Property Chat - Why you need lawyers in property transactions, unlike buying cars (Part 2)

This is Part 2 of an article published here.

The loan documentation is a tedious and complex process with every bank having its own drawdown requirements and processes. Each party instrumental to the transaction has to issue his respective confirmation and undertaking, be it the sale and purchase agreement (SPA) lawyers, housing loan lawyers, property developer or bank financiers. Hence, the time required for effectual disbursement of the loan would consume approximately three months, to be conservative, depending on its complexity.

Behind the scene

The following is a checklist (which varies from bank to bank) that conveyancing lawyers have to perform and undertake for the purchasers’ banks, inter alia:

- The lawyer must conduct land searches to ascertain the land information as represented in the SPA is correct and to confirm the presence or absence of any encumbrances, restrictions, prohibitions and acquisitions on the land in which the buildings are erected which may materially prejudice a financier’s interest or cause the financier not to be able to register its interest over the borrower’s housing unit or parcel.

- Searches are conducted on the developer and borrower to establish their solvency. If the borrower is a company, there is an additional checklist, such as reviewing the board of directors’ resolution and the corporate documents.

- For a property which is still under a master title, the end-financier lawyer must obtain a letter of undertaking from the developer to assure the financier that the developer will effect the transfer of the property to the purchaser once the separate strata title is issued, not to encumber the land any further through the creation of additional charges, and to apply for consent to transfer and charge. The financier lawyer also writes to the purchaser’s lawyer to seek his undertaking to attend to the perfection of the transfer once the separate strata title is issued. The responses and documents requested are then subsequently reviewed to ensure the contents comply with a financier’s requirement and if need be, the financier lawyer will seek further information or clarification from the developer. If the master title is charged to a financial institution (bridging financier), the end-financier lawyer will also need to request for a redemption statement and a Letter of Disclaimer whereby the master charge agrees not to foreclose the purchaser/borrower’s unit or parcel so long as the redemption sum is paid.

- The above does not include other checkings such as sighting of the developer’s licences, approvals for the project, issuance of the Certificate of Completion and Compliance (for completed projects), and that the quit rent and assessment tax have been duly paid to the land authorities and local council respectively. Not all loan processes are standard as development projects may have different schemes such as a leaseback arrangement or guaranteed income scheme in which a lawyer would also need to advise a financier on the terms of the scheme and its impact on the financier’s interest in the property.

- Then, there are the procedures to witness the instruments, endorsement, affirmation of the Statutory Declaration, stamping process, registration and extraction thereof.

- The Letter of Advice for release of loan which is issued by a lawyer to the financier is not a mere one pager. It usually runs into pages and pages (some nearly nine pages) of confirmation of facts, information and certain actions that have been taken such as lodgment of caveats to protect a financier’s interests, explanation on the land conditions, applicable public policy for special housing schemes, compliance by the relevant parties to the conditions set in the financier’s letter of offer, and the loan and security documentation that have been properly executed, affirmed, stamped and registered, where required.

- Once the drawdown requirements are satisfied, the financier lawyer then advises the financier to release part of the loan sum to the master charge (bridging financiers) for redemption purposes and thereafter to the developer’s Housing Development (Project) Account when the developer issues its progress claims to the end-financier and purchaser. The Letter of Advice may be uploaded onto a financier’s portal or printed in hard copies. The letter from the lawyer, entrusted with the housing loan, usually contains a professional undertaking from the lawyer to the financier to make good on any loss or damage suffered by a financier for any negligence, error, omission, or mistakes.

The end-to-end conveyancing process list is non exhaustive. It is not such a simple and straightforward process as perceived.

Discounted legal fees

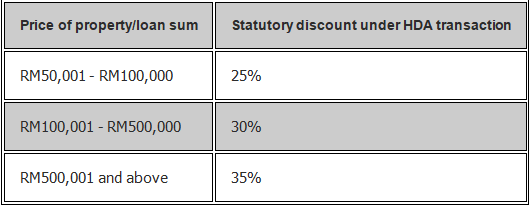

We do acknowledge that the amount of work that has to be done should be, and is, taken into account in the scaled fees. However, in a case where the purchase transaction is governed by the Housing Development (Control & Licensing) Act, 1966 (HDA), or where a loan is obtained to finance a HDA transaction, a permitted lower scale of fees will apply, ranging from 25% to 35% discounts (Table 2) based on the Solicitors' Remuneration Order 2005, which was gazetted on March 2, 2017 and came into operation on March 15, 2017.

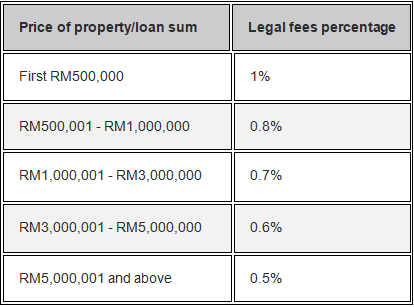

The legal fees are calculated based on a percentage of the buying price of the property or housing loan sum, which can be anywhere from 0.5% to 1% (Table 1):

Such discounted legal fees are certainly to the benefit of purchasers. However, though the SPA is in statutory form, *professional insurance still has to be purchased by lawyers to cover all circumstances.

In our opinion, the scaled fees benefit the low-income group more. Without the scaled fees, lawyers will likely charge more for low-end properties because the amount of work involved is often the same as high-end properties.

The purchase of a low-cost house entails having to apply for the formal consent of the state authorities, land office and sometimes the local council on top of having to recite the status of the property in the SPA – that is actually more tedious work than a high-end freehold property.

With the compulsory discount, I do not think purchasers for low- and medium-cost houses are overcharged.

While laypersons may have little idea and academicians may understand the peripheral procedures in conveyancing, the tasks entail voluminous work and only a hands-on legal practitioner or lawyer would understand the intricacies of the processes.

*Professional insurance: To enable lawyers to practise in the legal arena, he must be registered with the Bar Council, Malaysia and issued a Practising Certificate (PC) as an Advocate & Solicitor. For the PC to be issued, there is a strict list of compliance, one of which is the insurance coverage for professional indemnity.

This article is written by Datuk Chang Kim Loong, the Honorary Secretary-General of the National House Buyers Association (HBA) and edited by HBA volunteer lawyers. HBA could be contacted at: Email: [email protected] Tel: 012 3345676

This article is intended to offer an insight into the works of the conveyancing processes vis-à-vis sale and purchase and housing loan transactions. If in doubt, please seek your own independent legal advice.

Never miss out

Sign up to get breaking news, unique insights, event invites and more from EdgeProp.

Latest publications

Malaysia's Most

Loved Property App

The only property app you need. More than 200,000 sale/rent listings and daily property news.