KUALA LUMPUR (Nov 11): MRCB-Quill REIT's (MQREIT) third-quarter net property income rose 9% to RM32.4 million from RM29.74 million a year earlier as the property trust registered higher revenue from its real estate assets here and in Penang and as group property operating expenses decreased.

MQREIT told Bursa Malaysia today its revenue grew to RM41.71 million in the third quarter ended Sept 30, 2020 (3QFY20) from RM39.46 million a year earlier.

"The increase was mainly due to higher revenue generated from Menara Shell, Wisma TechnipFMC and Tesco Building Penang.

"Furthermore, property operating expenses for 3QFY20 were RM9.3 million, a decrease of approximately RM0.4 million or 4.3% as compared to 3QFY19. This was mainly due to lower operating expenses incurred for some of the properties under the portfolio," said MQREIT, which reported a 3QFY20 net profit rise to RM21.48 million from RM17.64 million.

For the cumulative nine months ended Sept 30, 2020, MQREIT said net property income climbed to RM96.68 million from RM91.6 million a year earlier while revenue increased to RM124.55 million from RM120.37 million.

MQREIT said net profit was higher at RM60.34 million versus RM53.5 million.

Looking ahead, MQREIT said that with the ongoing uncertainties due to the Covid-19 pandemic, the Klang Valley office and retail property markets are expected to remain challenging.

"We will continue to focus on asset management and leasing strategies that are centred on cost optimisation and tenant retention to overcome the challenging operating environment," MQREIT said.

At Bursa's 12.30pm break today, MQREIT's unit price rose 0.5 sen or 0.64% to 78.5 sen, valuing the group at about RM840 million.

MQREIT's latest reported net assets per unit stood at RM1.2034.

Get the latest news @ www.EdgeProp.my

TOP PICKS BY EDGEPROP

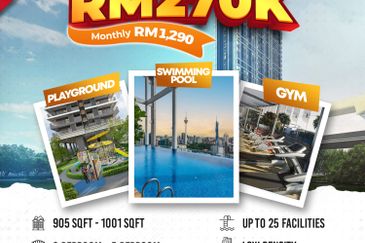

Residensi PR1MA Bandar Bukit Mahkota

Kajang, Selangor