- Accessibility to the development includes the Sprint Penchala Link and Kerinchi Link as well as nearby amenities in Seri Hartamas and Mont'Kiara, such as shopping malls, international schools and medical facilities.

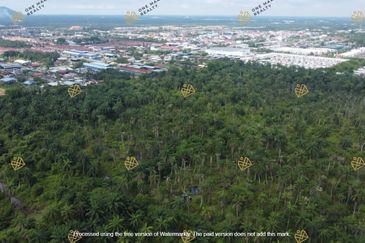

KUALA LUMPUR (May 16): YNH Property Bhd is disposing of a piece of freehold land measuring approximately 5.098 acres (2.06 hectares) in Desa Seri Hartamas to the Sunway Group for RM170 million cash.

YNH will receive an additional RM50 million cash from the Sunway Group should it manage to obtain a new development order (DO) from the authorities for a project with a minimum plot ratio of seven in its net land area within one year from the date of the signing of the sales and purchase agreement (SPA).

This additional sum will not be paid if YNH fails to get the new DO. Nonetheless, the sale would still stand, according to the group's filing with the stock exchange.

YNH announced to Bursa Malaysia that its wholly owned unit Kar Sin Bhd last Friday (May 12) entered into an SPA with Sunway Living Space Sdn Bhd, a unit of Sunway City Sdn Bhd, for the divestment. Sunway City is a wholly owned subsidiary of Sunway Bhd.

“We are excited to add this prime land to our portfolio, and to continue our commitment to creating vibrant integrated communities. This acquisition comes ready with an approved DO with a plot ratio of five, and we target to launch this development by early 2025,” said Sarena Cheah, the managing director of Sunway's property arm, Sunway Property, in a press statement.

“This underscores our confidence in the Malaysian property market, and we are confident that this development will be highly desirable among our multiple customer segments.”

Accessibility to the development includes the Sprint Penchala Link and Kerinchi Link as well as nearby amenities in Seri Hartamas and Mont'Kiara, such as shopping malls, international schools and medical facilities.

Sunway Property currently has a total land bank of 3,063 acres, with a potential gross development value of RM48.9 billion over a period of more than 15 years.

YNH to use proceeds for working capital, to repay borrowings

YNH, meanwhile, said in the filing that the sale proceeds will be used for working capital and repayment of bank borrowings, which will result in interest savings of RM3.77 million per annum, and reduce its gearing ratio from 0.65 times to 0.59 times.

The proposed disposal, which is estimated to be completed in three months, will also result in an estimated gain of RM2.6 million, after taking into consideration estimated expenses of RM800,000 in relation to the exercise.

For the financial year ended Dec 31, 2022, YNH's net loss widened to RM14.59 million, from RM2.79 million a year earlier, as revenue fell to RM210.75 million against RM231.28 million previously.

Total borrowings jumped to RM951.81 million at end-December 2022, from RM802.4 million a year earlier. Cash and bank balances, meanwhile, increased to RM48.67 million from RM34.15 million at end-December 2021.

YNH’s share price has climbed 46.5% over the past 12 months. The stock hit a record high of RM5.20 last Friday. At the close on Tuesday, it settled at RM4.90, up eight sen, with 69,900 shares changing hands and a market value of RM2.59 billion.

Sunway, on the other hand, closed at RM1.56, up one sen from the day before, giving it a market capitalisation of RM7.8 billion.

TOP PICKS BY EDGEPROP

Seri Mutiara Apartment, Bandar Baru Seri Alam

Masai, Johor

Bandar Baru Wangsa Maju (Seksyen 6)

Wangsa Maju, Kuala Lumpur