- The loss-making group said the proposed diversification is in line with its objective of generating an additional income stream in response to the group’s "lacklustre" financial performance and to reduce its reliance on the furniture business as its sole revenue contributor.

KUALA LUMPUR (June 22): After recently diversifying into property development, office furniture maker AHB Holdings Bhd has proposed to also diversify into the trading of building materials, machineries and equipment in view of rising costs in the increasingly competitive furniture business.

In a bourse filing on Thursday (June 22), the loss-making group said the proposed diversification is in line with its objective of generating an additional income stream in response to the group’s "lacklustre" financial performance and to reduce its reliance on the furniture business as its sole revenue contributor.

For the second quarter ended March 31, 2023 (2QFY2023), AHB’s net loss grew 57.41% to RM3.7 million from RM2.35 million a year earlier, which extended its spell in the red to 13 consecutive quarters. Revenue declined 5.6% to RM1.23 million from RM1.3 million.

AHB said the diversification is expected to result in a diversion of 25% or more of its net assets and may result in a contribution to 25% or more of its net profits in the future.

The group noted that it had received enquiries from two potential customers — a general trading and project management company, as well as an engineering solutions provider — for the supply of building materials, machineries and equipment, and will continue to seek more orders for its new proposed business.

Shareholders are to vote on the group’s proposed diversification at an extraordinary general meeting (EGM) to be called. TA Securities Holdings Bhd has been appointed to act as its principal adviser for the proposed diversification.

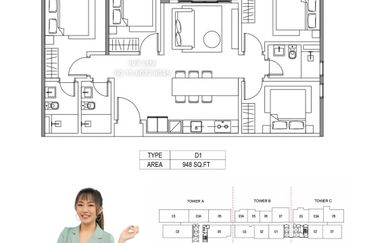

In February this year, the group obtained its shareholders’ approval to diversify into property development through the acquisition of 3,849.25 square metres of land in Kuala Lumpur for RM9.2 million for a planned residential development.

“The new trading business is complementary to the group’s recent diversification into the property development business, which will require the sourcing and procurement of raw materials for its development projects,” the group said.

It is worth noting that in May, Tunku Kamariah Aminah Maimunah Iskandariah Sultan Iskandar, the eldest sister of the Sultan of Johor, Sultan Ibrahim Almarhum Sultan Iskandar, joined AHB's board as its non-executive chairman.

A month before that, RHB Trustees Bhd emerged as AHB’s substantial shareholder after acquiring 63.08 million shares or a 15.957% stake in the group. It then upped its stake to 28.69%, comprising 136.36 million shares.

AHB shares ended unchanged at 16.5 sen on Thursday, giving the company a market capitalisation of RM97.42 million.

TOP PICKS BY EDGEPROP

Jalan 2/132

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Sunway Rydgeway Puncak Melawati

Taman Melawati, Selangor

M Adora @ Wangsa Melawati

Wangsa Maju, Kuala Lumpur

M Adora @ Wangsa Melawati

Wangsa Maju, Kuala Lumpur

The Ridge, KL East

Taman Melawati, Kuala Lumpur

Henna Residence @ The Quartz

Wangsa Maju, Kuala Lumpur

Henna Residence @ The Quartz

Wangsa Maju, Kuala Lumpur