- The authorities need to take stringent action against abuses of PPR and at the same time, work out the RTO for the deserving.

- HBA has been calling for stricter enforcement of existing rules to ensure that low-cost housing and PPR flats are not rented out to third parties and are allocated to the correct target group.

People’s Housing Projects, or referred to as Project Perumahan Rakyat (PPR), units built are only temporary living quarters for those looking, in future, to buy their own houses. They should only be rented out by the relevant agencies. The objective and aspiration of the government is for these transit homes to provide temporary living places for those who want to save enough money before embarking on buying their own homes. Those renting the PPR flats should regard them as merely temporary abodes to shelter their families and have roofs over their heads whilst striving to look for permanent homes.

Eligibility of tenants

In the Federal Territory of Kuala Lumpur, the Kuala Lumpur City Hall (DBKL) rents out these 700-sq ft 3-bedroom 2-bathroom units for a nominal rent of RM124 per month, and they are only eligible for families with monthly household incomes of RM3,000 and below.

While staying at these PPRs at subsidised rental charges, they can then build their savings to buy properties or move to better locations when their economic conditions improve. They should be given priority to buy low-cost, medium-cost or other affordable projects.

The rental agreement for the PPR unit clearly bars the tenant from subletting the rooms or handing over the entire unit to others. Those found flouting the agreement will be given a rental termination notice by the state government or local authority.

Evict those who flout rule

PPR tenants are supposed to self-occupy until they improve their financial positions and move out to allow those on the “waiting list” to take over their units. Those who flout the rules by subletting their units for obvious gains should be evicted and enforcement should be meted without delay. Without strict enforcement, those PPR homes could end up in the hands of undeserving individuals who will only rent them for profits.

They act like landlords and sublet rooms to foreigners and those who migrate from their villages to the cities. These have been going on for years but it seems enforcement action is slow and sometime thwarted by “outside” interference. This issue of “renting out a rented” PPR unit is not new. In fact, it has existed for some time now. All this is due to the greed of a few tenants who are out to make quick profits.

It is a betrayal of the purpose of building such PPR housing in the first place, which is to provide a roof for the poor and should not be used by profiteers as investment tools. By right, the PPR is aimed at providing a roof over the heads of the needy, especially those who have landed jobs in the rapidly-developing capital city.

HBA has been calling for stricter enforcement of existing rules to ensure that low- cost housing and PPR flats are not rented out to third parties and are allocated to the correct target group. The authorities should crack down on those who take advantage of such social housing schemes. It should check on those who abuse the benefits. You could identify them easily from the expensive cars and bikes parked there, and those with Astro satellite dishes installed.

Means test and exit policy

The tenants should go through a “means testing” – the process of measuring how much income a person has in order to decide if they qualify to continue receiving PPR “handouts”. These social benefits and welfare offered PPR tenants should be reviewed every three years by a committee within the agencies so that the tenants do not overstay and should gradually allow those incoming target families to take up occupation, for which there is a long waiting list. They should conduct door-to-door spot checks to verify that occupants of PPR homes are the intended ones. Stern action must be taken against those tenants who abuse the scheme. This includes imposing hefty fines or evicting them.

This is where enforcement must be strict so that those no longer eligible must give way to those deserving ones, but of course not to the extent of “throwing them into the streets”.

And, tenants who are no longer eligible for the PPR units should be honest and give up their units so that the houses can be given to those who truly deserve them.

Two categories of PPR

For the record, there are two categories of PPR: PPR disewa (rented) and PPR dimiliki (owned).

According to the National Housing Department website, PPR disewa was introduced in February 2002 and its objective was to rent out the units to people in the low-income group and squatters at RM94 to RM124 a month.

PPR dimiliki, on the other hand, was introduced to enable the B40 group to buy the units at RM35,000 (Peninsular Malaysia) and RM42,000 (Sabah and Sarawak).

Set aside PPR to be converted to RTO

It was reported in the media that tenants at the PPR Harmoni transit homes would be eligible to buy the 590 units at RM35,000 each through a rent-to-own (RTO) scheme and this was welcome by all. Indeed, the government should review certain PPR blocks to be converted to RTO to enable the tenants to buy their units through the scheme.

Do note that any units sold to buyers must be issued with individual strata titles. Hence, the management and maintenance, through the formation of a Joint Management Body or Management Corporation, will be under the purview of the Strata Management Act and its related regulations.

Through these initiatives, the tenants will be more proactive and make their neighbourhood a better place to live in. Most PPR flats are found poorly maintained and managed as tenants only consider their units as rented spaces. Currently, many of them do not bother to take care of their surroundings since they do not have a sense of belonging to the units, which ultimately turn into slums. This will create social problems for the society when the young are not brought up in a conducive environment.

Tips for successful RTO

In principle, the National House Buyers Association (HBA) supports RTO schemes if such schemes can truly help the rakyat. Traditionally, RTO schemes had been meant for the lower-income segment, or those under the urban poverty or B40 segment in the form of public housing programmes.

However, with the current high property prices compounded with the rising cost of living, a majority of the rakyat, even the M40, earning median monthly household incomes of RM6,275, find it very challenging to buy their first homes. This is especially true for the younger generation and single-income families.

HBA had, in the past, called for RTO schemes to be expanded to include the M40 segment. HBA believes that developing RTO schemes for the M40 would go a long way towards helping the rakyat own homes.

A typical RTO scheme is supposed to provide a lower entry cost to owning a unit as the tenant does not need to pay for the hefty 10% down payment to secure the unit, and legal fees and stamp duties for tenancies are typically cheaper compared to that of loan agreements and sale and purchase agreements.

The tenant merely needs to rent the unit by paying the security deposit (typically up to two months’ rental) and some utility deposits and can immediately rent the property with an option to purchase in the future. The tenant needs to pay the monthly rental, and when the tenant is financially ready to purchase the property, the tenant can exercise the option and will need to pay a revised monthly instalment payment.

In order for RTO schemes to succeed, it has to have the following key features:

Locked in property price

The price of the property must be locked in based on today’s price and not the prevailing market price, say, five years in the future. This is because the rate of increase in property prices is normally higher than the inflation rate or rate of increase in salaries. If the property price is going to be based on the prevailing market price in the future, the tenant or aspiring buyer may not be able to afford it.

Cheaper monthly rentals

The monthly rent of such housing units (before executing the option to buy) should be cheaper compared to the prevailing market rentals or equivalent to monthly loan instalments for similar housing units. In addition, the rent and any rate of subsequent increase should be stated upfront.

Protection for both tenant and landlord

So long as the tenant is paying his monthly obligations on time and in full, the tenant must be guaranteed the right to occupy the property during the contract period. The landlord cannot arbitrarily evict the tenant. At the same time, should the tenant or buyer default on his or her obligations, the landlord must be able to evict the recalcitrant tenant.

Option to buy at tenant’s sole discretion

The tenant should not be legally obligated to purchase the property. In the event the tenant does not wish to exercise the option to buy, the tenant must be allowed to continue renting the property based on terms that have to be stated upfront. Should the tenant wish to exercise the option to buy the said property later, the landlord cannot decline the request.

All payment obligations stated upfront

Any payments required to execute the option to purchase the property must be clearly stated upfront together with the revised monthly payments required. It is anticipated that the monthly payments will be higher and the tenant must be clearly informed of the revised amount in order to make an informed decision whether to exercise the option.

HBA also calls for careful screening of all participants of this RTO scheme to ensure that it reaches the intended target group. In addition, HBA calls for regular checks to be conducted to ensure that such RTO units are not sub-leased out.

As there are plenty of overhang properties (completed but unsold housing units), HBA calls for the government and private developers to offer these overhang properties for the RTO schemes. Besides being able to offer immediate housing units to help the needy, this will offer some cash flow relief to developers.

This article is written by Datuk Chang Kim Loong, Honorary Sec-Gen of the National House Buyers Association (HBA), which is a voluntary non-government and not-for-profit organisation manned wholly by volunteers.

HBA may be contacted via: www.hba.org.my / email: [email protected].

TOP PICKS BY EDGEPROP

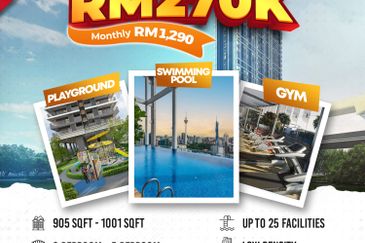

Residensi PR1MA Bandar Bukit Mahkota

Kajang, Selangor