- The research firm in a note on Thursday said that although office spaces are becoming more relevant, overall occupancy levels may remain thin, as the incremental supply of new office spaces could outweigh the modestly rising take-up, further dampening the sector’s outlook.

KUALA LUMPUR (Sept 21): Kenanga Research maintained its “neutral” call on the real estate investment trust (REIT) sector due to subdued consumer sentiment, dragged by inflation and the implementation of targeted fuel subsidies possibly undermining spending capacity.

The research firm in a note on Thursday said that although office spaces are becoming more relevant, overall occupancy levels may remain thin, as the incremental supply of new office spaces could outweigh the modestly rising take-up, further dampening the sector’s outlook.

In the first half of 2023, the National Property Information Centre quoted the completion of several new office buildings, which injected an additional 61,000 sq m into the market. This is likely to further dampen the desirability of the existing excess stock, Kenanga said.

However, according to the report, some relief was seen in the office and retail segments, which saw occupancy rates gradually rising with retail space in shopping complexes occupied at 76.6%.

“We believe the industry could benefit from improving appetite for physical retail spending, primarily seen in the prime locations,” the research outfit said, adding that the progressive reversion to working-in-office arrangements would also translate into some support for office demand.

Kenanga’s top picks in the sector are KLCCP Stapled Group, with a target price (TP) of RM7.18, and Sunway REIT (TP: RM1.63) as the firm believes their risk-to-reward ratios are favourable.

“We expect KLCC to remain resilient, thanks to its highly prime location and assets which we believe are less susceptible to spending pressures. On the other hand, Sunway REIT may have a balanced buffer against sector risk exposures, thanks to its diversified assets and strong brand equity,” the firm said.

It also remained cautious about Axis REIT, as its occupancy rates had witnessed a notable drop, declining from 95% at end-December 2022 to 89% at end-June 2023.

“This decline has had a significant adverse effect on its earnings and may translate into further near-term uncertainty,” Kenanga said.

Looking to buy a home? Sign up for EdgeProp START and get exclusive rewards and vouchers for ANY home purchase in Malaysia (primary or subsale)!

TOP PICKS BY EDGEPROP

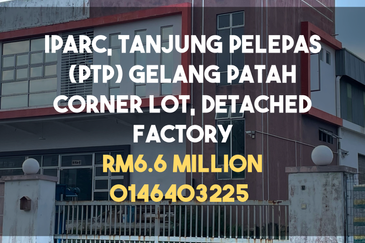

i-Parc @ Tanjung Pelepas

Gelang Patah, Johor

Bandar Baru Sri Petaling

Bandar Baru Sri Petaling, Kuala Lumpur

Seksyen 17 Petaling Jaya

Petaling Jaya, Selangor

Kuchai Business Centre

Kuchai Lama, Kuala Lumpur

Taman Perindustrian Meranti Jaya

Puchong, Selangor

PARK AVENUE (SEREMBAN 2)

Seremban, Negeri Sembilan

Ambang Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor