Real Estate & Housing Developers’ Association, Malaysia (REHDA) president Datuk Soam Heng Choon has expressed his concern on the increasing number of unsold bumiputera units in the country.

“The unreleased bumiputera lots contribute to about 40% to 50% of the country’s overhang numbers… Everybody needs to play their roles in trying to resolve this issue. The state government controls the release of unsold bumi lots, so the state government needs to come in and help the situation,” he said at a recent press conference.

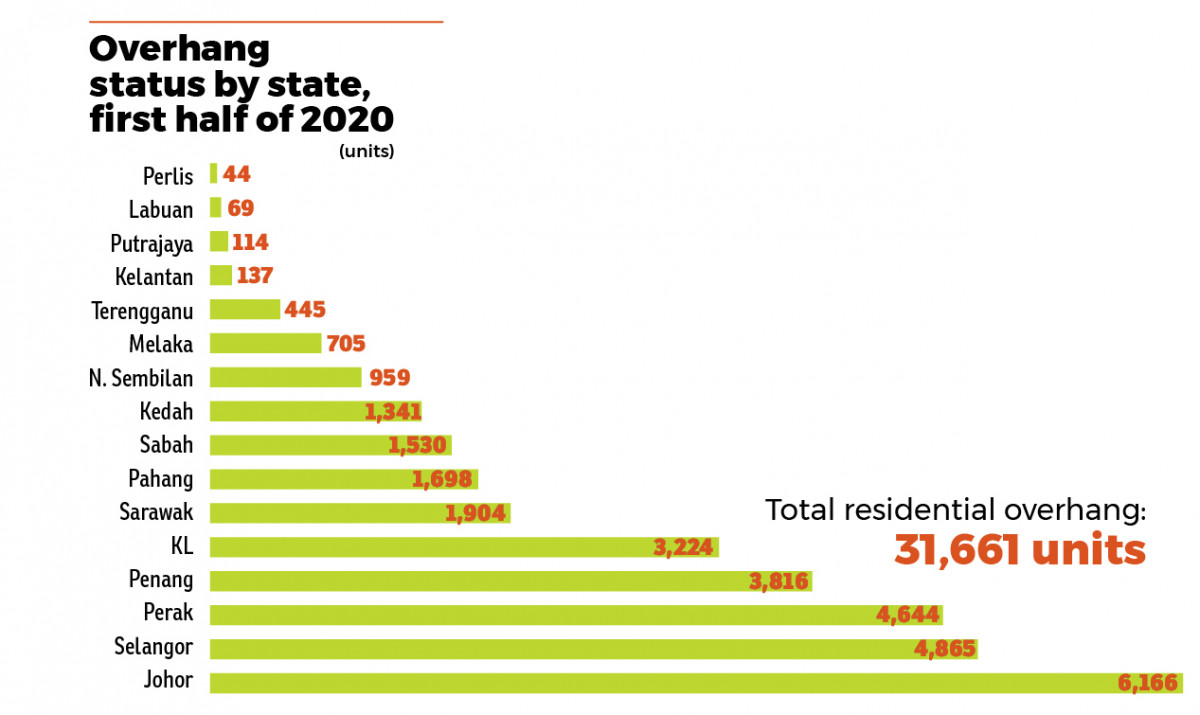

The National Property Information Centre’s (NAPIC) Property Market Status Report for the first half of 2020 showed there were 31,661 overhang residential units worth RM20.03 billion, an increase by 3.3% in volume and 6.4% in value from the 30,664 units worth RM18.82 billion recorded in 2H2019.

Johor retained the highest number and value of residential overhang in the country with 6,166 units worth RM4.74 billion, accounting for 19.5% and 23.7% respectively, of the national total in the period.

It also maintained its reign as the highest serviced apartment overhang state in 1H2020 with 73.7% share in volume (15,986 units) and 76.7% share in value (RM14.67 billion), with almost all of these overhang units being in Johor Bahru district.

The overhang in the serviced apartment subsector continues to rise and form the bulk of commercial property overhang, recording a total of 21,683 units valued at RM18.64 billion, up by 26.5% in volume and 24% in value against 17,142 units worth RM15.04 billion recorded in the June to December 2019 period.

Proactive measures for a timely release mechanism of ‘bumiputera’ lots

The National House Buyers Association (HBA) believes the move by the Perak state government to speed up the release of bumiputera lots is a step in the right direction and will ultimately benefit all in the long run.

Effective April 1, 2019, the Perak government allowed housing developers to apply for properties under the bumiputera quota to be released to other buyers if the properties were unsold by the Perak Housing & Property Board after six months.

It was reported that 50% of the bumiputera quota can be released to non-bumiputera buyers with these conditions:

• The physical construction has achieved 30%.

• That 60% of the non-bumiputera lots have been sold.

The balance 50% of the bumiputera quota can be released with the following conditions:

• After physical construction has reached 80%.

• That 90% of the non-bumiputera lots have been sold.

The ‘Dasar Kerajaan Perak’ (Perak government policy) vis-à-vis bumiputera release mechanism is still subsisting. Obviously, those developers who sell bumiputera lots to non-bumiputera buyers without the state’s prior approval would be subjected to fines or double the levy payment.

Such proactive initiatives should be emulated by other states in Peninsular Malaysia. With this step, developers will be able to reduce ‘holding costs’ and thus bring down house prices provided they do not conveniently ‘up their profit margin’.

There are many costs incurred in building a house that common buyers can relate to such as the costs of the land and the construction including labour and building materials. However, an important cost factor that many people may overlook is time — the longer the housing developer or the building contractor takes to finish building a project or to sell off their properties, the higher the cost incurred.

Under the New Economic Policy, property developers are required to reserve a certain number of units of their developments, say a minimum of 30%, for only bumiputera purchasers. The bumiputera quota differs from state to state and usually ranges from 30% to 50%. Furthermore, these bumiputera lots are to be offered at a discount ranging from 5% to 15%.

For housing developers, it would be quite mind boggling to understand and meet the various states’ policies with regards to this issue. They are after all, not charitable organisations and any additional cost incurred by them will be passed on to buyers.

What happens if the developer is unable to find enough bumiputera buyers for the bumiputera lots? What if the state housing board is unable to find qualified bumiputera buyers?

The longer it takes to sell the bumiputera lots, the higher the cost for the developers as their capital is locked down in those unsold units. The holding cost will eventually be transferred to future house buyers both bumiputera and non-bumiputera via the house price. Most developers will factor in their budget, the anticipated ‘holding cost’ for a period of three years since the current mechanism dictates so.

Developers have been complaining about the release mechanism of bumiputera lots as being not transparent, not consistent, and differs from state to state.

HBA had called for more transparent and consistent policies for the automatic release of bumiputera lots and the move by the Perak government is indeed a step in the right direction. Such policies that benefit the rakyat and bring down the costs of compliance must be heralded.

Malay reserve land: Enormous potential for development

‘Tanah Rezab Melayu’ or Malay reserve land (MRL) are different compared to bumiputera quotas. MRL are land, which can only be owned and held by Malay owners.

Compared to bumiputera quotas, MRL are virtually impossible to be legally ‘released’ to non-Malays. Furthermore, there are several other characteristics that distinguish MRL from bumiputera quotas. The following are a few of those features:

• All property built on the MRL are to be exclusively sold to Malays only

• Malay owners are not allowed to rent out properties built on MRL or the lands to non-Malays

• All businesses that operate on MRL must be owned by Malays

There is great potential in the development of these MRL especially those of reserve land located in the urban and not so rural areas. It is the product that is developed on the land that will ultimately determine the economic value of the land.

The reason MRL lagged behind in development was the failure of their owners to view their land as a strategic economic asset. Why don’t they see its potential? The government has to look into this as part of its agenda to uplift the economic development of the Malays. Looking at its huge potential, much more has to be done to make the property development sector more popular among the Malays. Once developed into housing schemes, they can be exclusively for the Malays’ wellbeing and shelter for their families.

Already, there are numerous housing projects on MRLs exclusively for the Malays. You find launches via ‘Facebook’ like the recent one at Kota Kemuning @ Shah Alam – freehold 2-story terraced houses at RM498,000 and advertisements in property portals for locations at Desa Sri Hartamas, Segambut, Taman Melawati, Sungei Long, Taman Pelangi, Sentul and many others.

Potential of Waqf lands

Waqf land or land endowments made by Muslims have vast potential for development as not enough people have thought about doing this. In Malaysia, more than 88% of waqf land, amounting to about 30,000ha, is left under utilised or idle.

If the potential of the waqf land is unlocked, it can help improve the socio-economic status of some Muslims, both owners who will get development profits and buyers who can get a discounted price for the property. It will achieve our government’s aspiration to provide affordable housing for those in need of it. It was reported in 2017 that there were more than 10,120ha of waqf land in the country that can be developed into commercial and residential projects.

We suggest that the relevant authorities help unlock their value since there is a high demand for homes within certain urban areas. Some of the waqf lands are in high-value areas, facilitating profitable development. Most of the property overhang was due to lack of emphasis on market studies related to less strategic locations and it is timely to undertake the development of waqf lands. Priority must be given to the formulation of the Waqf Land Act.

We envisage and our aspiration is that a house currently costing RM400,000 be ‘sold’ or rather ‘let on long lease’ for half the price in a waqf land scheme — after all, isn’t it just the construction price and compliance costs that one has to bear? Of course, this is a subject for another discussion.

Conclusion

National House Buyers Association humbly proposes, vis-a-vis the bumiputera quota (and please bear in mind that this is not exclusively for the Malays but also covers the other ethnic groups which fall under the category of ‘bumiputera’) for the state and Federal authorities through the National Land Council to device a standardised and transparent system for unlocking the bumiputera quota for overhang properties in the footsteps of the Perak state government.

Perhaps, they could initiate a working group committee to study the ‘nuts and bolts’ for such an objective calling in the expertise from the authorities, academia, civil society, REHDA and all other stakeholders.

Datuk Chang Kim Loong is the Hon. Secretary-General of the National House Buyers Association (HBA).

HBA can be contacted at: Email: [email protected]

Website: www.hba.org.my

Tel: +6012 334 5676

This story first appeared in the EdgeProp.my e-Pub on Oct 9, 2020. You can access back issues here.

Get the latest news @ www.EdgeProp.my