- REIT’s recovery remains on track this year, with marginal rental support provided to tenants, thanks to the improved retail environment, according to RHB Research.

KUALA LUMPUR (July 28): The recovery momentum for IGB Real Estate Investment Trust (REIT) is expected to continue, despite several headwinds such as the overnight policy rate (OPR) hike as well as inflationary pressure, according to analysts.

RHB Research said the REIT’s recovery remains on track this year, with marginal rental support provided to tenants, thanks to the improved retail environment. It continued to like the group as a recovery proxy, given its largely domestic profile and big turnover rent portion.

“We think there is still room to grow — [IGB REIT’s] management [has] guided that the turnover rent portion remains below pre-pandemic levels of 12% to 15%.

“While the inflationary environment is a key downside to retail performance — as customers’ purchasing power may weaken — we think retail sales in 3Q22 (the third quarter ending Sept 30, 2022) may still be boosted by the remaining effect of Employees Provident Fund savings withdrawals,” said RHB in a note on Thursday (July 28).

While RHB does not expect positive rental reversions for the REIT this year as tenants’ recoveries remain uneven, the research house is hopeful that reversions could be positive next year if tenant sales continue to be strong.

RHB kept its "buy" call on the stock, with a lower target price (TP) of RM1.85 (from RM1.92).

“We raise our earnings forecast for the financial year ending Dec 31, 2022 (FY22) by 5%, but dial back our FY23-24 earnings forecasts by -3% to -4% to account for the inflationary outlook. We also adjust our cost of equity assumptions to incorporate higher interest rate expectations. Our TP incorporates a 2% ESG (environmental, social and governance) premium, given the REIT’s excellent scores on the environment and social pillar,” said RHB.

On the other hand, robust growth in IGB REIT’s latest net property income (NPI) reflects strength in its retail malls, and it should further capture the retail sector’s recovery in the second half of the year, said CGS-CIMB Research.

IGB REIT’s NPI for the first half ended June 30, 2022 (1HFY22) was back to pre-pandemic levels, growing strongly by 70% year-on-year to RM213.42 million from RM125.52 million.

This translated into an NPI margin of 80% in 1HFY22, from 68% in 1HFY21.

“Despite the inflationary headwinds and the OPR hike, we believe its flagship malls’ strong neighbourhood appeal makes them relatively insulated. They remain poised to benefit from the retail sector’s recovery.

“Upside risk: Stronger retail spending/consumer sentiment in 2HFY22. Downside risk: subdued tenancy renewals with negative rental reversions,” said CGS-CIMB.

CGS-CIMB retained its "add" rating of the stock, backed by dividend yields of 5.1% to 6.2%, with a TP of RM1.90.

“We maintain our FY22-24 earnings per share and distribution per unit forecasts,” it added.

At the time of writing on Thursday, IGB REIT had risen 4.4% to RM1.66, valuing the group at RM5.94 billion.

TOP PICKS BY EDGEPROP

Taman Taming Indah 2

Bandar Sungai Long, Selangor

Telok Panglima Garang Industrial Zone

Telok Panglima Garang, Selangor

Taman Bukit Indah @ Iskandar Puteri

Johor Bahru, Johor

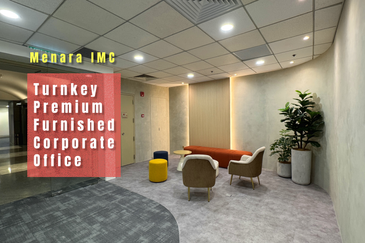

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

Menara HLX (formerly Menara HLA)

KL City Centre, Kuala Lumpur

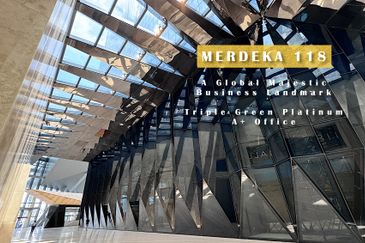

Merdeka 118 @ Warisan Merdeka 118

KLCC, Kuala Lumpur