, housing preferences, market sentiment, housing affordability, credit accessibility, as well as demographics and lifestyle changes. It can only be addressed by a collaborative measure that involves all industry stakeholders. If the government aims to resolve the overhang problem holistically, a detailed study on the overhang situation is necessary. Independent market viability and feasibility studies should be done before any project is embarked on.

Revenue loss for Government

As the property sector is deemed an important sector to the Malaysian economy, the Government launched the Home Ownership Campaign (HOC) in January 2019, with several extensions until 2021 to help property developers sell their overhang properties. Various incentives were offered, such as:

1. Full stamp duty exemption on the instrument of transfer of any home purchase up to RM1 million

2. For properties worth more than RM1 million up to RM2.5 million, 3% (instead of 4%) stamp duty on the instrument of transfer

3. Stamp duty exemption on loan agreement

4. Minimum 10% discount on purchase price of properties listed under the scheme

As the issue of overhang properties continue to adversely impact the bottom line of housing developers, there have been several calls from them asking for another HOC with the usual incentives to help them offload their overhang stock.

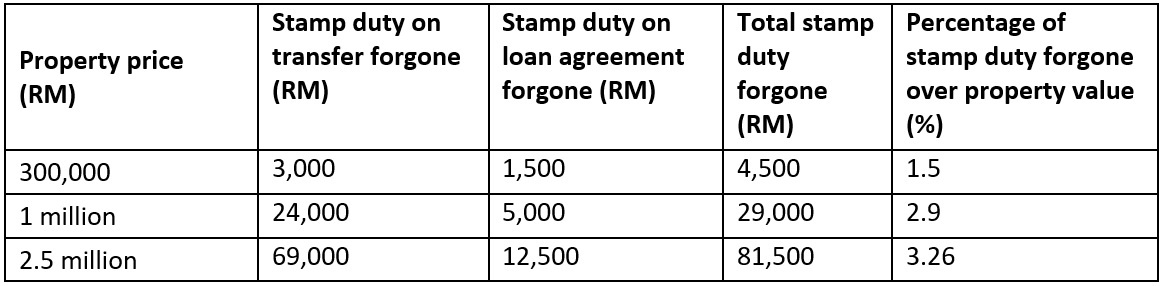

It is to be noted that the incentives under (1) to (3) above result in lower revenue to the Government and is an indirect subsidy to those housing developers to sell their expensive overhang properties. For a clearer picture, the stamp duty aka tax revenue forgone by the Government for every property priced below is as follows:

As we can see, the stamp duty forgone by the Government for a property priced at RM300,000 is reasonable – at only RM4,500 or about 1.5% of the property price. However, for a property priced at RM1 million, the stamp duty forgone increases exponentially to RM29,000 or 2.90% of the property value, and for a property priced at RM2.5 million, the stamp duty forgone is RM81,500 or 3.26% of the property price.

Indirectly, these are tax revenue forgone, which could have been used by the Government to help the rakyat such as improving or expanding subsidised educational and health facilities. So, why is the Government giving incentives to rich people buying expensive properties?

In addition, by offering incentives under HOC to properties priced up to RM2.5 million, the Government is in fact encouraging housing developers to build more expensive properties that the majority of the rakyat cannot afford. As land is a scarce resource, this will worsen the issue of housing affordability and even result in more of the rakyat being unable to buy their first homes.

Should there be another HOC, HBA strongly feels the incentives should only be for affordable properties priced below RM300,000.

(Read: Is the extension of HOC ‘privatising profits and socialising losses’?)

What should developers do?

So, how are housing developers going to offload their unsold expensive overhang properties? The solution is very simple, they must rectify their mistakes by giving the appropriate discounts or other freebies, or absorb all the stamp duties payable themselves.

Housing developers are profit-maximising organisations and it is in their best interest to build what the market can afford.

As part of the Government’s noble vision that every Malaysian family should be able to buy their own home, it can encourage and offer incentives to housing developers to build more affordable properties. However, for properties costing more than RM300,000, it should be a free market with minimal government intervention.

The Government is sending the wrong message by giving HOC incentives for properties priced above RM300,000 – that the Government will bail out housing developers with expensive overhang properties.

(Read also: Vacancy tax a bad idea – HBA)

HOC is like a patient taking paracetamol for the pain caused by terminal cancer. It may temporarily relieve the symptom of periodic pain but not cure the disease. The Government should actually identify the root causes of the continued overhang.

Overhang property is due to misguided housing developers, both private as well as government economic agencies applying the wrong pricing strategy to build and market their properties, which can only be corrected by applying the right strategy, which is to build what the rakyat can afford.

(Read: Overhang properties precipitate developers’ ‘hangover’)

Why are secondary properties not included?

On another note, the HOC, should it be reinstated, should be extended to secondary properties, i.e. completed properties that are currently owned by end-buyers. According to the National Property Information Centre, the secondary market accounts for 80% of all property transactions in 2019.

The secondary market or sub-sales too have been severely affected by the Covid-19 pandemic and its consequent movement control orders. If the intention of the government is to reactivate the property market, being the “economy driver” as claimed, then the incentives offered under HOC should be extended to first-time homebuyers looking to buy from the secondary market as well.

(Read also: HBA welcomes some, questions some and cautions some)

Datuk Chang Kim Loong is the Hon Secretary-general of the National House Buyers Association (HBA).

HBA can be contacted at:

Email: [email protected]

Website: www.hba.org.my

Tel: +6012 334 5676

The views expressed are the writer’s and do not necessarily reflect EdgeProp’s.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!