- In a note on Thursday (July 27), the research house said IGB REIT recorded core net profit of RM177.2 million for the first half of 2023 (1H2023), which was within house and consensus forecasts.

KUALA LUMPUR (July 27): Hong Leong Investment Bank (HLIB) Research has reaffirmed its call on IGB Real Estate Investment Trust (IGB REIT), with an unchanged target price (TP), and said the REIT will continue to demonstrate resilience for the remainder of the financial year 2023 (FY2023).

In a note on Thursday (July 27), the research house said IGB REIT recorded core net profit of RM177.2 million for the first half of 2023 (1H2023), which was within house and consensus forecasts.

It said IGB REIT's revenue in the second quarter of FY2023 (2QFY2023) decreased quarter-on-quarter by 8.5% due to lower rental income attributable to lower turnover rent coming off from a high base of retail spending in 1QFY2023, as festive season spending dissipates, while core net profit dipped by 15.9% due to increased utilities expenses, alongside reimbursement and upgrading costs.

HLIB Research maintained its ‘buy’ call on IGB REIT with an unchanged TP of RM1.88 based on FY2024 distribution per unit (DPU) on targeted yield of 6.1% which is derived from five-year historical average yield spread between IGB REIT and 10-year Malaysian Government Securities (MGS) yield.

Analyst Brian Chin Haoyan said despite the slowdown in 2QFY2023 compared to the previous quarter, IGB REIT will continue to demonstrate resilience for FY2023 on the back of strong labour market and the rental reversion outlook for Midvalley Megamall and The Gardens Mall.

“We expect its performance to pick up again in 4Q2023, underpinned by year-end holidays and festivals.

“Meanwhile, financing costs should remain stable as IGB REIT is largely insulated from the impact arising from OPR (overnight policy rate) hikes over the past year due to its near full composition of fixed rate borrowing,” he said.

Chin noted that 2QFY2023 core net profit of RM81.0 million lifted the first half of 2023’s core net profit to RM177.2 million and the results met its expectations at 49% and street's at 50%.

The REIT saw its net profit fell by 3% to RM80.97 million in 2QFY2023 from RM83.47 million in 2QFY2022 while its net property income declined 2.76% to RM102.79 million from RM105.72 million.

Distributable income also decreased 2.85% to RM87.25 million from RM89.81 million in 2QFY2022. IGB REIT then declared an income DPU of 2.37 sen, payable on Aug 29.

Revenue for the quarter, however, increased by 5.82% to RM141.54 million from RM133.76 million a year earlier due to higher rental income.

In terms of occupancy and gearing, Chin said both mall properties remained fully occupied and its gearing stood at 23%.

“We continue to like IGB REIT due to its prime asset location to capitalise on the strong recovery in domestic footfall, robust occupancy rates and monthly rental income exceeding pre-pandemic levels,” said Chin.

In the morning trading on Thursday, IGB REIT shares remained unchanged at RM1.65. Its market capitalisation stood at RM5.93 billion.

TOP PICKS BY EDGEPROP

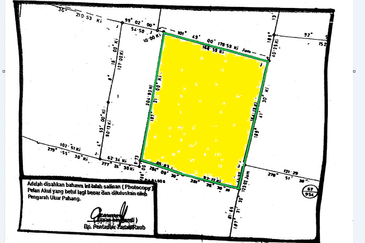

Taman Sri Putra, Sungai Buloh

Sungai Buloh, Selangor

Medan Idaman Business Centre

Setapak, Kuala Lumpur

Kawasan Perindustrian Balakong

Balakong, Selangor

Balakong Jaya Industrial Park

Balakong, Selangor