- With the adoption of a hybrid workplace, companies are also looking for space that offers greater flexibility of space planning. Net absorption for the first half of 2023 already surpassed 80% of 2022 overall volume.

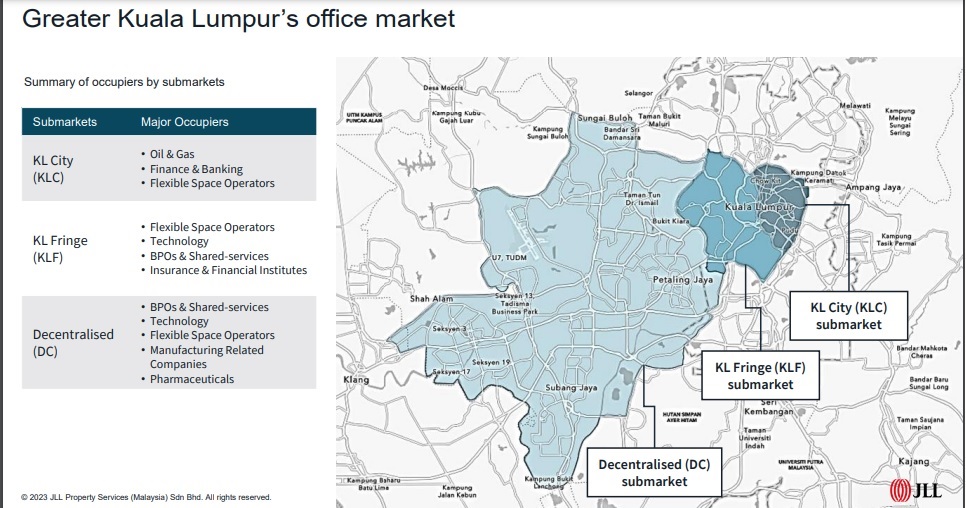

KUALA LUMPUR (July 26): Demand for offices in KL Fringe and KL City submarkets will continue to be high for the second quarter of 2023, according to JLL Property Services (M) Sdn Bhd’s Greater Kuala Lumpur Property Market Monitor 2Q2023.

In 1H2023, new supply of four projects were completed, totalling 1.15 million sq ft of net leasable area (NLA), with the largest being Menara AFFIN in the Tun Razak Exchange (TRX) precinct. Also delivered in the 2Q2023 were the two projects in Pavilion Damansara Heights and one project in Sunway Velocity 2 (V2 Office Tower).

By the end of the year, three more high-profile developments are expected to be completed, adding two million sq ft of NLA, including Merdeka 118, PNB Project 1194, and another office tower in Pavilion Damansara Heights.

With the adoption of a hybrid workplace, companies are also looking for space that offers greater flexibility of space planning. Net absorption for 1H2023 has already surpassed 80% of the 2022 overall volume. This suggests that market demand in 2023 will see a more robust performance.

This positive net absorption can be attributed to two major factors:

*Tenants are increasingly relocating to environmentally, socially, and governance (ESG) compliant spaces. A trend especially notable among companies in the financial sector, IT, and MNCs.

*There’s a noticeable shift towards quality-driven decisions as tenants opt for modern office spaces offered at competitive rents. This is particularly evident among those in media, manufacturing, service providers, and technology sectors, seeking affordable yet upgraded office spaces.

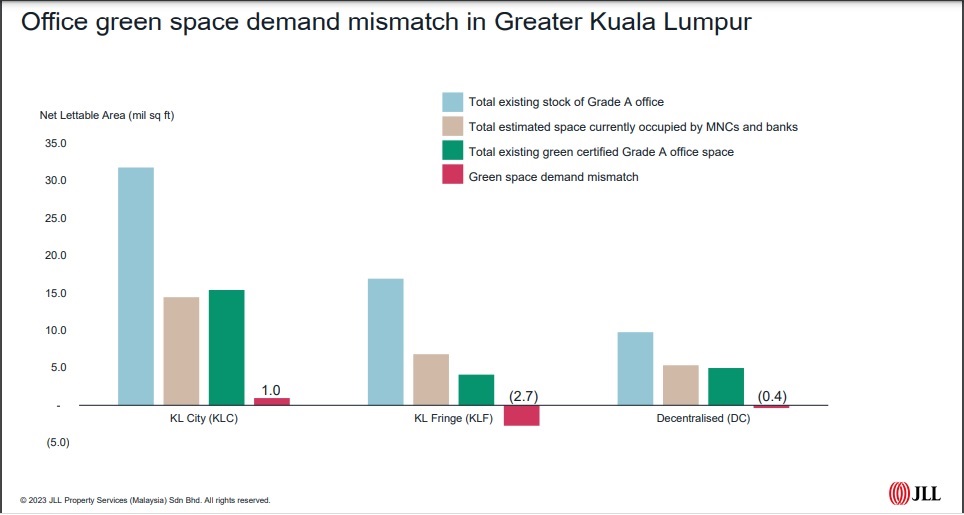

With MNCs and financial institutions being the two groups that drive the demand for ESG compliant space, these companies will likely move to green offices before 2030 to comply with their corporate policies.

According to JLL estimates, the two mentioned groups currently occupy approximately 45% of the total high-quality office space in Greater Kuala Lumpur. JLL Research also indicates that around 35% to 40% of this occupied space has already received green certification.

The demand and supply of the green space in the KL City submarket is balanced at the moment, and will continue to have more ESG compliant stock in the future with Merdeka 118. While the KL Fringe submarket is facing quite a substantial shortage, landlords in this location may consider upgrading their properties by obtaining green certification to meet the high demand of the tenants.

As for vacancy rate, the KL Fringe submarkets continue to maintain the lowest vacancy at 10% due to limited new stock. There’s also a stable demand for the location. KL City submarket on the other hand, has highest vacancy rate at 31.5% due to high growth in new stock. It has slightly decreased in 2Q2023, mainly attributed to the strong demand in the TRX precint that is poised to be financial districts.

Despite the positive improvements of the office market, the future rental growth might see a negative effect due to high volume of new supply, with tenants being cautious in their decisions to relocate or expand.

TOP PICKS BY EDGEPROP

Horizon Hills The Green

Iskandar Puteri, Johor

Bandar Kinrara

Bandar Kinrara Puchong, Selangor

Royal Strand @ Country Garden Danga Bay

Johor Bahru, Johor

Jalan Bukit Bintang

Bukit Bintang, Kuala Lumpur

Happy Garden (Taman Gembira)

Kuchai Lama, Kuala Lumpur

Bukit Jalil, 2.5 Storey house (end lot), Taman Jalil Sutera, Kuala Lumpur

Bukit Jalil, Kuala Lumpur

Pearl Villa Townhouse

Bandar Saujana Putra, Selangor

Taman Tun Dr Ismail (TTDI)

Taman Tun Dr Ismail, Kuala Lumpur