- Landmarks said it is of the view that there will be no material impact to its business, both financially and operationally, in view that it has no other outstanding loans or facilities with any other banks or financial institutions.

KUALA LUMPUR (March 14): Landmarks Bhd, a 21.7% associate of Genting Bhd, said its wholly owned subsidiary has defaulted in its repayment on financing facilities totalling RM133.37 million.

In a filing on Tuesday (March 14), the property developer said OCBC Bank (Malaysia) Bhd has issued its wholly owned unit Andaman Resort Sdn Bhd a notice of recall dated March 8, demanding the repayment of banking and credit facilities amounting to RM133.37 million be paid within 14 days — by March 22.

“The company and Andaman Resort are currently engaged in the process of devising a repayment plan that is commensurate with their current financial position and the timing for such repayment,” it said.

Landmarks continued that Andaman Resorts will propose to OCBC to utilise RM50.75 million in its debt service reserve account to set off the total outstanding amount.

“For the remaining outstanding sum of RM82.62 million, the company intends Andaman Resort to raise the sum within 60 days from March 17, 2023, upon the bank agreeing to the payment proposals,” it said, adding that the proposals shall be submitted to the bank on or before March 17.

Landmarks said it is of the view that there will be no material impact to its business, both financially and operationally, in view that it has no other outstanding loans or facilities with any other banks or financial institutions.

“In the meantime, the company will take proactive measures to engage with its creditors, where applicable, to seek their continuous support,” it added.

Touching on why the company was unable to fulfil its obligations under the financial facilities, Landmarks reasoned that due to a fire incident which took place at The Andaman Resort in January 2021, its biggest revenue contributor at the time, its unit Andaman Resort, ceased business operations.

Genting Bhd holds a 21.7% stake in Landmarks via Phoenix Spectrum Sdn Bhd, while Landmarks executive deputy chairman and chief executive officer Mark Wee Liang Yee owns a 12.84% direct stake and 10.35% indirect stake in the company.

Landmarks has been in the red for the past 12 financial years since the financial year ended Dec 31, 2010 (FY2010), save for a year of profitability in FY2020 due to a one-off gain and fair value gain on an investment.

For its latest full-year period, the company posted a wider net loss of RM43.28 million in FY2022 versus RM34.49 million a year earlier, while cumulative revenue rose to RM24.29 million versus RM5.58 million previously.

The larger net loss in FY2022 was due to RM138 million in recognition of estimated fire insurance receivable in FY2021 which offset property, plant and equipment written off and impairment of RM109.88 million, as well as retrenchment costs of RM3.1 million.

Shares in Landmarks ended down half a sen or 3.23% at 15 sen, giving the company a market capitalisation of RM97.76 million.

TOP PICKS BY EDGEPROP

Horizon Hills @ Golf East

Horizon Hills, Johor

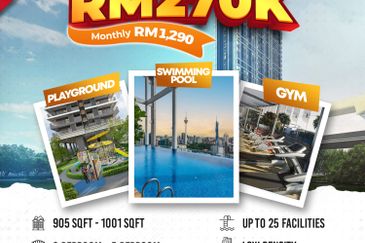

The Harmony (Residensi Riamas)

Jalan Klang Lama (Old Klang Road), Kuala Lumpur

Kawasan Perindustrian Indahpura

Kulai, Johor

Taman Perindustrian Desa Cemerlang

Ulu Tiram, Johor

Inspiration Park @ East Ledang

East Ledang, Johor