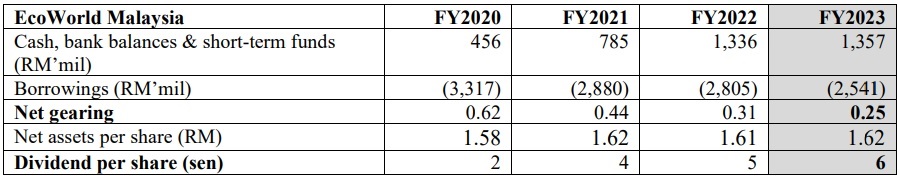

- The board has declared a final dividend of two sen per share in 4Q2023, bringing total dividends declared for FY2023 to six sen per share.

KUALA LUMPUR (Dec 14): Eco World Development Group Bhd announced its results for 4Q2023 today, with EcoWorld Malaysia achieving RM3.61 billion sales in FY2023, exceeding its sales target of RM3.5 billion.

The group stated in a media release that sales were broad-based with substantial contributions by each of its four revenue pillars:

1 Eco Business Parks: RM1.04 billion industrial sales recorded during the year, the highest in a single year, with exponential growth achieved over the last four years since FY2020.

2 Eco Hubs: RM515 million commercial properties sold in FY2023, 15% higher than FY2022 and 33% above the average annual sales between FY2020 – 2022.

3 Total residential sales of RM2.05 billion in FY2023, from two revenue pillars namely: i) Eco Townships and ii) Eco Rise

This year, EcoWorld recorded RM1.47 billion from sales of homes within its Eco Townships that were priced above RM650,000 and RM577 million from homes priced below RM650,000, mainly from the group’s duduk series of apartments.

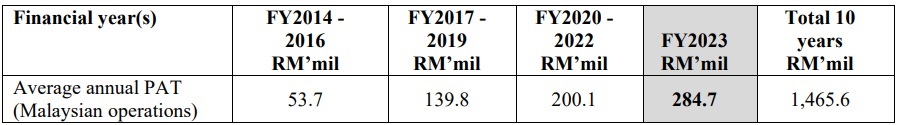

There was also record high profit after tax (PAT) from Malaysian operations in FY2023 of RM284.7 million, attributable to higher gross profit achieved and higher interest income earned. (PAT from Malaysian operations in 4Q2023 amounted to RM92.8 million, largely on par with RM96.7 million in 4Q2022).

• FY2023 marks the 10th anniversary of the EcoWorld brand’s emergence on the Malaysian property scene. The group’s PAT from Malaysian operations over the last decade is tabulated below:

The sustained 10-year growth trajectory is attributable to concerted efforts to strategically expand beyond aspirational townships to create four sizeable and diversified revenue pillars; and transform and digitalise the group’s business operations for greater productivity and efficiency.

As at Oct 31, 2023, the group’s future revenue remains healthy at RM3.49 billion, providing clear earnings and cashflow visibility in the near and mid-term.

The group’s balance sheet continues to strengthen with FY2023 cash balances at its highest and net gearing levels at its lowest in 10 years.

The following table summarises EcoWorld Malaysia’s financial position in recent years:

The board has therefore declared a final dividend of two sen per share in 4Q2023, bringing total dividends declared for FY2023 to six sen per share.

Meanwhile, EcoWorld International (EWI) achieved RM1.18 billion sales in FY2023. As at Oct 31, 2023 it has approximately RM850 million of completed and nearly-completed stocks available for sale, of which EWI’s effective share is approximately RM650 million.

EWI distributed an interim dividend of RM792 million (33 sen per share) in September 2023 and declared a final dividend of RM144 million (six sen per share) in 4Q 2023, payable in January 2024.

EcoWorld Malaysia’s share of the interim and final dividends from EWI is RM213.84 million and RM38.88 million respectively.

EWI targets to sell out all its remaining stocks in FY2024 and distribute the excess cash generated (net of amounts required for its pared down operational requirements) back to shareholders.

The potential receipt of more dividends from EWI in FY2024 will add to EcoWorld Malaysia’s cash reserves and strengthen the group’s capabilities to acquire new land bank.

In 4Q2023, EcoWorld Malaysia reviewed the carrying values of its investment in EWI. A further impairment of RM82.0 million was recognised due to:

1 EWI’s reduced number of future projects and continued deferral of new launches; and

2 the higher weighted average cost of capital applied to review the investment in EWI as a result of further increases in UK interest rates in FY2023.

Notwithstanding the above impairment and share of EWI’s losses, EcoWorld Malaysia recorded a PAT of RM3.3 million in 4Q2023.

The group’s PAT for FY2023 (including EWI) is RM189.3 million, 20% higher than FY2022.

“FY2023 is a significant year for EcoWorld Malaysia as it marks our 10th year in the industry. The group’s Malaysian operations achieved our highest ever profits, growing strongly from an annual average of RM53.7 million in our first three years as a property group to RM284.7 million in FY2023,” said Datuk Chang Khim Wah, president & CEO of EcoWorld Malaysia.

“Today, the EcoWorld brand has gained wide acceptance across 4 sizeable and diversified revenue pillars, namely our Eco Townships, Eco Business Parks, Eco Rise and Eco Hubs pillars. This enables the group to cater to every segment of the residential, commercial and industrial markets. More importantly, we have the agility and flexibility to adapt & target our launches to serve needs of the market segment with the highest demand in a particular year, thus accelerating sales and improving returns for our shareholders,” added Chang.

Given the maturity of the group’s current development portfolio, EcoWorld Malaysia has entered a highly cash-generative phase of each project’s lifecycle. In addition, future revenue as at Oct 31, 2023 remains healthy at RM3.49 billion, providing clear earnings and cashflow visibility in the near and midterm.

For FY2024, the board is maintaining its sales target at RM3.5 billion for its Malaysian operations as the group focuses on sustainable growth by improving absolute returns from its valuable landbank, whether via margin improvement or higher yield per sq ft of land developed.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

Bayu Sutera @ Celyn, Bandar Sri Sendayan

Seremban, Negeri Sembilan

HIJAYU 3A @ BANDAR SRI SENDAYAN

Seremban, Negeri Sembilan

Sri Teratai Apartment

Bandar Kinrara Puchong, Selangor

Ambang Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Trio by Setia

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Taman Sri Pelabuhan @ Klang

Port Klang, Selangor

Graham Garden @ Eco Grandeur

Bandar Puncak Alam, Selangor

Graham Garden @ Eco Grandeur

Bandar Puncak Alam, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)