KUALA LUMPUR (Aug 28): Parkson Holdings Bhd’s net loss for the fourth quarter ended June 30, 2020 (4QFY20) ballooned to RM209.25 million, from RM92.33 million in the preceding quarter (3QFY20), due mainly to impairment losses on assets.

Revenue contracted 3% to RM677.99 million in 4Q, from RM698.94 billion in 3Q, according to the departmental store operator’s filing with Bursa Malaysia.

The latest net loss compares with a net loss of RM42.13 million a year earlier (4QFY19), on revenue of RM954.32 million.

This is the group’s ninth loss-making quarter. Its last profitable quarter was 3QFY18, when it reported a net profit of RM25.30 million.

For the full financial year ended June 30 (FY20), Parkson’s net loss expanded to RM427.28 million from RM129.18 million a year ago (FY19), as revenue fell 19.36% to RM3.25 billion from RM4.03 billion.

On a positive note, the group said it had posted an operating profit of RM44 million in 2QFY20, compared with the RM57.92 million operating loss recorded in 1QFY20, driven by operations in China.

Operations in the Chinese market saw an uptick in terms of profitability, where it recorded a higher profit of RM89.48 million in 2QFY20, rising 45% compared with RM61.82 million in 2QFY19.

The group said it maintains a positive outlook on the retail industry in China.

With the effective control of the pandemic and the implementation of various measures to stimulate consumer spending, China's retail market has recovered gradually with consumer consumption picking up steadily.

Nonetheless, the group said it will continue to adopt an active and cautious strategy and diversify its business development by exploring various operation models to broaden its income sources.

As for the Southeast Asian region, Parkson said the operating environment is expected to remain challenging, amid competition and the Covid-19 pandemic.

The group has nevertheless taken various measures to weather the impact of Covid-19, as well as the challenges ahead. Much emphasis will be placed on cost containment, improving stores' productivity and optimising operational efficiency to improve results, it said.

Parkson’s share price closed up 0.5 sen or 5.56% higher at 9.5 sen yesterday, valuing the group at RM101.39 million. Some 9.24 million shares were traded. Over the past 12 months, the counter has been trading between seven sen and 26 sen.

EdgeProp Malaysia Virtual Property Expo 2020 (VPEX 2020) is happening now! Find out more exclusive projects and exciting deals here

Stay safe. Keep updated on the latest news at www.EdgeProp.my

TOP PICKS BY EDGEPROP

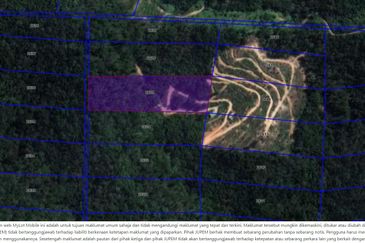

Taman Taming Indah 2

Bandar Sungai Long, Selangor

Telok Panglima Garang Industrial Zone

Telok Panglima Garang, Selangor

Seri Baiduri

Setia Alam/Alam Nusantara, Selangor

Kuala Terengganu Golf Resort

Kuala Terengganu, Terengganu

hero.jpg?GPem8xdIFjEDnmfAHjnS.4wbzvW8BrWw)