ESG more than compliance or PR exercise, but value-creator – Building the Future ESG Conference

- The global shift towards ESG now means “from changing our behaviour, we can even make money”.

- Property developers would face a market risk if they fail to take ESG seriously, because consumers and investors, both globally and locally, are beginning to demand for it.

- “We can’t tell [international] investors and say we have the cheapest land value or the cheapest labour cost. ESG is the main thing now.”

PETALING JAYA (June 16): Real estate industry players have been called to consider the Environment, Social and Governance (ESG) agenda not just as a compliance or marketing exercise, but a crucial value-generating factor for their business.

“A lot of us are driven by compliance. We have got to do it because Bursa [Malaysia] or our investors are asking for it,” said Matthias Gelber, who is also internationally known as the “Green Man”.

However, ESG is now seen as “the biggest business opportunity we’ve seen since a long time”, he stressed in his opening remarks at the Building the Future ESG Conference 2023 yesterday.

“ESG helps keep our risks to the minimum and our opportunities to innovate our core business to the maximum,” he said when chairing the conference.

Addressing the general perception among Malaysians, where the main concern is the profitability factor, he said the global shift towards ESG now means “from changing our behaviour, we can even make money”.

The message was reiterated by several speakers from the inaugural conference organised by The Proptech Academy under MHub.

Demand from consumers and investors

“Embracing ESG is more than a PR (public relations) exercise. As of today, it is a business imperative,” said managing director and CEO of Zerin Habitat under Zerin Properties, Previndran Singhe.

Read also:

The shift towards Green Lending

“First, you can’t run away because it is a compliance risk, led by Bursa Malaysia, Bank Negara Malaysia and the Securities Commission.”

Besides that, he said property developers would face a market risk if they fail to take ESG seriously, because consumers and investors, both globally and locally, are beginning to demand for it, he said during his presentation titled “Sustainable practices in real estate market set to create a positive impact”.

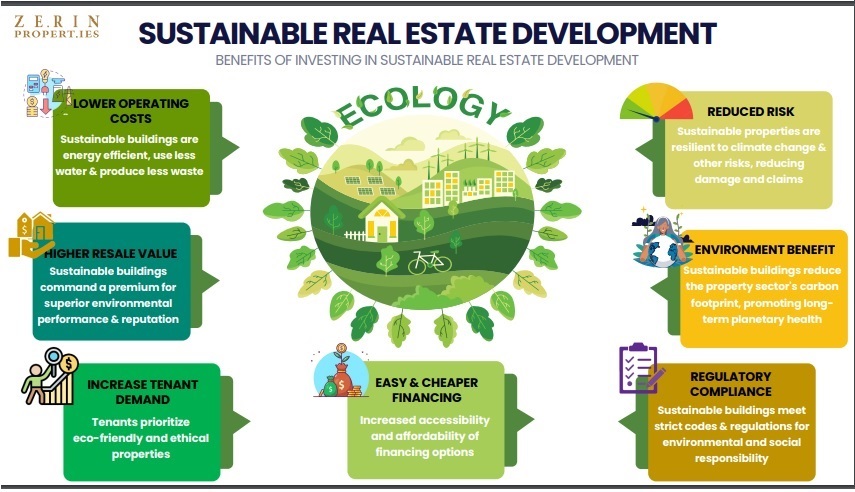

Besides lower utility bills for occupants and reduced operating cost for business owners, he pointed out that sustainable buildings command premiums for their superior environmental performance and reputation, and holds a higher resale value than traditional buildings.

“Tenants, [especially from overseas], also prioritise eco-friendly and ethical properties,” he pointed out.

In terms of financing, ESG-standard developments enjoy easier and more affordable options because ESG is increasingly becoming a priority for banks, Previndran said, citing IJM Corporation and Sunway Group that have signed sustainability-linked loans recently.

“Financial incentives in the form of tax credits or grants by government and industry associations encourage sustainable practices by reducing upfront costs for developers, builders and property owners,” he added.

Addressing non public-listed companies which may think they do not need to heed ESG because there is no compliance risk, he cautioned, “It will creep on you when Scope 3 comes in – when all the listed companies need all their suppliers to comply to their ESG standards”.

Main consideration for corporate buyers

Similarly, Knight Frank executive director (land and industrial solutions) Allan Sim said ESG is “a reality in property development” now.

Although ESG concerns may not affect local homebuyers’ decision-making today, he pointed out that ESG is the main consideration for corporate buyers.

“If you try to sell a property to European or American funds in the future, they won’t buy from you because of [the lack of] ESG [standards],” Sim said in his presentation entitled “ESG attribution on the new generation of industrial developments”.

As an example, Sim shared that when he was dealing with logistics assets investors from Germany and the US two years ago, the clients decided to bring their businesses to Thailand due to the lack of green-rated warehouses in Malaysia [then].

Showing the automated waste management system as another example of innovation in sustainability, Sim said such a system does not exist in Malaysia's industrial buildings yet.

“If Vietnam has this and Malaysia doesn’t have, how will we [compete]?” he asked.

“We can’t tell [international] investors and say we have the cheapest land value or the cheapest labour cost. ESG is the main thing now.”

Calling on developers and landowners to be more ESG-strategic, he encouraged them to record the development process because it would be a powerful visual narrative for their investors.

“If you want to show your ESG compliance, the video is the one that will tell the story of how you have built the building.”

He also pointed out that if traditional real estate players are still indifferent to ESG developments, they will see their bottom lines declining and be replaced by savvier players soon.

Reuse building materials

Giving examples of more sustainable construction methods, Sim also called on builders and developers to consider reusing building materials, citing it as a standard priority in construction in the US.

Concurring, MDEC (Malaysia Digital Economy Corp) head of strategy and policy, Dr Sumitra Nair, gave an example of a client who had saved as much as 30% of its building cost from reusing the materials from an old building on a site it had taken over, instead of the conventional method of total demolition.

“Sustainability is not about charity alone, but it is more about how you ensure you are doing the right thing from day one.

“If you address environmental and social issues within your business, you are going to make your business more resilient and sustainable in the longer term,” she stressed during her presentation entitled “How a focus on sustainability and digital can help manage headwinds”.

Held at Avante Hotel here, the full-day conference brought together a host of field experts and industry leaders who shared the latest insights on ESG developments in the property sector through 10 speakers and three panel discussion sessions. EdgeProp.my was the media partner.

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Telegram

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.