- “The pandemic in 2020 and 2021 demonstrated that our core business was highly vulnerable to lockdowns and movement control orders.”

KUALA LUMPUR (Sept 22): Kedah-based property developer Bina Darulaman Bhd (BDB) is planning to potentially diversify into the agriculture, renewable energy and telecommunications (telco) sectors to capitalise on the respective sectors’ resilience.

“The pandemic in 2020 and 2021 demonstrated that our core business was highly vulnerable to lockdowns and movement control orders. The pandemic also demonstrated that certain sectors remained resilient throughout the pandemic phase, namely food production (agriculture), power (renewable energy) and telecommunications,” BDB acting president and group chief executive officer Mohd Iskandar Dzulkarnain Ramli said during the group’s media briefing on its financial results for the second quarter ended June 30, 2022 on Thursday (Sept 22).

“Looking ahead, the group will be undertaking studies to identify and determine the feasibility of adding these business sectors to its portfolio in order to further embed resilience and future-proof revenue and profitability,” he added, noting that BDB will make an announcement to update on its plans by 2023.

Mohd Iskandar noted that while the diversification plan is only in its early stages, the group would like to diversify into all three sectors if possible while ensuring the sustainability of its current core business segments of property development, and engineering, construction and quarry in the post-Covid-19 era.

However, he added that BDB’s diversification plan is still early in the works, and only in the stage of conducting a feasibility study of the prospects.

When put against the backdrop of an expected economic downturn in 2023, Mohd Iskandar said BDB will try to minimise any potential impact.

“If the market has been affected, of course we will be affected, but what we foresee right now is that our direct exposure is minimal, as we don’t have any investments outside of Malaysia.

“So, the risk of that is not a test on us at all. Secondly, like this year, [despite] the war between Russia and Ukraine, and the oil price hike, we managed to pass through all this turbulence, and we will try to continue all of this to ensure that if there is an impact, we need to minimise the impact like what we are doing right now,” he added.

Mohd Iskandar noted that the group’s management is monitoring the situation on a monthly basis, and will act accordingly to developments of the economic situation to ensure that the diversification plan is on track.

“Yes, we take note of all the challenges, but as of today, we reckon that we can still achieve the planned work that was laid out (the feasibility study),” he said, adding that the group will prudently manage costs to ensure that it can weather any potential headwinds it faces in 2023.

At the noon break, shares in BDB were unchanged at 29 sen, giving the group a market capitalisation of RM88.12 million.

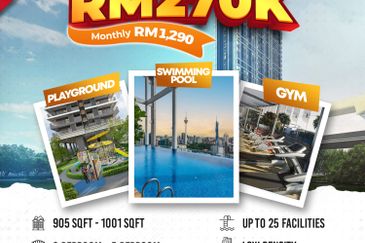

TOP PICKS BY EDGEPROP

Jalan Taman Setiawangsa

Taman Setiawangsa, Kuala Lumpur

Tasik Mewah Condominium

Seremban, Negeri Sembilan

The Hills, Horizon Hills

Iskandar Puteri (Nusajaya), Johor