- The RM1.5 billion sukuk, issued by Country Garden’s Malaysian unit Country Garden Real Estate Sdn Bhd (CGRE), was first rated by RAM Ratings back in 2015.

KUALA LUMPUR (Aug 9): Chinese property giant Country Garden Holdings Co’s failure to make payments on its two dollar bond coupons due Aug 6 (Sunday) totalling US$22.5 million (RM103 million) has raised concerns over a cross-default on its Islamic Medium-Term Notes (IMTN) Programme in Malaysia.

The RM1.5 billion sukuk, issued by Country Garden’s Malaysian unit Country Garden Real Estate Sdn Bhd (CGRE), was first rated by RAM Ratings back in 2015.

In response to The Edge’s queries, RAM Ratings spokesperson said: “We are in the midst of seeking further clarification from the client and will make the necessary announcement in due course. Under the terms of CGRE’s sukuk, a default of the guarantor (Country Garden Holdings) can trigger a cross default on the CGRE IMTN, if not remedied within the 30-day grace period.”

In December 2022, RAM Ratings had revised its outlook on the long-term rating of CGRE’s IMTN to “negative” from “stable”, while keeping its “AA3” rating, on expectation that Country Garden’s debt coverage levels will remain weak in 2023 or so amid the marked slowdown in the Chinese residential property sector. This was despite the Chinese government’s policy to help support the recovery in housing demand.

RAM Ratings had stressed that Country Garden’s position as China’s biggest residential property developer, minimal project concentration and commendable geographical diversity would continue to support the rating.

“This is complemented by its healthy liquidity position and diverse funding sources. On the other hand, a leveraged balance sheet and weaker debt coverage levels are moderating factors, as are the group’s focus on China’s more challenging Tier 3 and Tier 4 cities and its exposure to the sector’s vagaries and cyclicality,” it had noted.

A bond analyst whom The Edge spoke to said Country Garden’s missed bond coupon payments come as a surprise given that it is the biggest property developer in China.

“We will continue to monitor this space while checking with private bankers. In the meantime, we wish to mention that as the biggest property developer and with a good track record of property delivery, this news indeed comes as a surprise,” he said.

Nonetheless, he stressed that Country Garden is not considered defaulting on the payments yet due to the 30-day grace period. As such, he believes that the property firm will strive to look for cash to settle the coupon due or may even request for an extension for the coupon payments.

Bloomberg data shows that CGRE’s bondholders include Manulife Investment Management (M) Bhd with RM28.7 million worth of bonds maturing March 27, 2025, held across two funds as at April 30 this year.

A check on Maybank Asset Management Sdn Bhd’s product fact sheet also shows that as at June 30 this year, it held RM35 million worth of CGRE’s ringgit bonds maturing March 2025, and another RM25 million maturing May 4, 2026.

Maybank Asset Management Sdn Bhd also held US$1.8 million worth of Country Garden’s US dollar bonds maturing January 2024 and February 2026.

Meanwhile, AHAM Asset Management Bhd held US$7.72 million in Country Garden’s US dollar bonds maturing July 2026, as at end-March this year.

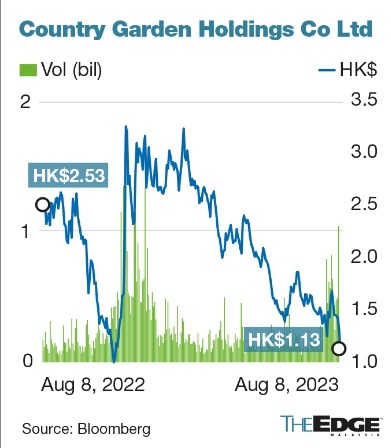

Country Garden has seen its shares and bond plunge following news that it was unable to make the coupon payments for two notes maturing in 2026 (worth US$10.5 million) and 2030 (worth US$12 million). Both payments have a 30-day grace period.

The developer’s next dollar bonds to mature, due Jan 27, slumped nearly 13 cents to 11 cents, according to prices compiled by Bloomberg.

Country Garden’s share price ended Tuesday's session at HK$1.13 — the lowest level since November last year — after dropping 14.39% or 19 sen. Year to date, it has fallen 58% from HK$2.67.

The missed payments have cast doubt over the group’s financial health and its potential impact on the already troubled property market in China.

Notably, another China commercial real estate developer Dalian Wanda Group made headlines last month after it failed to pay a coupon on its US$400 million bond due 2025, which was due on July 23.

However, the group managed to pay the coupon before the 10-day grace period, after it sold a unit to help pay down the dollar bond. It was reported that the group agreed to sell a 49% stake in a unit of Beijing Wanda Cultural Industry Co to China Ruyi Holdings Ltd for 2.26 billion yuan.

Looking to buy a home? Discover exclusive rewards and vouchers for your dream home when you sign in to EdgeProp START.

TOP PICKS BY EDGEPROP

Shah Alam NEW LAUNCH Resort Concept 4 bed Sky condo!

Kota Kemuning, Selangor

Kota Kemuning [LIMITED CONDO Besar 4 Bilik] Monthly 1.7k Dapat!

Kota Kemuning, Selangor

KOTA KEMUNING NEW LAUNCH BIG CONDO 4 ROOMS! Monthly 1.7k only!

Kota Kemuning, Selangor

MUST VISIT NEW CONDO NEAR KOTA KEMUNING! Monthly 1.7k Get 4 room Big Condo!

Kota Kemuning, Selangor

KOTA KEMUNING NEW LAUNCH CONDO 4R3B [Monthly from 1.7k!]

Kota Kemuning, Selangor

LAST 4 bedroom Condo Monthly 1.8k get at Kota Kemuning!

Kota Kemuning, Selangor

Seksyen 25, Shah Alam (Taman Sri Muda)

Shah Alam, Selangor