To many, the building of over-priced houses by “profit-seeking” developers has caused the aggravation of housing affordability in the country, thereby leading to a spike in the number of overhangs in the market.

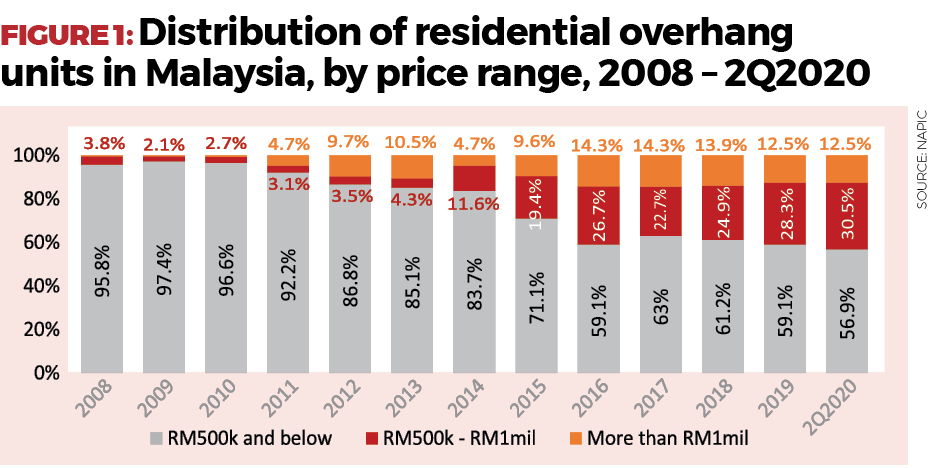

This argument is supported by the rise of completed unsold stock for houses priced between RM500,000 to RM1 million and more than RM1 million. Both of these categories are contributing to as high as 30.5% and 12.5% of the total overhang in 2Q2020, compared with only 3.8% and 0.4% of the total overhang in 2008 (Figure 1).

However, it is too simplistic to conclude that the high number of overhangs is the end result of high house prices that have gone far beyond people’s affordability level.

First, there are still a large number of completed unsold units priced at RM500,000 and below, with the percentage of 56.9% in 2Q2020; and 55.7% of these houses are under the category of RM300,000 and below.

While these type of unsold units is often referred to as products located in less-appealing locations that are not meeting the mass market demand; one should realise that not all these houses are “location-mismatched products”.

Even if there are any, these homes are likely derived from those that are under the government’s price-controlled social housing schemes (i.e. RUMAHWIP, PR1MA, RSKU, etc.). The portion contributed by free-market houses is deemed limited.

Developers would not simply launch a project that suffers losses. Any private development will be backed up by detailed planning and convincing feasibility study before kicking off, so as to counter any potential risks in the subsequent development phases.

A high number of overhang units priced at RM300,000 and below may, in fact, indicate that the problem of today’s housing affordability runs deeper than one can imagine.

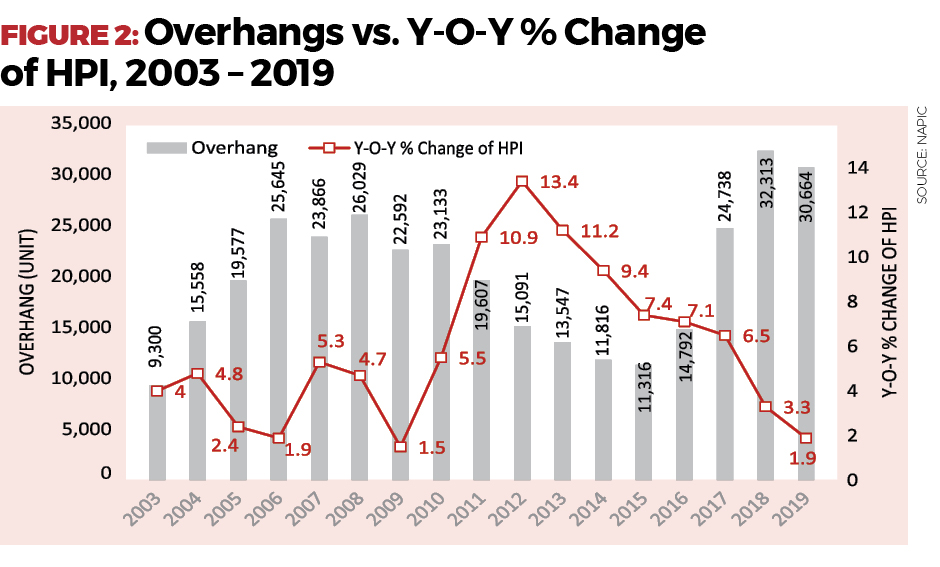

Besides, the rise of overhang units does not correlate with the increase of house prices. House prices have escalated since 2010, with a growth of 5.5% to 10.9% in 2011, and further to 13.4% in 2012. While house prices continued to grow at a rate of 11.2% in 2013, 9.4% in 2014, and 7.4% in 2015, the number of overhangs was falling, from 23,133 in 2010 to 13,547 in 2013, and further down to 11,316 in 2015 — being the lowest since 2003 (Figure 2).

Let us assume that the high overhang units are the direct outcome of high house prices, the number of overhangs should be growing in tandem with the escalating house prices. Since it doesn’t, this indicates that high house prices are not the main cause of overhangs.

In fact, today’s overhang and housing affordability problem is likely a reflection of the decreasing purchasing power among mass market buyers. This happens when household income is not increasing as quickly as the overall cost of living, and along with it, their ability to afford a house.

This, then, translates into a decline in housing demand and a less active housing market. A clearer picture on “how slowing income growth has severely affected the Malaysian housing affordability” can be obtained by studying the growth of house prices against the growth of income in Malaysia and selected Asian countries.

As one could observe, house prices in all these countries are either trending downwards or moderating throughout the period of 1990 to 2019; except for Malaysia and Hong Kong, where house prices in these two countries are generally on a rising trend, with a significant growth trend in 2010 to 2019.

Likewise, income growth in all these countries is generally higher than the house prices growth throughout 1990 to 2019; except for Malaysia and Hong Kong, where income growth in these two countries is found to be lower than the house prices growth especially in 2010 to 2015.

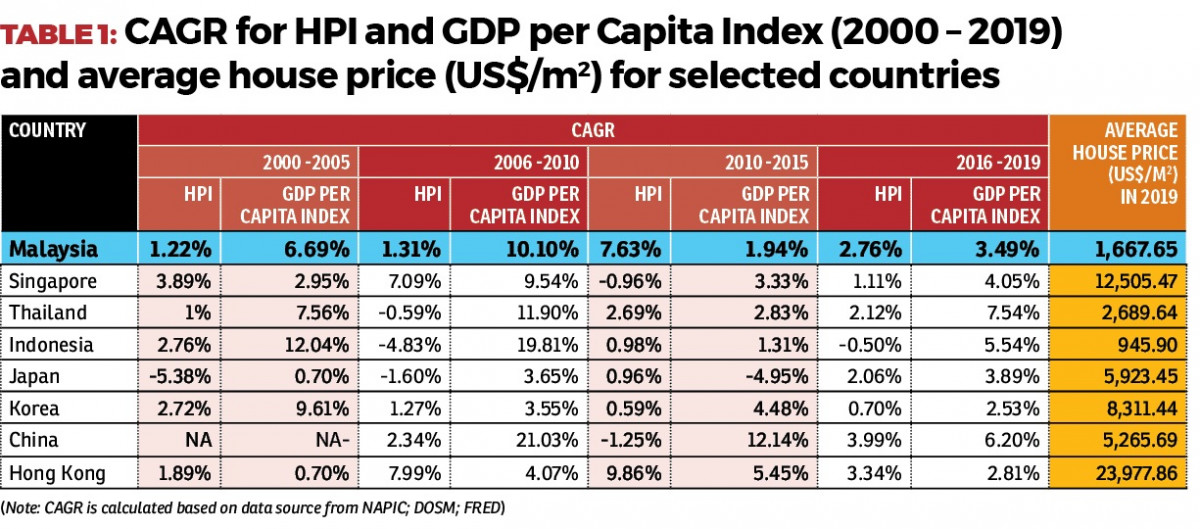

The respective compound annual growth rate (CAGR) for house prices and income in Malaysia is 7.63% and 1.94%; while in Hong Kong, the respective CAGR for house prices and income is 9.86% and 5.45%. While Japan, too, showed a lower income growth in 2010 to 2015, against a CAGR house price growth at 0.96%, the divergence is much smaller than the one in Malaysia and Hong Kong, owing to Japan’s moderating house prices.

In the case of Malaysia, it has experienced the most drastic house prices escalation during 2007 to 2014, with a CAGR of 11.4%, against the growth rate of income, at a CAGR of 6.4%.

Widening gap between income and house prices

House prices skyrocketed during this period not only due to the introduction of developer interest-bearing scheme (DIBS) that helped drum up the buying sentiment; but it was also attributed to the favourable lending policy and built-up speculative herd instinct among buyers and investors that increased the deviation of house price from its fundamentals.

To add salt to the wound, the country, at the same time, expanded its credit by engaging in an expansive monetary policy in order to increase the money supply available to borrow, to spend, and to invest.

As a consequence, house prices have badly inflated, leading to the deterioration of housing affordability nationwide. Even though house prices have seen moderation over the past few years (since 2017), the gap between income and house prices is still widening, owing to the weak performance of the country’s economy.

Following the outbreak of Covid-19 in 2020, the gap between house prices and income is expected to widen further, and housing affordability will still be a challenging issue in the coming years.

The worrying trend now is that households have less discretionary income to spend, as a sizable portion of their income has been devoted to servicing debt obligations as well as confronting the escalating living cost.

These households — mainly from the B40 and M40 income groups — tend to expose themselves to the phenomena of “house poor” (or to be referred to as “house rich, cash poor”), where they are short of cash after the allocation of an exorbitant percentage of their monthly budget on homeownership including mortgage payments, property taxes, maintenance, and utilities.

They may probably need to make unrealistic compromises in other areas of their lives, which could be detrimental to future consumption, activity, and emergency. This also explains why houses in Malaysia are perceived as “expensive” by locals, but are rather “cheap” in the eyes of foreign investors.

By comparing the per metre square of average house prices (US$/m2) among countries worldwide, one can see that house prices in Malaysia (US$1,668.65/m2) are not “expensive” based on international standards.

The country’s house price is far behind most Asian countries such as Hong Kong (US$23,977.86/m2), Singapore (US$12,505.47/m2), South Korea (US$8,311.44/m2), Japan (US$5,923.45/m2), China (US$5,205.69/m2), and Thailand (US$2,689.64/m2).

Now take a look at the country’s house price compared with other Asian countries that have a relatively lower GDP per capita, such as Vietnam (US$1,534.55/m2), Iran (US$1,527.48/m2), Philippines (US$1,287.83/m2), Sri Lanka (US$1,257.31/m2), Nepal (US$1,050.82/m2), India (US$1,045.70/m2), Iraq (US$1,009.76/m2), and Indonesia (US$945.90/m2).

House price in Malaysia is still not “expensive”, considering the quality, standard, and the size of houses being offered. In this sense, it is not that houses in the country are too “expensive” to be afforded, but the reality is that the mass market buyers are too “poor” to afford a house.

Suppose the main driver of the problem is the badly impaired people’s purchasing power (which sounds more like an economic issue), mandating private developers to build more price-controlled social houses that are aimed to serve the low-income group (just like tackling a social problem) will never be able to increase people’s housing affordability level. Instead, such policy movement will lead to the profound structural problem in the housing market — cross-subsidisation — which tends to pass-on the tax burden in building price-controlled housing to the free market house buyers.

The government should realise that when wages and salaries are not catching up with the prices of commodities that continually increase, the housing affordability level is inevitably decreased.

To complete the picture in solving the issue of housing affordability, measures to address the problem should not be limited to those financial supports given to the buyers, but also to include ways to incentivise builders in supplying houses, such as sun-setting outdated and onerous rules, streamlining and expediting development approvals, as well as eliminating unnecessary requirements.

These measures will surely facilitate the establishment of an environment that promotes healthy, responsive, affordable, and high-opportunity housing markets.

Dr Foo Chee Hung is MKH Bhd manager of product research & development

This story first appeared in the EdgeProp.my e-Pub on Oct 16, 2020. You can access back issues here.

Get the latest news @ www.EdgeProp.my