KUALA LUMPUR (March 3): Grand-Flo Bhd is planning to buy two properties in Genting Highlands — the land and project development rights of an ongoing mixed development known as Grand Ion Majestic (GIM), and the adjacent serviced apartments and commercial lots of a completed project known as Grand Ion delemen (GID) — for RM422.89 million.

It is buying the properties from Galeri Tropika Sdn Bhd (GTSB), which is majority owned by NCT Building & Civil Engineering Sdn Bhd (NCT BCE), a wholly-owned unit of NCT Venture Corp Sdn Bhd, in which Grand Flo's executive chairman and group managing director Datuk Seri Yap Ngan Choy holds 80% and his brother Datuk Yap Fook Choy holds 20%.

At the same time, it has proposed to undertake a private placement to raise over RM75 million to fund its current and upcoming property development projects. In addition, the group wants to change its name from Grand Flo to NCT Alliance Bhd.

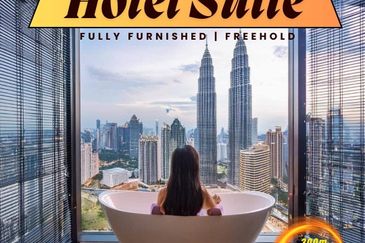

In a statement, Grand Flo said GIM, which it will be acquiring for RM210 million, comprises three blocks of serviced apartments with 1,885 units, as well as 30 units of retail and office lots, with residual gross development value of RM1.1 billion. GID, on the other hand, has 100 completed serviced apartments and 15 units of retail lots. The two projects are within close proximity of Resorts World Genting.

As for GID, Grand Flo said the serviced apartments will be acquired at RM212.89 million, and that the retail lots will be rented back to the vendor, GTSB, for a five-year guaranteed rental yield of 7% per annum.

It plans to satisfy the total purchase consideration for the acquisitions by cash, assumption of liabilities and issuance of redeemable convertible unsecured loan stocks (RCULS) in tranches to GTSB.

“These acquisitions form part of the group’s ongoing efforts to replenish and reinforce our presence in the property development sector. GIM and GID are the only other developments at the hilltop of Genting Highlands, thus providing great opportunities to tap into given the upcoming tourist attractions in the area.

"Furthermore, with the establishment of a franchise agreement with Wyndham Hotel Asia Pacific Co. Ltd, the five-star hotel operator will be operating part of GIM and the hotel will carry the Wyndham brand name under the US-based Wyndham Hotels & Resorts Inc, one of the world’s largest hotel franchising company. We are confident this will further boost the marketability and future prospects for GIM and GID,” said Ngan Choy.

The group posted a net profit of RM4.77 million in the fourth quarter ended Dec 31, 2020 (4QFY20), compared to a net loss of RM2.4 million a year ago, as revenue jumped 80% to RM35.5 million versus RM19.7 million last year, thanks to higher recognition from its property division.

For the full year, its net profit more than doubled to RM5.63 million from RM2.65 million, as revenue climbed 11% to RM76.9 million from RM69.42 million previously.

Despite challenging market conditions due to the Covid-19 pandemic, Grand-Flow’s property development division’s net profit surged by 176% to RM12.1 million, a significant improvement compared with RM4.4 million in the previous year.

Shares of Grand-Flo ended 23 sen or 68.12% higher to 58 sen yesterday, for a market capitalisation of RM307.49 million.

Get the latest news @ www.EdgeProp.my

Subscribe to our Telegram channel for the latest stories and updates

TOP PICKS BY EDGEPROP

Subang Perdana Goodyear Court 10

Subang Jaya, Selangor

KL Gateway Premium Residence

Bangsar South, Kuala Lumpur

Impian Bukit Tunku

Kenny Hills (Bukit Tunku), Kuala Lumpur