KUALA LUMPUR (April 20): The Employees Provident Fund (EPF) has clarified that members will continue to earn dividends for the remaining portion of their EPF savings up to age 100.

In a statement today, the retirement fund said that an old statement regarding the maximum age of 75 years for EPF dividend payment currently circulating via WhatsApp and online is outdated and no longer applicable.

The EPF reiterated its statement dated Nov 3, 2016, that effective Jan 1, 2017, members will continue to earn dividends for the remaining portion of their EPF savings up to age 100.

This was introduced following an amendment to the EPF Act 1991 to ensure that members who choose to maintain a portion of their savings with the EPF after retirement will continue to benefit from the compounding effect of annual dividends until their EPF savings are fully withdrawn.

"The EPF will inform members prior to transferring any unclaimed savings when the member reaches age 100. Any claim after the transfer can be made through the Registrar of Unclaimed Money.

"We urge members to be cautious about misleading or unsubstantiated information received through social media platforms and refrain from circulating them," it said.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

TOP PICKS BY EDGEPROP

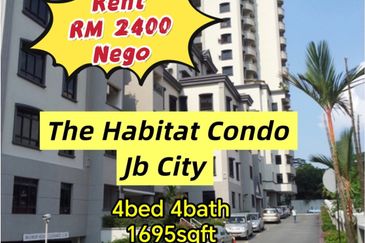

Jentayu Residency (Jentayu Residensi)

Tampoi, Johor

Country Garden Central Park Phase 1

Johor Bahru, Johor