- Executive chairman Tan Sri Abdul Rahim Abdul Rahman: Despite the various economic and geo-political challenges that still remain, in addition to the rising inflation and interest rate hikes that prolonged the 'wait-and-see' attitude of buyers; transaction activities in 2022 have proven the market to be somewhat resilient — showing a significant rebound in overall market activities

KUALA LUMPUR (Feb 9): Rahim & Co International Sdn Bhd states that as a continuation of 2022 having had more progress, residential and industrial property sub-sectors have shown signs of positive growth while others are poised to follow suit but at a slower pace. This was revealed at the launch of Rahim & Co’s Property Market Review 2022/2023 report on Thursday (Feb 9).

Its executive chairman Tan Sri Abdul Rahim Abdul Rahman said the property market faced continued challenges in 2022 but had managed to remain resilient.

“Despite the various economic and geo-political challenges that still remain, in addition to the rising inflation and interest rate hikes that prolonged the 'wait-and-see' attitude of buyers; transaction activities in 2022 have proven the market to be somewhat resilient — showing a significant rebound in overall market activities.

“This does not mean that the market has fully recovered, but more of a sign that it is resuming the rebound trend that was interrupted by the pandemic and other adverse domestic political and economic factors on our shores,” he said.

Rahim also said the firm is cautiously optimistic about this year’s property market prospect and believes that with strategic development roadmaps as well as the potential catalytic impact of major infrastructure developments, the Malaysian property sector will be stable and realign to the path of gradual recovery despite the cautious sentiment amid the anticipated economic headwinds. He also added that the local property market will ease off to peak in 2024/2025.

The firm was also represented by its director of valuation Chee Kok Thim, chief executive officer of estate agency Siva Shanker, director of Petaling Jaya office Choy Yue Kwong and director of research Sulaiman Saheh, who shared insights on the property market for 2022/2023 during the event.

According to the report, Malaysia’s property market recorded higher transaction activities in 2022 compared to the first half of 2021 and even that of the first half of 2019. The total volume of property transactions for the country increased by 34.5% year-on-year in the first half of 2022. Total value of these transactions increased by 36.1%.

Meanwhile, for the first nine months of 2022, the volume of property transactions increased to 45.8%, while the total value of transactions at the end of the third quarter of 2022 recorded a 33.7% growth.

The report also stated that the residential sector saw continued positive growth in transaction performance. Of the transactions, primary sales made up 18.5% with the remaining being secondary sales as developers have taken a passive and cautious approach in new project launches. With the support of the Malaysian Home Ownership Initiative (i-MILIKI), which provides stamp duty exemptions for eligible first-time homebuyers coupled with real property gains tax exemption for individual owners, the residential sector is expected to be stable in the coming months with gradual growth expected.

Besides that, housing affordability stayed at the forefront of issues alongside the overhang and buy-or-rent dilemma, the report said. While various incentives and financial-aid schemes are provided to help ease the financial burden of first-time homebuyers and further stimulate transaction activities, concerns about overhang numbers remained as new supply influx continued, even for the affordably priced units.

Sulaiman added that Malaysia recorded a combined total of 55,482 overhang residential units — which includes residential, serviced apartments and small office home office (SoHo) units — that are worth RM41.57 billion. Johor has the highest number of overhang properties followed by the Klang Valley.

For the commercial sector, the challenges and hurdles lie in meeting the needs and preferences of today’s consumers and occupiers whose lifestyle have evolved with the digital and e-commerce trend that was accelerated by the pandemic. The report said the office market continues to face a saturated environment of high supply against a stagnant rental demand.

However, decentralised office areas with good transportation connectivity and contemporary facilities are more in demand than others, the report added. For retail, with supply still facing occupancy pressure, demand by consumers was normalising for most of the year despite rising inflation, the report added.

The hotel sector, being the hardest hit during the pandemic period — according to the report — is anticipated to take a longer period to regain itself to pre-pandemic levels, but the sector has been picking up well saved by its lag in supply growth. Although facing difficulties in terms of the labour force, the rebound in tourism activities has boded well for the sector, the report shared.

In the industrial sector, the overall transaction performance maintained its positive growth. The report stated that the prospect is encouraging as the country achieved a total net foreign direct investment inflow of RM54 billion for the first nine months of 2022 in comparison to 2021’s RM29.7 billion (within the same period). The logistics sub-sector continued to be in the spotlight as new supply has entered the market to meet the contemporary needs of current and future logistic players.

TOP PICKS BY EDGEPROP

Seksyen 51, Petaling Jaya

Petaling Jaya, Selangor

The Cruise Residence

Bandar Puteri Puchong, Selangor

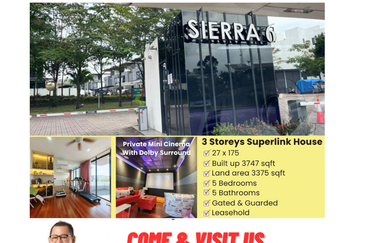

Bandar Sierra Puchong

Puchong South, Selangor

Pusat Bandar Puchong

Bandar Puteri Puchong, Selangor

Asteria Apartment @ Bandar ParkLand

Klang, Selangor

Bandar Botanic

Bandar Botanic/Bandar Bukit Tinggi, Selangor

Bayu Villa Apartment, Bayu Perdana

Klang, Selangor

The Parque Residence @ Eco Santuary

Telok Panglima Garang, Selangor

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)