- Domestically, the central bank noted that following its strong outturn in the first quarter of the year, the local economy has since expanded at a more moderate pace as exports were weighed down by slower external demand in line with expectations.

- Going forward, the central bank said economic growth will continue to be driven by resilient domestic demand.

KUALA LUMPUR (July 6): As Bank Negara Malaysia’s decision to hold the overnight policy rate at 3% came in line with consensus expectations, most economists see the central bank keeping its monetary policy stance on hold until the end of the year.

“We believe that BNM is now more sanguine about the growth and inflation outlooks but stopped short of sounding less hawkish,” said OCBC’s senior Asean economist Lavanya Venkateswaran in a note issued after the central bank announced its decision on Thursday (July 6).

Lavanya thinks the stance is justified, not just in the context of external factors including the continued hawkish drumbeat of global central banks, but also domestic factors such as sticky core inflation pressures and the inflationary impact of potential changes to government subsidy policies.

“Our forecast, therefore, remains for BNM to remain on hold for the rest of this year,” she said, noting that risks to OCBC’s forecast are overly hawkish global central bank moves, as well as upward adjustments to subsidised prices ― particularly of fuel.

In its statement announcing the rate decision, BNM said the 3% OPR remains slightly accommodative and supportive of the Malaysian economy as the central bank's Monetary Policy Committee (MPC) continues to see limited risks of future financial imbalances.

It also noted that global growth remains weighed down by persistent core inflation and higher interest rates, and that China's recovery has slowed in recent months.

"Globally, headline inflation continued to moderate, but core inflation remains above historical averages. For most central banks, the monetary policy stance is likely to remain tight. The growth outlook remains subject to downside risks, mainly from a slower momentum in major economies, higher-than-anticipated inflation outturns, an escalation of geopolitical tensions, and a sharp tightening in financial market conditions," BNM said.

Domestically, the central bank noted that following its strong outturn in the first quarter of the year, the local economy has since expanded at a more moderate pace as exports were weighed down by slower external demand in line with expectations.

Going forward, the central bank said economic growth will continue to be driven by resilient domestic demand. “While the growth outlook is subject to some downside risks stemming from weaker-than-expected global growth, upside risks mainly emanate from domestic factors such as stronger-than-expected tourism activity and faster implementation of projects,” it added.

Meanwhile, UOB economists Julia Goh and Loke Siew Ting is similarly of the view that BNM would hold the OPR at 3% for the remainder of 2023, saying that while a higher US Federal Funds Rate (FFR) terminal rate and ringgit pressure complicates the OPR outlook, moderating inflation trends and growth uncertainties take precedence at this point.

“A prolonged period of ringgit weakness may lead to businesses passing on additional costs to consumers, albeit this would be balanced with the view of staying price-competitive as demand slows and normalises.

“Even as the US Federal Reserve (US Fed) is expected to raise interest rates further, most regional central banks have started to pause rate hikes in 2Q2023, while Vietnam and China have been cutting interest rates to boost their economic growth,” the pair said, noting that select banks are expected to follow suit with rate cuts in 1Q2024, as inflation returns or moves closer to their respective target bands.

With the expected rate cuts on the horizon, coupled with weaker economic data points, lagged effects of past rate hikes, and easing inflation, Goh and Loke said the window for another OPR hike may have closed.

“Today’s statement (from BNM), which we interpret as more neutral, further supports this view. In sum, we maintain our call for OPR to remain at 3% for the rest of the year,” they added.

MIDF: BNM will consider OPR hike in 2H

Taking a different view, MIDF Research said it believes BNM will consider another 25 basis point (bps) rate hike in 2H2023, premised on Malaysia’s stronger-than-expected economy, in line with the central bank’s focus of ensuring sustainable growth momentum of Malaysia’s economy.

“Malaysia’s domestic economy continues to surprise market expectations, especially the distributive trade sales performance, tight job market and sticky core inflation (5M2023: 3.8% versus 2022: 3%),” it said.

MIDF said another avenue BNM may take in flexing its monetary arms is via normalising its Statutory Reserve Requirements (SRR) to 3%, from 2% since March 2022.

“However, the decision will be subjected to the stability of economic growth, the pace of price increases and further improvement in macroeconomic conditions, particularly a continued recovery in the labour market and growing domestic demand,” the research house said.

“From a medium-term perspective, the policy rate normalisation is needed to avert risks that could destabilise the future economic outlook, such as persistently high inflation and a further rise in household indebtedness,” it added.

'OPR-FFR parity at record low, major factor to strong US dollar'

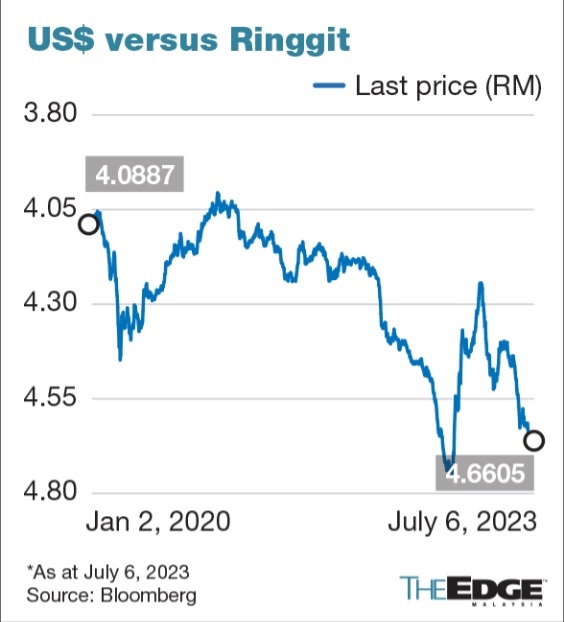

Meanwhile, MIDF highlighted that as the US Fed actively raised its FFR since mid-2022 to 5.25% as at May 2023, while BNM’s hike in the same month pushed the OPR to 3.25%, parity between the two rates has fallen to negative 2.25% ― the lowest on record.

“We opine the widening OPR-FFR differential is one of the major factors contributing to the strong US dollar,” the research house noted.

MIDF said that as of 1H2023, the ringgit has performed better than the yen by 5.3% year-on-year, rupiah by 3.4%, Taiwan dollar by 2%, Australian dollar by 1.9%, and Canadian dollar by 1.5%.

“Fundamentally, the ringgit is in [a] good position, as [the] domestic economy stays on upbeat momentum; and as [a] net exporter of crude petroleum, liquefied natural gas (LNG) and palm oil, Malaysia stands to benefit from the elevated global commodity prices.

“The ringgit [is] to stay on [the] depreciation path, as the US Fed keeps on delaying its interest rate pause. Also, weaker-than-expected China’s performances indirectly disappoint the ringgit, given that exports to China (13.2% of total exports) fell by 8.8% year-on-year in the first five months of 2023 (2022: increased by 9.4%).

For 2023, MIDF said it has lowered its ringgit average forecast to RM4.43 to US$1, and year-end forecast at RM4.20.