- Quarterly revenue more than doubled to RM65.49 million from RM28.84 million on the back of higher contribution from its property development segment.

KUALA LUMPUR (Sept 21): Glomac Bhd’s net profit tripled to RM5.18 million for the first quarter ended July 31, 2022 (1QFY23), from RM1.73 million a year earlier, on higher revenue contribution from increased sales and construction activities.

Earnings per share rose to 0.67 sen from 0.23 sen, the property developer’s bourse filing showed.

Quarterly revenue more than doubled to RM65.49 million from RM28.84 million on the back of higher contribution from its property development segment.

Glomac said the improved financial performance was mainly driven by the resumption of construction activities in tandem with the easing of Covid-19 restrictions in the country.

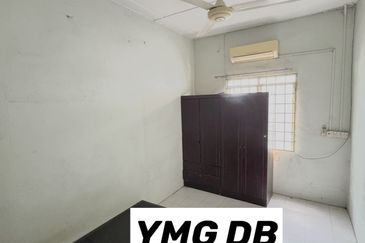

Contributing projects to the revenue included ongoing phases in Saujana Perdana, Plaza@Kelana Jaya and 121 Residences, the group said in a statement.

Glomac noted that it achieved higher new sales of RM52 million in 1QFY23, compared with RM30 million in 1QFY22.

The better sales performance was driven by the full take up of its shop offices at Lakeside Residences, Puchong as well as firm demand of ongoing township projects at Saujana Perdana and Saujana Utama 5. RUMA33, the maiden launch at Saujana Utama 5, is all sold since its release to the market in late-2021.

Looking ahead, Glomac said it aims to drive earnings through steady construction progress at ongoing projects, and executing RM469 million new launches planned for this year.

It said unbilled sales of RM512 million as at July 31 offers earnings visibility for the group.

“Glomac intends to drive earnings through steady construction progress at its ongoing projects, and successfully executing its upcoming new launches.

“However, there are underlying concerns over the inflation, labour shortage, rising interest rate and material cost that may affect the property sector.

“Longer-term prospects remain intact, underpinned by a healthy balance sheet and a strong pipeline of future development projects largely strategically located within the Klang Valley,” the group said.

Glomac’s share price finished unchanged at 28 sen, bringing it a market capitalisation of RM224 million.

TOP PICKS BY EDGEPROP

Duduk Huni @ Eco Ardence

Setia Alam/Alam Nusantara, Selangor

7 Square @Bukit Serdang

Seri Kembangan, Selangor

Bukit Jalil Golf & Country Resort

Bukit Jalil, Kuala Lumpur

Kawasan Perindustrian Nilai 3

Nilai, Negeri Sembilan

Nusa Cemerlang Industrial Park

Gelang Patah, Johor